SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ |

Preliminary Proxy Statement |

¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x |

Definitive Proxy Statement |

¨ |

Definitive Additional Materials |

¨ |

Soliciting Material Pursuant to § 240.14a-11(c) or § 240.14a-12 |

EQUINIX, INC.

(Name of Registrant As Specified

In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

¨ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

(1) |

|

Title of each class of securities to which transaction applies: |

Ordinary shares, par value S$1.00 per share (the “i-STT Ordinary Shares”) of i-STT Pte Ltd (“i-STT”)

Series A Redeemable Preferred Stock, par value $0.001 per share (the “Pihana Series A Preferred Stock”), of Pihana Pacific, Inc. (“Pihana”)

Series B Convertible Preferred Stock, par value $0.001 per share, of Pihana (the “Pihana Series B Preferred Stock”)

| |

(2) |

|

Aggregate number of securities to which transaction applies: |

54,000,000 i-STT Ordinary Shares

5,000,000 shares of Pihana Series A

Preferred Stock

80,189,964 shares of Pihana Series B Preferred Stock

4,587,384 warrants to acquire shares of Pihana Series B Preferred Stock (the “Pihana Warrants”)

| |

(3) |

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated

and state how it was determined): |

$0.555 per i-STT Ordinary Share (a)

$0.001 per share of Series A Preferred Stock (b)

$0.001 per share of Series

B Preferred Stock (c)

$5.580 per Pihana Warrant (d)

| |

(a) |

|

Calculated per Rule 0-11(c) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), based on the par value per i-STT Ordinary

Share (translated using the October 15, 2002 noon buying rate of the Federal Reserve Bank of New York of $0.5548 Singapore Dollars per United States Dollar) because i-STT has an accumulated deficit. |

| |

(b) |

|

Calculated per Rule 0-11(c) under the Exchange Act, based on the par value per share of Series A Preferred Stock because Pihana has an accumulated deficit.

|

| |

(c) |

|

Calculated per Rule 0-11(c) under the Exchange Act, based on the par value per share of Series B Preferred Stock because Pihana has an accumulated deficit.

|

| |

(d) |

|

Represents the exercise price of each Pihana Warrant. |

| |

(4) |

|

Proposed maximum aggregate value of transaction: |

$2,997,000 for the i-STT Ordinary Shares

$5,000 for the Series A Preferred Stock

$80,190 for the Series B Preferred Stock

$25,597,602 for the Pihana

Warrants

$28,679,792 for the transaction

$5,277 (e)

| |

(e) |

|

Calculated as $92.00 per $1,000,000 of the proposed maximum aggregate value of the transaction. |

x |

|

Fee paid previously with preliminary materials: |

¨ |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously.

Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| |

(1) |

|

Amount Previously Paid: |

| |

(2) |

|

Form, Schedule or Registration Statement No.: |

December 10, 2002

TO THE STOCKHOLDERS OF EQUINIX, INC.

Dear Stockholder:

A special meeting of stockholders of Equinix, Inc. will be held at the offices of Willkie Farr & Gallagher located at 787 Seventh Avenue, New York, New York 10019 on December 30, 2002, beginning at 9:00 a.m. Eastern Time.

On October 2, 2002, we entered into agreements to consummate a series of related acquisition and financing

transactions. Under the terms of these agreements, we intend to combine our business with two similar businesses through the acquisition of i-STT Pte Ltd and Pihana Pacific, Inc. Second, we intend to sell a minimum of $30.0 million and up to $40.0

million of convertible secured notes to investors, including STT Communications Ltd, to finance continuing operations of the combined companies and to reduce our outstanding debt. These notes will be convertible into shares of our common stock and

preferred stock. Upon completion of these transactions, STT Communications, i-STT’s sole stockholder, and the Pihana stockholders could together hold a majority of our stock. In addition, in the event STT Communications converts its notes and

warrants to equity, it, together with the Pihana stockholders, will hold nearly 65% of our stock, which would essentially constitute a change of control.

Prior to these transactions, we had no relationship with STT Communications. Neither STT Communications nor Pihana were affiliates of Equinix or each other. Following these transactions, because of the

large percentage of our stock that will be held by STT Communications, STT Communications will become an affiliate of Equinix and will have significant influence over matters requiring stockholder consent.

In connection with these transactions, we intend to amend our credit facility and to reduce our outstanding debt by exchanging a large

portion of our outstanding 13% senior notes due 2007 for a combination of cash and shares of our common stock. Each of these transactions is more fully described in this proxy statement. In connection with the special meeting, you are being asked to

vote in favor of the issuance of shares of our common stock and preferred stock in connection with these transactions.

In addition, we have been notified by the Nasdaq Qualification Panel that in order to qualify for listing on The Nasdaq National Market following the closing of the proposed transactions, our stock price must trade above $5.00 per

share. To bring the trading price of our common stock above $5.00, we intend to effect a reverse stock split. Based on our stock price on December 6, 2002 of $0.28 per share, in order to achieve the $5.00 minimum share price, we would need to

complete a reverse stock split such that for every 17.86 shares currently outstanding, there would be one share outstanding following such reverse stock split.

Our board of directors has approved these transactions, and recommends that you vote FOR each of the proposals described in this proxy statement.

It is important that your shares be represented and voted at the meeting. WHETHER OR NOT YOU PLAN TO ATTEND OUR SPECIAL

MEETING, PLEASE COMPLETE, SIGN, DATE AND PROMPTLY RETURN THE ACCOMPANYING PROXY IN THE ENCLOSED POSTAGE-PAID ENVELOPE. Returning the proxy does NOT deprive you of your right to attend the special meeting. If you decide to attend the

special meeting and wish to change your proxy vote, you may do so automatically by voting in person at the meeting.

On behalf of the board of directors, I would like to express our appreciation for your continued interest in the affairs of Equinix. We look forward to seeing you at the special meeting.

Sincerely,

Peter F. Van Camp

Chairman of the Board

and Chief Executive Officer

This proxy statement and the related proxy card was first mailed to our stockholders on or about December 10, 2002.

EQUINIX, INC.

2450 Bayshore Parkway

Mountain View, CA 94043

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To be held December 30, 2002

A special meeting of stockholders of Equinix, Inc. will be held at the offices of Willkie Farr &

Gallagher located at 787 Seventh Avenue, New York, New York 10019, on December 30, 2002, beginning at 9:00 a.m. Eastern Time for the following purposes:

| |

1. |

|

To approve the issuance of shares of our common stock and preferred stock in connection with the combination of our business with the businesses of i-STT Pte

Ltd and Pihana Pacific, Inc., the issuance of convertible secured notes in connection with a new debt financing pursuant to which we will raise a minimum of $30.0 million and a maximum of $40.0 million and the exchange of a significant portion of

our senior notes for a combination of cash and shares of our common stock. |

| |

2. |

|

To adopt the agreement and plan of merger, dated as of October 17, 2002, by and between Eagle Oasis, Inc., our wholly-owned subsidiary, and us.

|

The foregoing items of business are more fully described in this proxy statement.

Only stockholders of record at the close of business on November 22, 2002 are entitled to notice of, and to vote at, the special

meeting and at any adjournments or postponements thereof. A list of such stockholders will be available for inspection at our headquarters located at 2450 Bayshore Parkway, Mountain View, California 94043, during ordinary business hours for the

ten-day period prior to the special meeting.

BY ORDER OF THE BOARD OF DIRECTORS,

Peter F. Van Camp

Chairman of the Board

and Chief Executive Officer

Mountain View, California

December 10, 2002

|

| IMPORTANT WHETHER OR NOT YOU PLAN TO ATTEND OUR SPECIAL MEETING, PLEASE COMPLETE, SIGN, DATE AND PROMPTLY RETURN THE ACCOMPANYING PROXY IN THE ENCLOSED POSTAGE-PAID ENVELOPE. YOU MAY REVOKE YOUR PROXY AT ANY TIME PRIOR TO THE SPECIAL

MEETING. IF YOU DECIDE TO ATTEND OUR SPECIAL MEETING AND WISH TO CHANGE YOUR PROXY VOTE, YOU MAY DO SO AUTOMATICALLY BY VOTING IN PERSON AT THE MEETING. |

|

| |

|

Page

|

| |

|

1 |

| |

| |

|

4 |

| |

| |

|

4 |

| |

| |

|

5 |

| |

| |

|

5 |

| |

| |

|

6 |

| |

| |

|

8 |

| |

| |

|

9 |

| |

| |

|

10 |

| |

| |

|

10 |

| |

| |

|

11 |

| |

| |

|

11 |

| |

| |

|

11 |

| |

| |

|

12 |

| |

| |

|

12 |

| |

| |

|

12 |

| |

| |

|

13 |

| |

| |

|

16 |

| |

| |

|

19 |

| |

| |

|

20 |

| |

| |

|

21 |

| |

| |

|

22 |

| |

| |

|

24 |

| |

| |

|

24 |

| |

| |

|

31 |

| |

| |

|

40 |

| |

| |

|

41 |

| |

| |

|

42 |

| |

| |

|

42 |

| |

| |

|

42 |

| |

| |

|

42 |

| |

| |

|

42 |

| |

| |

|

42 |

| |

| |

|

43 |

| |

| |

|

43 |

i

| |

|

Page

|

| |

|

44 |

| |

| |

|

44 |

| |

| |

|

46 |

| |

| |

|

48 |

| |

| |

|

48 |

| |

| |

|

54 |

| |

| |

|

55 |

| |

| |

|

55 |

| |

| |

|

55 |

| |

| |

|

55 |

| |

| |

|

58 |

| |

| |

|

58 |

| |

| |

|

60 |

| |

| |

|

60 |

| |

| |

|

61 |

| |

| |

|

76 |

| |

| |

|

77 |

| |

| |

|

78 |

| |

| |

|

78 |

| |

| |

|

78 |

| |

| |

|

79 |

| |

| |

|

80 |

| |

| |

|

80 |

| |

| |

|

81 |

| |

| |

|

82 |

| |

| |

|

82 |

| |

| |

|

82 |

| |

| |

|

83 |

| |

| |

|

83 |

| |

| |

|

83 |

| |

| |

|

84 |

| |

| |

|

84 |

| |

| |

|

86 |

| |

| |

|

87 |

| |

| |

|

87 |

ii

| |

|

Page

|

| |

| |

|

87 |

| |

| |

|

87 |

| |

| |

|

89 |

| |

| |

|

92 |

| |

| |

|

92 |

| |

| |

|

92 |

| |

| |

|

92 |

| |

| |

|

92 |

| |

| |

|

93 |

| |

| |

|

94 |

| |

| |

|

95 |

| |

| |

|

95 |

| |

| |

|

95 |

| |

| |

|

95 |

| |

| |

|

96 |

| |

| |

|

97 |

| |

| |

|

106 |

| |

| |

|

120 |

| |

| |

|

121 |

| |

| |

|

122 |

| |

| |

|

123 |

| |

| |

|

132 |

| |

| |

|

133 |

| |

| |

|

141 |

| |

| |

|

144 |

| |

| |

|

146 |

| |

| |

|

146 |

| |

| |

|

146 |

| |

| |

|

F-1 |

| |

Annex A—Combination Agreement, dated as of October 2, 2002, by and among Equinix, Inc., Eagle Panther Acquisition Corp., Eagle Jaguar Acquisition Corp., i-STT Pte Ltd, STT Communications Ltd, Pihana Pacific, Inc. and

Jane Dietze, as representative of the stockholders of Pihana Pacific, Inc. |

|

A-1 |

| |

| |

|

B-1 |

| |

| |

|

C-1 |

iii

QUESTIONS AND ANSWERS ABOUT THE COMBINATION, THE FINANCING, THE SENIOR NOTE EXCHANGE, THE AMENDMENT TO THE CREDIT FACILITY AND THE CHARTER MERGER

Q: |

|

Why am I receiving this proxy statement? |

A: |

|

You are receiving this proxy statement in connection with a special meeting of our stockholders to approve transactions more fully described in this

proxy statement. |

Q: |

|

When and where will the special meeting of Equinix stockholders be held? |

A: |

|

December 30, 2002 beginning at 9 a.m., local time, at the offices of Willkie Farr & Gallagher at 787 Seventh Avenue, New York, New York 10019.

|

Q: |

|

What proposals am I being asked to vote for? |

A: |

|

On October 2, 2002, we entered into agreements to consummate a series of related acquisition and financing transactions that will result in our issuance

of shares of our common stock and preferred stock (and instruments convertible or exercisable into shares of our common stock and preferred stock) that will represent approximately 77.5% of our capital stock as of the closing of those transactions.

Under the listing rules of The Nasdaq National Market we are required to seek the approval of our stockholders when we propose to issue new shares of stock, or instruments convertible or exercisable into new shares of stock, in excess of 20% of our

outstanding capital stock. The following is a brief description of the transactions: |

| |

• |

|

First, we intend to combine our existing Internet exchange business with two similar businesses through the acquisition of the outstanding stock of i-STT Pte

Ltd from STT Communications Ltd and a merger of one of our subsidiaries with Pihana Pacific, Inc. pursuant to the terms of a combination agreement that we entered into on October 2, 2002. We call this transaction the combination.

|

| |

• |

|

Second, we intend to sell a minimum of $30.0 million and up to $40.0 million of convertible secured notes to STT Communications and other investors to finance

continuing operations and a reduction of our outstanding debt pursuant to the terms of a securities purchase agreement that we entered into on October 2, 2002. These notes will be convertible into shares of our common stock and preferred stock. We

call this transaction the financing. |

| |

• |

|

Finally, we intend to significantly reduce our outstanding debt by exchanging a large portion of our 13% senior notes due 2007, or our senior notes, for a

combination of cash and shares of our common stock. We call this transaction the senior note exchange. |

In Proposal 1, you are being asked to vote for the issuance of shares of our common stock and preferred stock in connection with the combination, the financing and the senior note exchange.

We do not have a sufficient number of authorized and unissued shares of preferred stock to complete the combination and financing.

Therefore, we need to increase the number of authorized shares of our preferred stock. In addition, we need to increase our trading price by effecting a reverse stock split. The goal of the reverse stock split is to increase the trading price of our

common stock on The Nasdaq National Market to a price in excess of $5.00 for a sustained period of time. While the reverse stock split will reduce the number of shares of common stock you hold, it will not by itself change your relative percentage

ownership of our common stock as compared to our other stockholders.

To accomplish the increase in

authorized shares of preferred stock and the reverse stock split, Eagle Oasis, Inc., one of our wholly-owned subsidiaries, will merge with and into us. We call this transaction the charter merger.

1

As a result of the charter merger, the certificate of incorporation of Eagle

Oasis, Inc. will become our certificate of incorporation. The Eagle Oasis, Inc. certificate of incorporation that we assume in the charter merger will contain sufficient authorized shares of preferred stock and common stock to complete the

combination, the financing and the senior note exchange and will effect the reverse stock split. The actual number of authorized shares and the reverse stock split ratio will be determined by our officers immediately prior to the closing based on

the trading price of our stock and market conditions at the time of closing.

In Proposal 2, you are being asked

to adopt the agreement and plan of merger, dated October 17, 2002, by and between us and Eagle Oasis, Inc., our wholly-owned subsidiary, that will implement the charter merger.

Q: |

|

What will happen if all of the proposals are not approved at the special meeting? |

A: |

|

If our stockholders do not approve the issuance of our stock in connection with the combination, the financing and the senior note exchange, we will most likely

file for protection under federal bankruptcy law. See “Risk Factors” beginning on page 24. |

Q: |

|

What do I need to do now? |

A: |

|

After carefully reading and considering the information contained in this proxy statement, please complete and sign your proxy and return it in the

enclosed return envelope as soon as possible so that your shares may be represented and voted at our special meeting. If you sign and send in your proxy and do not indicate how you want to vote, we will count your proxy as a vote for the proposal to

approve the issuance of shares of our common stock and preferred stock in connection with the combination, the financing and the senior note exchange and the adoption of the merger agreement. See the enclosed proxy card for instructions on how to

vote by telephone and by Internet. |

Q: |

|

Do I have appraisal rights if I oppose the issuance of common stock and preferred stock in connection with the combination, financing and senior note

exchange and the charter merger? |

A: |

|

No. None of our stockholders will have appraisal rights in connection with the transactions described in Proposals 1 and 2. |

Q: |

|

When do you expect these transactions to be completed? |

A: |

|

The transactions are anticipated to close by the end of 2002, but may close in 2003 depending on how quickly we can complete the SEC review and complete the

senior note exchange. Prior to the closing, we will work closely together with i-STT and Pihana to plan the smooth integration of the three organizations. |

Q: |

|

If my shares are held in ‘street name’ by my broker, will my broker vote my shares for me? |

A: |

|

Shares held in ‘street name’ are shares held in brokerage accounts or held by other nominees on a stockholder’s behalf. Your broker or nominee

will vote your shares only if you provide instructions on how to vote. You should follow the directions provided by your broker or nominee regarding how to instruct your broker to vote your shares. If you do not instruct your broker or nominee, your

shares will not be voted. |

Q: |

|

Can I change my vote after I have mailed my signed proxy? |

A: |

|

Yes. You can change your vote at any time before your proxy is voted at our special meeting. If you hold your shares in your own name, you can do this in one of

three ways. First, you can send a written notice stating that you would like to revoke your proxy. Second, you can complete and submit a new proxy. If you choose either of these two methods, you must submit your notice of revocation or your new

proxy before the

|

2

| |

meeting to the address set forth in the answer to the last question below. Third, stockholders can attend the meeting and vote in person. If your shares are held in ‘street name’, you

should follow the directions provided by your broker or nominee regarding how to change your vote. |

Q: |

|

What do I do if I have questions? |

A: |

|

If you have any questions about the issuance of common stock in connection with the combination, the financing, the senior note exchange or the charter

merger or if you need additional copies of this proxy statement and you are one of our stockholders, you should contact: |

Georgeson Shareholder Communications, Inc.

(866) 870-4339

3

This summary, together with the question and answer section, highlights

some of the information discussed in greater detail elsewhere in this proxy and may not contain all of the information that is important to you. For a more complete understanding of the combination, the financing, the senior note exchange, the

charter merger and the other related transactions described in this proxy statement, you should carefully read this entire document and the documents referred to in this proxy statement. See “Where You Can Find Additional Information”

beginning on page 146.

Equinix, Inc.

We design, build and operate neutral Internet Business Exchange hubs, or IBX hubs, where Internet businesses place their equipment and their network facilities in order to

interconnect with each other to improve Internet performance. Our carrier neutral IBX hubs and Internet exchange services enable network service providers, enterprises, content providers, managed service providers and other Internet infrastructure

companies to directly interconnect with each other for increased performance and cost advantages.

We currently

have seven IBX hubs, consisting of more than 810,000 square feet, which operate in key U.S. Internet intersection points—Washington, D.C., New York, Dallas, Chicago, Los Angeles and Silicon Valley areas. In addition, we have strategic

partnerships established in Europe and Asia to serve customer needs in those areas.

Our headquarters are located

at 2450 Bayshore Parkway, Mountain View, California 94043. Our phone number is (650) 316-6000.

i-STT Pte Ltd

i-STT offers the following services, which are organized under three general business divisions, to its customers:

| |

• |

|

WEBCentre. i-STT’s “WEBCentre” division maintains carrier neutral data center facilities in Singapore and Bangkok

which house customers’ critical computer systems, networks, and telecommunications equipment. This division also provides system and network management services to ensure the optimal performance and continuous availability of customers’

computer systems. These services are very similar to those offered by Equinix and Pihana in their facilities. |

| |

• |

|

Connectivity Services. i-STT’s connectivity services division provides connectivity services that enable multiple

telecommunications carriers and Internet service providers to interconnect with each other at a single location and provide direct Internet connectivity to enterprise customers within the data center. |

| |

• |

|

Enterprise Messaging. i-STT’s enterprise messaging division enables enterprises to outsource the operations and management of

their email systems to i-STT. These email systems are based on the Lotus Notes and Microsoft Exchange platforms. |

i-STT is a wholly-owned subsidiary of STT Communications. STT Communications is a Singapore telecommunications and information technologies company. Through its subsidiaries, STT Communications provides fixed and mobile

telecommunications, data, internet services, telephone equipment distribution, managed hosting, teleport services, broadband cable and video, and e-business software development services.

4

STT Communications is a majority-owned subsidiary of Singapore Technologies Pte Ltd, a Singapore based conglomerate. Singapore Technologies, in turn, is a wholly-owned subsidiary of Temasek

Holdings (Private) Limited, an investment holding company wholly-owned by the government of Singapore.

i-STT has

two operating units, one in Singapore and the other in Bangkok, and its headquarters are located at Blk 20 Ayer Rajah Crescent, #05-05/08 Ayer Rajah Industrial Estate, Singapore 139964. i-STT’s phone number is (65) 6723-8888.

Pihana Pacific, Inc.

Pihana operates a business similar to ours, along the Pacific rim. Pihana designs and builds carrier neutral data centers to house critical Internet systems for Internet service providers, telecommunications carriers, content service

providers, and enterprise customers. Pihana has deployed an Internet exchange network to facilitate high performance routing of Internet traffic and provides an integrated suite of services, including enterprise system management, storage,

colocation and disaster recovery services.

Pihana’s regional footprint includes seven data center facilities

in Los Angeles, California, Singapore, Tokyo, Japan, Seoul, Korea, Sydney, Australia, Hong Kong and Honolulu, Hawaii. Pihana has its regional headquarters in Hong Kong.

Pihana is privately held and is not controlled by any single person or group. Pihana’s significant investors include, among others, affiliates of Goldman Sachs, UBS

Capital, Morgan Stanley Dean Witter Private Equity and Columbia Capital.

The combination agreement requires

Pihana to dispose of its Seoul, Korea data center subsidiary and enter into arrangements to terminate or amend its office lease in Singapore, its office lease in Honolulu, Hawaii and part of its data center lease in Los Angeles, California.

Pihana’s headquarters are located at 1100 Alakea Street, Suite 3000, Honolulu, Hawaii 96813. Pihana’s

telephone number is (808) 528-7500.

The Special Meeting

The special meeting will be held on Monday, December 30, 2002, beginning at 9 a.m., local time, at the offices of Willkie Farr & Gallagher located at 787 Seventh

Avenue, New York, New York 10019.

Record Date

The record date for determining the holders of shares of our outstanding common stock entitled to vote at the special meeting is the close of business on November 22, 2002.

On the record date, 98,892,711 shares of our common stock were issued and outstanding.

The Issuance of Shares in Connection with the Combination, the Financing and the Senior Note Exchange

The combination is our acquisition of the businesses of i-STT and

Pihana for cash and shares of our common stock and preferred stock as described below. See “The Combination” beginning on page 55.

5

Acquisition of Pihana

We will acquire Pihana through a merger of one of our indirect wholly-owned subsidiaries with Pihana. As consideration for the merger,

we expect to pay $10,000 and issue to the holders of Pihana’s preferred stock, shares of our common stock representing approximately 23.2% of our capitalization as of the closing of the combination. See “The Combination—The Pihana

Merger” beginning on page 55.

Acquisition of i-STT

One of our indirect wholly-owned subsidiaries will purchase all of i-STT’s issued and outstanding stock from STT Communications.

In consideration for the i-STT acquisition, we expect to pay $10,000 and issue to STT Communications shares of our common stock and Series A preferred stock representing approximately 28.3% of our capitalization as of the closing of the combination.

See “The Combination—The i-STT Stock Purchase” beginning on page 58.

Adjustments to

Consideration

The number of shares of our common stock and preferred stock to be issued to STT

Communications and Pihana’s preferred stockholders is subject to adjustment based on our and i-STT’s working capital balance and the amount of cash Pihana has as of the opening of business, without giving effect to the combination, on the

day of the closing of the combination. See “The Combination—The Pihana Merger—Determination of the Pihana Merger Consideration” beginning on page 55 and “The Combination—The i-STT Stock Purchase—Determination of

the i-STT Stock Purchase Consideration” beginning on page 58.

Closing of the Combination, the

Financing and the Senior Note Exchange

Unless otherwise noted, references in this proxy statement to the

closing shall refer to the closing of the combination, the financing and the senior note exchange. The closing of the financing is conditioned upon the closing of the combination. The closing of the combination and the financing are conditioned upon

the closing of the senior note exchange. We intend to close the combination, the financing and the senior note exchange immediately following our special meeting. We are targeting the closing to occur on December 31, 2002. See “The

Combination” beginning on page 55, “The Financing” beginning on page 78 and “The Senior Note Exchange” beginning on page 82.

In order to provide cash for our operations and to retire and

restructure a portion of our outstanding debt, we will raise additional capital at the closing of the financing. At the closing of the financing, we will sell a minimum of $30.0 million and a maximum of $40.0 million of convertible secured notes.

The convertible secured notes will be convertible into shares of our common stock and preferred stock at a price of approximately $0.34 per share, which represents a 10% premium over the 30 trading day average closing price of our common stock

ending five days prior to signing the combination agreement. Each convertible secured note issued to STT Communications will be convertible into shares of our Series A preferred stock or shares of our non-voting Series A-1 preferred stock and will

accrue interest at the rate of 14% per annum. All convertible secured notes issued to other investors will be convertible into shares of our common stock and accrue interest at the rate of 10% per annum. All interest on the convertible secured notes

will be paid in the form of additional notes of the same series. All of the convertible secured notes will mature in November 2007. Due to the size of the investment by STT Communications and the concurrent negotiation of our acquisition of i-STT,

the notes and warrants to be issued to STT Communications have preferential terms in comparison with notes and warrants to be issued to other investors.

6

Until the second anniversary of the closing, unless terminated earlier as described in this proxy statement, STT

Communications will be subject to restrictions on the amount of our voting securities that it may acquire upon conversion of notes or warrants. Under the securities purchase agreement, STT Communications may not convert its convertible secured notes

or the warrants received in connection with the purchase of such notes into shares of our Series A preferred stock or common stock, but instead must convert or exercise into shares of our non-voting Series A-1 preferred stock, if:

| |

• |

|

as a result of such conversion, STT Communications and its affiliates would hold more than 40% of our outstanding voting stock; or

|

| |

• |

|

STT Communications has not complied with requirements of the Hart-Scott-Rodino Antitrust Improvements Act, or HSR Act, with respect to a conversion that would

cause it to hold voting stock valued in excess of $50.0 million. |

The convertible secured notes

issued to STT Communications will be secured by a first priority lien on all of i-STT’s assets and the assets of Pihana’s Singapore subsidiary. All of the convertible secured notes will be secured by a second priority lien on substantially

all of the remaining assets.

As additional consideration for the convertible secured notes, we will issue to each

purchaser warrants for shares of our common and preferred stock. Warrants issued to STT Communications will be exercisable for shares of our Series A preferred stock or shares of our non-voting Series A-1 preferred stock depending on whether STT

Communications would exceed the 40% voting stock threshold described above. All other warrants will be exercisable for shares of our common stock. Each warrant will initially be exercisable for $0.01 per share.

The material terms of the Series A preferred stock and the Series A-1 preferred stock are as follows:

| |

• |

|

Liquidation: In the event of our liquidation, dissolution or winding-up, our assets will be distributed pro rata to Series A

preferred stock, Series A-1 preferred stock and common stock on an as-converted to common stock basis. |

| |

• |

|

Redemption: The Series A preferred stock and the Series A-1 preferred stock are not redeemable at the option of the holder. After

seven years, we will have the right, but not the obligation, to repurchase the Series A preferred stock and the Series A-1 preferred stock at the then current fair market value. |

| |

• |

|

Conversion: The Series A preferred stock and the Series A-1 preferred stock will initially be convertible into one share of common

stock (subject to the anti-dilution adjustments described below). The Series A preferred stock will be convertible at any time at the option of the holder. The Series A-1 preferred stock may only be converted to Series A preferred stock or common

stock under specified conditions. See “Governance of the Combined Company” beginning on page 89. |

| |

• |

|

Automatic Conversion: Subject to the conversion restrictions on the Series A-1 preferred stock as described above, all shares of

Series A-1 preferred stock and all but 100 shares of Series A preferred stock will automatically convert into common stock upon our achieving four consecutive quarters of profitability. |

| |

• |

|

Antidilution Adjustments: There will be proportional adjustments for stock splits and stock dividends and similar events.

|

| |

• |

|

Voting Rights: Except as required by Delaware law, the Series A preferred stock will vote with the common stock on an as-converted

to common stock basis. Except as otherwise provided by Delaware law, the Series A-1 preferred stock will be non-voting. |

| |

• |

|

Series A Board Seats: The holders of Series A preferred stock will have the right to elect three directors until the earlier of

(i) there are no longer 100 shares of Series A preferred stock outstanding or (ii) the second anniversary of the closing. |

7

The closing of the financing is conditioned upon the closing of the

combination. See “The Financing” beginning on page 78.

As a condition to closing the combination and financing,

we are required to substantially reduce the outstanding amount of our senior notes so that no more than $22.3 million is outstanding under the notes. This condition requires us to retire at least $124.9 million of our outstanding senior notes unless

two of the three combining companies agree to waive the condition. Prior to signing the combination agreement, we received offers to exchange outstanding senior notes from the holders of $101.2 million of our senior notes, leaving more than

$23.7 million additional senior notes that we are required to exchange in the senior note exchange in order to close the combination and the financing. In connection with the combination and financing, we have made an offer to exchange cash and

shares of our common stock for all of our outstanding senior notes. Holders of our senior notes will receive an amount of cash and shares of our common stock based on the aggregate principal amounts of senior notes exchanged as described in the

following tables. The amount of cash and the number of shares exchanged for each senior note will vary depending on the aggregate amount of senior notes exchanged, the amount of convertible secured notes issued in connection with the financing and

the number of shares issued in connection with the combination. The tables below describe the amount we will pay for every $1.00 of principal of senior notes exchanged and the aggregate consideration that will be given for the senior notes.

Table 1—Consideration per $1.00 principal amount of senior notes exchanged

| Total Principal Amount Exchanged

($ in millions)

|

|

|

|

|

|

|

|

|

| Equal to or greater than:

|

|

but less than:

|

|

Cash Consideration

|

|

Maximum Stock Consideration**

|

|

Maximum

Value of Stock Consideration***

|

|

Maximum Total Consideration per $1.00 Senior Note Exchanged

|

| $115.0* |

|

$125.0 |

|

$0.13 |

|

.469 |

|

$0.13 |

|

$0.26 |

| $125.0 |

|

$132.5 |

|

$0.14 |

|

.383 |

|

$0.11 |

|

$0.25 |

| $132.5 |

|

$140.0 |

|

$0.15 |

|

.317 |

|

$0.09 |

|

$0.24 |

| $140.0 |

|

$147.2 |

|

$0.16 |

|

.261 |

|

$0.07 |

|

$0.23 |

| $147.2 |

|

NA |

|

$0.17 |

|

.212 |

|

$0.06 |

|

$0.23 |

Table 2—Aggregate consideration

for senior notes exchanged

| Total Principal Amount Exchanged

($ in millions)

|

|

|

|

Maximum Aggregate Stock Consideration

(shares in

millions)**

|

|

Aggregate

Value of Stock

Consideration

($ in millions)***

|

|

|

| Equal to or greater than:

|

|

|

but less than:

|

|

Maximum Aggregate Cash Consideration ($ in millions)

|

|

|

|

Maximum Total Aggregate Consideration

($ in millions)

|

| $115.0 |

* |

|

$125.0 |

|

$16.3 |

|

58.6 |

|

$16.4 |

|

$32.7 |

| $125.0 |

|

|

$132.5 |

|

$18.6 |

|

50.7 |

|

$14.2 |

|

$32.8 |

| $132.5 |

|

|

$140.0 |

|

$21.0 |

|

44.4 |

|

$12.4 |

|

$33.4 |

| $140.0 |

|

|

$147.2 |

|

$23.6 |

|

38.4 |

|

$10.8 |

|

$34.4 |

| $147.2 |

|

|

NA |

|

$25.0 |

|

31.2 |

|

$8.7 |

|

$33.7 |

* |

|

We have assumed a minimum of $115.0 million of senior notes are exchanged. In the event that less than $115.0 million of senior notes are exchanged and the

senior note exchange is consummated, the cash consideration paid per $1.00 of principal amount of senior notes exchanged and the aggregate shares issued shall equal the amounts set forth for $115.0 million of senior notes exchanged.

|

8

** |

|

Actual numbers may decrease depending upon total number of shares issued in the combination and the financing and the principal amount of senior notes

exchanged. |

*** |

|

Stock value based on the closing price of our common stock on The Nasdaq National Market on December 6, 2002 of $0.28. |

We have commenced an exchange offer for all of our outstanding senior notes, and the holders of the senior notes

currently have until December 24, 2002 to tender their senior notes to us in exchange for the consideration described above. The expiration of the exchange offer may be extended at our option and the closing of the senior note exchange is

conditioned upon our stockholders approving Proposal 1 to authorize the issuance of the shares in the senior note exchange. See “The Senior Note Exchange” beginning on page 82.

Post-Closing Capitalization

The closing of the combination, the financing and the

senior note exchange will significantly change our ownership structure. The table below indicates the relative ownership percentage of the combined company that will be owned by our existing stockholders, the holders of our senior notes who exchange

their senior notes, STT Communications and the former stockholders of Pihana. These percentages are subject to adjustment at the closing of the combination based on closing conditions in the transaction documents and the actual amount of senior

notes exchanged. See “The Combination” beginning on page 55.

| Stockholders

|

|

Approximate % of our Capital Stock

|

|

Approximate % of our Voting Stock Following the Financing**

|

| |

Following the closing of the Combination

|

|

Following the Financing**

|

|

| Existing stockholders* |

|

30.7% |

|

22.5% |

|

25.7% |

| Senior noteholders participating in the exchange |

|

17.8% |

|

13.1% |

|

14.9% |

| STT Communications |

|

28.3% |

|

47.4% |

|

40.0% |

| Former Pihana preferred stockholders |

|

23.2% |

|

17.0% |

|

19.4% |

| |

* |

|

Our existing stockholders’ capital stock is calculated based on the total number of shares of our common stock outstanding, plus all shares of our common

stock issuable upon the exercise of our outstanding stock options and warrants with an exercise price less than $0.306 per share (as adjusted for the assumed cashless exercise of those options and warrants). |

| |

** |

|

The percentages in this column assume we issue $30.0 million of convertible secured notes and related warrants in the financing to STT Communications, and the

subsequent conversion of all notes and the exercise of all warrants issued to STT Communications into capital stock, but does not include shares of our stock issuable upon exercise of the change in control warrants and cash trigger warrants

described in this proxy statement. For two years following the closing, STT Communications has agreed to convert its convertible secured notes and warrants into shares of our non-voting preferred stock if conversion of the notes and warrants would

cause STT Communications to hold more than 40% of our outstanding voting stock. This restriction will expire before the second anniversary of the closing if enumerated events occur. See “Governance of the Combined Company” beginning on

page 89. |

Unless otherwise noted, references in this proxy statement to the

combined company’s capitalization are based on the assumptions and methodologies contained in the foregoing table.

9

Governance of the Combined Company

Nomination of

Directors. Following the closing, our board of directors will consist of nine members who will be nominated for two years following the closing, as follows:

| |

• |

|

Three members of our pre-combination board of directors will remain on the board following the combination. Any vacancies among these directors will be filled

based on the nomination of the two directors who remain following the creation of that vacancy. One of these directors must at all times qualify as an independent director under the rules of The Nasdaq National Market. We call these directors the

Equinix directors. |

| |

• |

|

Three members of our board of directors will be individuals nominated by STT Communications. We call these directors the STT Communications directors.

|

| |

• |

|

One member of our board of directors will be an individual nominated by the former preferred stockholders of Pihana. |

| |

• |

|

Two members of our board of directors will be individuals nominated by our nominating committee who qualify as independent directors under the rules of The

Nasdaq National Market. |

After the two year period expires, all directors will be elected by a

plurality of votes cast at a meeting of our stockholders.

To the extent additional independent directors must be

nominated to our board under the rules of The Nasdaq National Market, STT Communications and the Pihana stockholders have each agreed to nominate one director who qualifies as an independent director under those rules.

Board Committees. For two years after the closing, all committees will consist of at least one of the

Equinix directors and one STT Communications director. In no event will any committee contain more STT Communications directors than our directors. One of the STT Communications directors will serve as the chairman of our board of directors and

chairman of our Compensation Committee.

Restrictions on Conversion. As described

above, for two years following the closing, STT Communications has agreed to convert its convertible secured notes and warrants into shares of our non-voting preferred stock if conversion of the notes and warrants would cause STT Communications to

hold more than 40% of our outstanding voting stock. This restriction will expire before the second anniversary of the closing if enumerated events occur, including a material breach by us of our obligations under our material agreements with STT

Communications, if a third party makes a tender offer for our shares, if STT Communications makes a tender offer with specified criteria or if STT makes additional cash investments in our shares. After two years, STT Communications will be free to

convert its notes and warrants into shares of our common stock and Series A preferred stock without limitation.

Officers. Following the combination, our current management team will continue to serve in their current positions. Prior to closing, we will mutually agree with STT Communications on an individual to

run our newly acquired operations in Asia.

Risks Related to the Combination, the Financing and the Senior Note Exchange

The

combination, the financing and the senior note exchange involve a variety of significant risks. You should carefully consider the factors discussed in the section entitled “Risk Factors” beginning on page 24.

10

Proposal 1, relating to approval of the issuance of our stock in

connection with the combination, the financing, and the senior note exchange, must be approved by a majority of the votes cast at the special meeting by holders of our common stock.

Proposal 2, relating to the adoption of the merger agreement, must be approved by the holders of at least a majority of our issued and outstanding shares of common stock.

Each share of our common stock is entitled to one vote.

Amendment to Our Credit Facility

As a condition to the combination, the financing and

the senior note exchange, we are required to amend the terms of our credit facility. As part of this amendment we will pay down approximately $7.5 million of the outstanding principal and eliminate a number of the restrictive financial covenants

under our credit facility, including those related to our achieving minimum quarterly revenue and earnings before interest, taxes, depreciation and amortization, or EBITDA results. See “The Credit Facility” beginning on page 86.

To provide a mechanism to allow STT Communications and other purchasers of the convertible secured notes to

ensure our compliance with liquidity and payment covenants under our credit facility, at the closing, we will issue cash trigger warrants to STT Communications and other investors. The holders of the cash trigger warrants will have the right, but

not the obligation, to purchase shares of our common stock or, in the case of STT Communications, shares of our preferred stock. The cash trigger warrants will become exercisable only upon a default of our minimum cash covenant under our credit

facility or our failure to make principal or interest payments on amounts outstanding under our credit facility when due. The maximum value of shares that may be purchased under the cash trigger warrants is $30.0 million. The maximum value of shares

that may be purchased upon any one exercise of the cash trigger warrants is equal to the sum of (a) any shortage of cash under our cash covenant or any missed principal or interest payment plus (b) $5.0 million. See “The Financing—Cash

Trigger Warrants” beginning on page 80.

In addition to completing each of the transactions described

above, there are a number of conditions to closing the combination and financing transactions, including:

| |

• |

|

Obtaining our stockholders’ approval of Proposal 1 and Proposal 2. |

| |

• |

|

Maintaining our listing on The Nasdaq National Market or The Nasdaq Small Cap Market. If at the closing of the combination our common stock is listed on The

Nasdaq Small Cap Market, we must not have received any indication from Nasdaq that we would not be allowed to transfer back to The Nasdaq National Market after our stock trades above $1.00 for 30 consecutive trading days.

|

| |

• |

|

We must have agreed with STT Communications on a management financial model and management structure for the combined companies.

|

| |

• |

|

Pihana must have reduced its operations in Los Angeles, Hawaii and Singapore and divested itself of its operations in Korea. |

| |

• |

|

Each of us, STT Communications and Pihana must meet cash, non-current liabilities and working capital tests. |

| |

• |

|

No events shall have occurred that would constitute a material adverse effect on us, i-STT or Pihana. |

11

| |

• |

|

We must have renegotiated our ground lease in San Jose. |

| |

• |

|

We must obtain an independent valuation of all of our personal and real property assets for purposes of determining that we are not a real property holding

company under U.S. law. |

| |

• |

|

Documents effecting the security interests of the convertible secured notes must be executed and delivered by us to the purchasers of our convertible secured

notes. |

| |

• |

|

Guarantees of the convertible secured notes by all of our subsidiaries must be executed and delivered by us to the purchasers of our convertible secured

notes. |

Recommendation of the Board of Directors; Our Reasons for the Combination, the Financing and the Senior Note Exchange

Our board of directors, has voted FOR, and recommends that you vote FOR, the approval of Proposal 1. For a description of the reasons which our board considered in approving and recommending the

combination, the financing and the senior note exchange, see “Proposal 1—Issuance of Shares in connection with the Combination, the Financing and the Senior Note Exchange—Our Reasons for the Combination, the Financing and the Senior

Note Exchange” beginning on page 46.

Opinion of Financial Advisor

In connection with the combination, our board of

directors received a written opinion from Salomon Smith Barney Inc. as to the fairness, from a financial point of view, to Equinix of the aggregate consideration to be paid by Equinix in the combination. The full text of Salomon Smith Barney’s

written opinion, dated October 2, 2002, is attached to this proxy statement as Annex B. We encourage you to read this opinion carefully in its entirety for a description of the assumptions made, procedures followed, matters considered and

limitations on the review undertaken. Salomon Smith Barney’s opinion was provided in connection with the combination, does not address any related transaction and does not constitute a recommendation to you as to how you should vote or act

on any matters relating to the combination or any related transactions.

Charter Merger

In order to facilitate the combination, the financing and the senior note exchange described above, we need to accomplish the following:

| |

• |

|

Increase in Authorized Shares. We need to increase the number of authorized shares of our preferred stock to allow for the

issuance of shares of stock in connection with the combination and the financing. The authorized number of shares of preferred stock will be increased from 10,000,000 shares to 100,000,000 shares. |

| |

• |

|

The Reverse Stock Split. On November 25, 2002, the Nasdaq Qualifications Panel notified us that as a result of the combination,

the financing and the senior note exchange, we will be required to submit an application to re-qualify for initial listing on The Nasdaq National Market. One of the conditions to qualifying for initial listing is that our stock price must trade at

or above $5.00 per share. For the last several months our common stock has traded substantially below $5.00. To bring the trading price of our common stock above $5.00, our board of directors has authorized a reverse stock split to reduce the number

of shares of our common stock outstanding. As a result of the reverse stock split, shares of our common stock will be combined into a smaller number of shares of our common stock. While the reverse stock split will reduce the number of shares held

by each of our stockholders, it will not change

|

12

the percentage of our outstanding stock owned by each stockholder. Based on our stock price on December 6, 2002 of $.28 per share, in order to achieve the $5.00 minimum share price we would need

to complete a reverse stock split such that for approximately every 17.86 shares currently outstanding there would be one share outstanding following such reverse stock split. We anticipate that the actual reverse stock split ratio will cause our

stock price to exceed the $5.00 minimum requirement. Shares issuable in the combination, the financing and the senior note exchange will be adjusted to reflect the reverse stock split.

The reverse stock split and the increase in our authorized shares will occur as a result of the charter merger. We could also accomplish the reverse stock split and an

increase in the authorized shares through an amendment to our restated certificate of incorporation. Under the terms of our restated certificate of incorporation, an amendment requires the affirmative vote of 66 2/3% of our outstanding common stock. The charter merger, on the other hand, only requires the affirmative vote of a

majority of our outstanding common stock. As we have disclosed throughout the proxy statement, if these transactions are not approved, we would file for bankruptcy protection and our existing stockholders’ equity would be almost entirely

eliminated. While we believe we could ultimately get the required 66 2/3% vote to approve an amendment, given the

importance of getting the transaction closed as soon as possible, we decided the charter merger was in the best interests of the company and its stockholders and creditors.

In Proposal 2, you are being asked to vote for the adoption of the agreement and plan of merger, dated October 17, 2002, by and between us and Eagle Oasis, Inc., our

wholly-owned subsidiary, that will implement the charter merger.

Recommendation of the Board of Directors

Our board of directors has voted FOR, and

recommends that you vote FOR, the approval of Proposal 2.

13

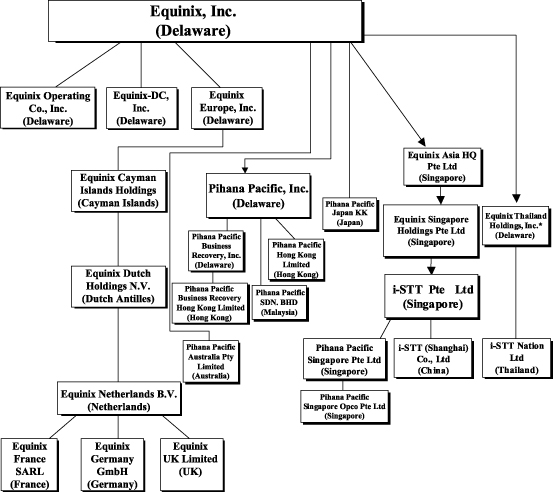

Structure of Equinix, Inc.

The following chart shows the structure of Equinix, Inc. and its subsidiaries prior to the combination, the financing, and the senior note exchange. The parenthetical information indicates the

jurisdiction of incorporation for each entity.

14

The following chart shows the structure of Equinix, Inc. and its subsidiaries following the combination, the financing

and the senior note exchange. The parenthetical information indicates the jurisdiction of incorporation for each entity.

* |

|

i-STT owns 60% of i-STT Nation Ltd, the entity through which i-STT does business in Thailand. The other 40% is owned by Nation Media Group of Thailand. At the

closing of the combination, Equinix Thailand Holdings, Inc. will acquire i-STT’s 60% share of i-STT Nation Ltd. |

15

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL DATA

You should read the following table in conjunction with our historical consolidated financial statements and related notes and our

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this proxy statement.

The consolidated statement of operations data for the fiscal years ended December 31, 2001, 2000 and 1999 and the consolidated balance sheet data as of December 31, 2001 and 2000 have been derived from

our audited consolidated financial statements included elsewhere in this proxy statement. The consolidated statement of operations data for the period from June 22, 1998 (inception) to December 31, 1998 and the consolidated balance sheet data as of

December 31, 1999 and 1998 are derived from our audited financial statements not included or incorporated by reference in this proxy statement.

The consolidated balance sheet data as of September 30, 2002 and the consolidated statements of operations data for the nine months ended September 30, 2002 and 2001 are based on our unaudited

quarterly consolidated financial statements included in this proxy statement.

The information as of and for the

nine month periods ended September 30, 2002 and 2001 is unaudited and has been prepared on the same basis as our annual consolidated financial statements. In the opinion of our management, this quarterly information reflects all adjustments,

consisting only of normal recurring adjustments, necessary for a fair presentation of the information for the periods presented. The results of operations for the nine months ended September 30, 2002 are not necessarily indicative of the results

that may be expected for the full year ended December 31, 2002, or any future period.

| |

|

Nine Months Ended

September 30,

|

|

|

Years Ended December 31,

|

|

|

Period from June

22, 1998 (inception) to December 31, 1998

|

|

| |

|

2002

|

|

|

2001

|

|

|

2001

|

|

|

2000

|

|

|

1999

|

|

|

| |

|

(unaudited) |

|

|

|

|

|

|

|

| Statement of Operations Data: (in thousands, except per share amounts) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

|

$ |

58,385 |

|

|

$ |

45,948 |

|

|

$ |

63,414 |

|

|

$ |

13,016 |

|

|

$ |

37 |

|

|

$ |

— |

|

| Costs and operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of revenues (includes stock-based compensation of $216, $412, $426, $766, $177 and none for the periods ended

September 30, 2002 and 2001 and December 31, 2001, 2000, 1999, and 1998, respectively) |

|

|

78,599 |

|

|

|

74,593 |

|

|

|

94,889 |

|

|

|

43,401 |

|

|

|

3,268 |

|

|

|

— |

|

| Sales and marketing (includes stock-based compensation of $802, $2,344, $2,830, $6,318, $1,631 and $13 for the periods

ended September 30, 2002 and 2001 and December 31, 2001, 2000, 1999, and 1998, respectively) |

|

|

12,168 |

|

|

|

13,274 |

|

|

|

16,935 |

|

|

|

20,139 |

|

|

|

3,949 |

|

|

|

47 |

|

| General and administrative (includes stock-based compensation of $4,622, $13,285, $15,788, $22,809, $4,819 and $151 for

the periods ended September 30, 2002 and 2001 and December 31, 2001, 2000, 1999, and 1998, respectively) |

|

|

22,735 |

|

|

|

47,013 |

|

|

|

58,286 |

|

|

|

56,585 |

|

|

|

12,603 |

|

|

|

902 |

|

| Restructuring charges |

|

|

28,960 |

|

|

|

48,565 |

|

|

|

48,565 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total costs and operating expenses |

|

|

142,462 |

|

|

|

183,445 |

|

|

|

218,675 |

|

|

|

120,125 |

|

|

|

19,820 |

|

|

|

949 |

|

| Loss from operations |

|

|

(84,077 |

) |

|

|

(137,497 |

) |

|

|

(155,261 |

) |

|

|

(107,109 |

) |

|

|

(19,783 |

) |

|

|

(949 |

) |

| Interest income |

|

|

961 |

|

|

|

9,477 |

|

|

|

10,656 |

|

|

|

16,430 |

|

|

|

2,138 |

|

|

|

150 |

|

| Interest expense |

|

|

(26,411 |

) |

|

|

(32,948 |

) |

|

|

(43,810 |

) |

|

|

(29,111 |

) |

|

|

(3,146 |

) |

|

|

(220 |

) |

| Gain on debt extinguishment |

|

|

27,188 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(82,339 |

) |

|

$ |

(160,968 |

) |

|

$ |

(188,415 |

) |

|

$ |

(119,790 |

) |

|

$ |

(20,791 |

) |

|

$ |

(1,019 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted |

|

$ |

(0.88 |

) |

|

$ |

(2.07 |

) |

|

$ |

(2.39 |

) |

|

$ |

(3.48 |

) |

|

$ |

(4.98 |

) |

|

$ |

(1.48 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average shares |

|

|

93,687 |

|

|

|

77,843 |

|

|

|

78,681 |

|

|

|

34,461 |

|

|

|

4,173 |

|

|

|

688 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16

| |

|

As of September 30,

|

|

|

As of December 31,

|

|

| |

|

2002

|

|

|

2001

|

|

|

2001

|

|

|

2000

|

|

|

1999

|

|

|

1998

|

|

| |

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance Sheet Data: (in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents and short-term investments |

|

$ |

11,622 |

|

|

$ |

165,842 |

|

|

$ |

87,721 |

|

|

$ |

207,210 |

|

|

$ |

222,974 |

|

|

$ |

9,165 |

|

| Restricted cash and short-term investments |

|

|

1,517 |

|

|

|

27,875 |

|

|

|

28,044 |

|

|

|

36,855 |

|

|

|

38,609 |

|

|

|

— |

|

| Working capital (deficit) |

|

|

(95,931 |

) |

|

|

74,075 |

|

|

|

39,889 |

|

|

|

126,677 |

|

|

|

229,178 |

|

|

|

8,920 |

|

| Property and equipment, net |

|

|

386,699 |

|

|

|

327,278 |

|

|

|

325,226 |

|

|

|

315,380 |

|

|

|

28,444 |

|

|

|

482 |

|

| Construction in progress |

|

|

— |

|

|

|

91,066 |

|

|

|

103,691 |

|

|

|

94,894 |

|

|

|

18,312 |

|

|

|

31 |

|

| Total assets |

|

|

428,318 |

|

|

|

648,739 |

|

|

|

575,054 |

|

|

|

683,485 |

|

|

|

319,946 |

|

|

|

10,001 |

|

| Senior secured credit facility |

|

|

100,000 |

|

|

|

150,000 |

|

|

|

105,000 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Senior notes |

|

|

139,303 |

|

|

|

187,387 |

|

|

|

187,882 |

|

|

|

185,908 |

|

|

|

183,955 |

|

|

|

— |

|

| Redeemable convertible preferred stock |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

97,227 |

|

|

|

10,436 |

|

| Total stockholders’ equity (deficit) |

|

|

147,866 |

|

|

|

227,725 |

|

|

|

203,521 |

|

|

|

375,116 |

|

|

|

8,472 |

|

|

|

(846 |

) |

| |

| Other Financial Data: (in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash used in operating activities |

|

|

(29,741 |

) |

|

|

(52,057 |

) |

|

|

(68,854 |

) |

|

|

(68,073 |

) |

|

|

(9,908 |

) |

|

|

(796 |

) |

| Net cash used in investing activities |

|

|

(6,507 |

) |

|

|

(191,812 |

) |

|

|

(153,014 |

) |

|

|

(302,158 |

) |

|

|

(86,270 |

) |

|

|

(5,265 |

) |

| Net cash provided by (used in) financing activities |

|

|

(13,700 |

) |

|

|

155,134 |

|

|

|

107,799 |

|

|

|

339,847 |

|

|

|

295,178 |

|

|

|

10,226 |

|

17

EQUINIX, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

SELECTED UNAUDITED QUARTERLY FINANCIAL INFORMATION

The Company believes that period-to-period comparisons of its financial results should not be relied upon as an indication of future

performance. The Company’s revenues and results of operations have been subject to significant fluctuations, particularly on a quarterly basis, and the Company’s revenues and results of operations could fluctuate significantly

quarter-to-quarter and year-to-year. Significant quarterly fluctuations in revenues will cause significant fluctuations in our cash flows and the cash and cash equivalents and accounts receivable accounts on the Company’s balance sheet. Causes

of such fluctuations may include the volume and timing of new orders and renewals, the sales cycle for our services, the introduction of new services, changes in service prices and pricing models, trends in the Internet infrastructure industry,

general economic conditions (such as the recent economic slowdown), extraordinary events such as acquisitions or litigation and the occurrence of unexpected events.

The unaudited quarterly financial information presented below has been prepared by the Company and reflects all adjustments, consisting only of normal recurring

adjustments, which in the opinion of management are necessary to present fairly the financial position and results of operations for the interim periods presented.

The following table presents selected unaudited quarterly information for the period ending September 30, 2002 and the fiscal years 2001 and 2000:

| |

|

For the quarterly periods ending

|

|

| |

|

March 31

|

|

|

June 30

|

|

|

September 30

|

|

| |

|

(in thousands, except per share data) |

|

| 2002: |

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

|

$ |

20,158 |

|

|

$ |

18,040 |

|

|

$ |

20,187 |

|

| Net loss |

|

|

(13,694 |

) |

|

|

(24,557 |

) |

|

|

(44,088 |

) |

| Basic and diluted net loss per share |

|

|

(0.16 |

) |

|

|

(0.25 |

) |

|

|

(0.44 |

) |

| |

|

For the quarterly periods ending

|

|

| |

|

March 31

|

|

|

June 30

|

|

|

September 30

|

|

|

December 31

|

|

| |

|

(in thousands, except per share data) |

|

| 2001: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

|

$ |

12,613 |

|

|

$ |

16,157 |

|

|

$ |

17,178 |

|

|

$ |

17,466 |

|

| Net loss |

|

|

(41,537 |

) |

|

|

(37,857 |

) |

|

|

(81,574 |

) |

|

|

(27,447 |

) |

| Basic and diluted net loss per share |

|

|

(0.54 |

) |

|

|

(0.48 |

) |

|

|

(1.03 |

) |

|

|

(0.34 |

) |

| 2000: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

|

$ |

136 |

|

|

$ |

892 |

|

|

$ |

3,933 |

|

|

$ |

8,055 |

|

| Net loss |

|

|

(18,009 |

) |

|

|

(26,811 |

) |

|

|

(32,085 |

) |

|

|

(42,885 |

) |

| Basic and diluted net loss per share |

|

|

(2.40 |

) |

|

|

(2.62 |

) |

|

|

(0.70 |

) |

|

|

(0.57 |

) |

18

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL DATA

You should read the following table in conjunction with i-STT’s historical consolidated financial statements and related notes and

i-STT’s “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in this proxy statement, which have been prepared in accordance with Singapore GAAP. Singapore GAAP differs in certain

respects from U.S. GAAP. For a discussion of material differences as applied to i-STT’s financial statements, see Note 27 to i-STT’s consolidated financial statements. All dollar amounts presented are in U.S. dollars.

The consolidated statements of operations data for the fiscal year ended December 31, 2001 and the period from January 3,

2000 (inception) to December 31, 2000 and the consolidated balance sheet data as of December 31, 2001 and 2000 have been derived from audited consolidated financial statements of i-STT included in this proxy statement.

The consolidated balance sheet data as of September 30, 2002 and the consolidated statements of operations data for the nine months ended

September 30, 2002 and 2001 has been derived from unaudited interim consolidated financial statements of i-STT also included in this proxy statement/prospectus.