Exhibit 10.45

Execution Version

29 June 2007

IXEUROPE PLC

and

CIT BANK LIMITED

as Arranger

and

CIT CAPITAL FINANCE (UK) LIMITED

acting as Administrative Agent and Security Trustee

and

THE LENDERS

£82,000,000 SENIOR FACILITIES AGREEMENT

Herbert Smith LLP

TABLE OF CONTENTS

| Clause |

Headings |

Page | ||

| 1. | DEFINITIONS AND INTERPRETATION | 4 | ||

| 2. | THE FACILITIES | 26 | ||

| 3. | PURPOSE | 28 | ||

| 4. | CONDITIONS OF UTILISATION | 28 | ||

| 5. | UTILISATION OF LOANS | 29 | ||

| 6. | OPTIONAL CURRENCY | 30 | ||

| 7. | REPAYMENT | 30 | ||

| 8. | PREPAYMENT AND CANCELLATION | 31 | ||

| 9. | INTEREST | 37 | ||

| 10. | INTEREST PERIODS | 38 | ||

| 11. | CHANGES TO THE CALCULATION OF INTEREST | 39 | ||

| 12. | FEES | 40 | ||

| 13. | TAX GROSS UP AND INDEMNITIES | 41 | ||

| 14. | INCREASED COSTS | 47 | ||

| 15. | OTHER INDEMNITIES | 48 | ||

| 16. | MITIGATION BY THE LENDERS | 50 | ||

| 17. | COSTS AND EXPENSES | 50 | ||

| 18. | GUARANTEE AND INDEMNITY | 51 | ||

| 19. | REPRESENTATIONS | 57 | ||

| 20. | INFORMATION UNDERTAKINGS | 63 | ||

| 21. | FINANCIAL COVENANTS | 68 | ||

| 22. | GENERAL UNDERTAKINGS | 69 | ||

| 23. | EVENTS OF DEFAULT | 80 | ||

| 24. | CHANGES TO THE LENDERS | 83 | ||

| 25. | CHANGES TO THE OBLIGORS | 87 | ||

| 26. | ROLE OF THE ADMINISTRATIVE AGENT, THE ARRANGER AND OTHERS | 90 | ||

2

| 27. | CONDUCT OF BUSINESS BY THE FINANCE PARTIES | 97 | ||

| 28. | SHARING AMONG THE FINANCE PARTIES | 97 | ||

| 29. | HEDGE COUNTERPARTIES | 98 | ||

| 30. | THE SECURITY TRUST | 100 | ||

| 31. | PARALLEL DEBT | 104 | ||

| 32. | PAYMENT MECHANICS | 105 | ||

| 33. | SET-OFF | 107 | ||

| 34. | NOTICES | 107 | ||

| 35. | CALCULATIONS AND CERTIFICATES | 111 | ||

| 36. | PARTIAL INVALIDITY | 111 | ||

| 37. | REMEDIES AND WAIVERS | 111 | ||

| 38. | AMENDMENTS AND WAIVERS | 111 | ||

| 39. | COUNTERPARTS | 112 | ||

| 40. | GOVERNING LAW | 112 | ||

| 41. | ENFORCEMENT | 113 | ||

| SCHEDULE 1 The Original Parties | 114 | |||

| SCHEDULE 2 Conditions Precedent/Subsequent | 116 | |||

| SCHEDULE 3 Utilisation Requests | 129 | |||

| SCHEDULE 4 Mandatory Cost Formulae | 131 | |||

| SCHEDULE 5 Forms of Transfer Certificate and Assignment Agreement | 134 | |||

| SCHEDULE 6 Form of Accession Letter | 139 | |||

| SCHEDULE 7 Form of Resignation Letter | 140 | |||

| SCHEDULE 8 Form of Compliance Certificate | 141 | |||

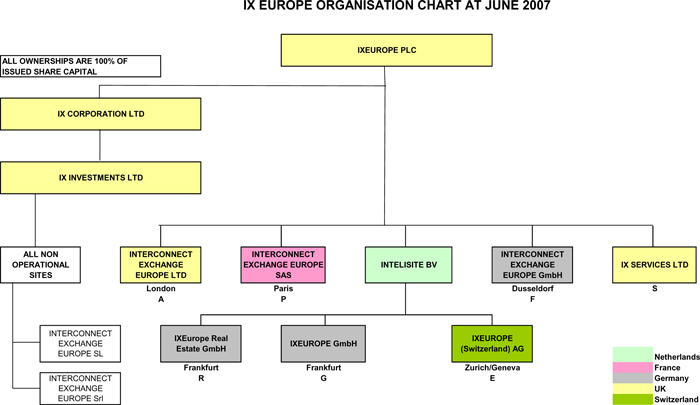

| SCHEDULE 10 Part I IX Europe Organisation Chart | 144 | |||

| SCHEDULE 10 Part II Current CEO, COO and CFO | 145 | |||

| SCHEDULE 11 Permitted Leases | 146 | |||

| SCHEDULE 12 Template for Acquisition Summary | 147 | |||

| SCHEDULE 13 Form of Confirmation | 153 | |||

3

| THIS | AGREEMENT is dated June 2007 and made |

| BETWEEN: |

| (1) | IXEUROPE PLC a company incorporated in England and Wales (the “Company”); |

| (2) | THE SUBSIDIARIES of the Company listed in Part I of Schedule 1 (The Original Obligors) as original borrowers (together with the Company the “Original Borrowers”); |

| (3) | THE SUBSIDIARIES of the Company listed in Part II of Schedule 1 (The Original Guarantors) as original guarantors (together with the Company the “Original Guarantors”); |

| (4) | THE FINANCIAL INSTITUTIONS listed in Part III of Schedule 1 (The Original Lenders) as lenders (the “Original Lenders”); |

| (5) | CIT BANK LIMITED as arranger (the “Arranger”); |

| (6) | CIT CAPITAL FINANCE (UK) LIMITED as agent of the Lenders (the “Administrative Agent”); |

| (7) | THE GOVERNOR AND COMPANY OF THE BANK OF IRELAND as original hedge counterparty (the “Original Hedge Counterparty”); and |

| (8) | CIT CAPITAL FINANCE (UK) LIMITED as security trustee for and on behalf of the Finance Parties (as defined below) and others (the “Security Trustee”). |

| IT | IS AGREED as follows: |

| 1. | DEFINITIONS AND INTERPRETATION |

| 1.1 | Definitions |

In this Agreement:

“Accession Letter” means a document substantially in the form set out in Schedule 6 (Form of Accession Letter).

“Accountants Report” means the report of BDO Stoy Hayward on the financial affairs of the Group provided pursuant to Clause 4.1 (Initial conditions precedent).

“Accounting Principles” means generally accepted accounting principles and practices in the jurisdiction of incorporation of the relevant member of the Group.

“Acquisition Information Template” means a document substantially in the form set out in Schedule 12 (Template for acquisition summary) setting out the relevant information relating to a Permitted Acquisition.

“Additional Borrower” means a company which becomes an Additional Borrower in accordance with Clause 25 (Changes to the Obligors).

“Additional Cost Rate” has the meaning given to it in Schedule 4 (Mandatory Cost Formulae).

“Additional Guarantor” means a company which becomes an Additional Guarantor in accordance with Clause 25 (Changes to the Obligors).

“Additional Obligor” means an Additional Borrower or an Additional Guarantor.

4

“Affiliate” means, in relation to any person, a Subsidiary of that person or a Holding Company of that person or any other Subsidiary of that Holding Company.

“Agent’s Spot Rate of Exchange” means the spot rate of exchange of Lloyds TSB Plc (or of such other bank of similar standing as the Administrative Agent may appoint in consultation with the Company) for the purchase of the relevant currency with the Base Currency in the London foreign exchange market as of 11:00 a.m. on a particular day.

“Assignment Agreement” means an agreement substantially in the form set out in Part II of Schedule 5 (Form of Assignment Agreement) or any other form agreed between the relevant assignor and assignee.

“Authorisation” means an authorisation, consent, approval, resolution, licence, exemption, filing, notarisation or registration.

“Availability Period” means:

| (A) | in relation to Facility A, the period from and including the Closing Date to and including the date falling 9 Months thereafter; |

| (B) | in relation to Facility B, the period from and including the Closing Date to and including the date falling 36 Months thereafter; |

| (C) | in relation to Facility C, the period from and including the Closing Date until the date falling one Month prior to the Termination Date; and |

| (D) | in relation to Facility D, such period as may be agreed between the Obligors’ Agent, the Administrative Agent and the Lenders in respect of Facility D. |

“Available Commitment” means, in relation to a Facility, a Lender’s Commitment under that Facility minus (subject as set out below):

| (A) | the Base Currency Amount of its participation in any outstanding Loans under that Facility; and |

| (B) | in relation to any proposed Utilisation, the Base Currency Amount of its participation in any other Loans that are due to be made under that Facility on or before the proposed Utilisation Date, |

other than, in relation to any proposed Utilisation under Facility C only, that Lender’s participation in any Facility C Loans that are due to be repaid or prepaid on or before the proposed Utilisation Date.

“Available Facility” means, in relation to a Facility, the aggregate for the time being of each Lender’s Available Commitment in respect of that Facility.

“B&S Finance Lease” means a Finance Lease between a member of the Group and B&S Card Services GmbH and which has the commercial effect of a “back to back” arrangement in form and substance satisfactory to the Administrative Agent, acting reasonably.

“Base Case” means the document comprising the financial forecasts for the Group in the agreed form and signed, for the purposes of identification, by the Company and the Administrative Agent.

“Base Currency” means sterling.

5

“Base Currency Amount” means in relation to a Loan, the amount specified in the Utilisation Request delivered by a Borrower for that Loan (or, if the amount requested is not denominated in the Base Currency, that amount converted into the Base Currency at the Agent’s Spot Rate of Exchange on the date which is two Business Days before the Utilisation Date or, if later, on the date the Administrative Agent receives the Utilisation Request) adjusted to reflect any repayment (other than a repayment arising from a change of currency), prepayment, consolidation or division of that Loan.

“Blocked Bank Accounts” means two bank accounts of IX Europe GmbH held at Deutsche Bank, Große Gallusstr. 10-14, 60323 Frankfurt am Main with account number 095 07 09 30 and Dresdner Bank, Filiale Fürstenhof, 60613 Frankfurt am Main with account number 938 117 70, two bank accounts of Interconnect Exchange Europe GmbH held at HypoVereinsbank, Mainzer Landstr. 23, 60329 Frankfurt am Main with account number 605823467 and Commerzbank, Breite Str. 25, 40213 Dusseldorf with account number 135155010 and one bank account of IX Europe (Switzerland) AG held at Credit Suisse with account number 604731-41-4-G4 in each case where such accounts hold monies the subject of rent deposits only, and such other accounts as the Administrative Agent shall agree in writing.

“Borrower” means an Original Borrower or an Additional Borrower unless it has ceased to be a Borrower in accordance with Clause 25 (Changes to the Obligors).

“Borrowing Group” means the Group excluding any Dormant Subsidiary.

“Borrowing Group EBITDA” means EBITDA in relation to the Borrowing Group only.

“Break Costs” means the amount (if any) by which:

| (A) | the interest (which for the avoidance of doubt excludes the Margin) which a Lender should have received for the period from the date of receipt of all or any part of its participation in a Loan or Unpaid Sum to the last day of the current Interest Period in respect of that Loan or Unpaid Sum, had the principal amount or Unpaid Sum received been paid on the last day of that Interest Period; |

exceeds:

| (B) | the amount which that Lender would be able to obtain by placing an amount equal to the principal amount or Unpaid Sum received by it on deposit with a leading bank in the Relevant Interbank Market for a period starting on the Business Day following receipt or recovery and ending on the last day of the current Interest Period. |

“Budget” means the annual budget for the Group as referred to in Clause 20.4 (Budget).

“Business Day” means a day (other than a Saturday or Sunday) on which banks are open for general business in London and:

| (A) | (in relation to any date for payment or purchase of swiss francs) Zurich; or |

| (B) | (in relation to any date for payment or purchase of euro) is a TARGET Day. |

“Capital Expenditure” means any expenditure or obligation in respect of expenditure which in accordance with the Accounting Principles is treated as capital expenditure and including the capital element of any expenditure or obligation incurred in connection with a capital or Finance Lease, other than a B&S Finance Lease.

6

“Cash” means, at any time, cash at bank and credited to an account in the name of an Obligor and to which an Obligor is alone beneficially entitled and for so long as:

| (A) | repayment of that cash is not contingent on the prior discharge of any other indebtedness of any Borrowing Group member or of any other person whatsoever or on the satisfaction of any other condition; |

| (B) | there is no Security over that cash except Transaction Security; and |

| (C) | such cash is freely and immediately available to be applied in repayment or prepayment of Financial Indebtedness of the Group. |

“Cashflow Available For Debt Service” or “CAFDS” means, in respect of any Relevant Period, Borrowing Group EBITDA for that Relevant Period then adjusted for any adjustments agreed by the Administrative Agent and after:

adding back:

| (A) | any decrease in the amount of Working Capital at the end of that Relevant Period compared against Working Capital at the start of that Relevant Period; |

| (B) | any cash receipt in respect of any exceptional or extraordinary item (excluding any such receipt that is applied in mandatory prepayment of the Facilities); |

| (C) | any cash receipt in respect of any Tax rebate; |

| (D) | any increase in provisions, other non-cash debits and other non-cash charges taken into account in establishing Borrowing Group EBITDA; and |

| (E) | any drawdowns under Facility B and Facility C, |

and deducting:

| (A) | any amount of Capital Expenditure (other than any incurred by way of finance or capital lease) actually made by any member of the Borrowing Group (save to the extent the same is funded under the Finance Documents); |

| (B) | any increase in the amount of Working Capital at the end of that Relevant Period compared against Working Capital at the start of that Relevant Period; |

| (C) | any cash payment in respect of any exceptional or extraordinary item; |

| (D) | any amount actually paid or due and payable in respect of Tax on the profits of any member of the Borrowing Group; |

| (E) | any decrease in provisions and other non-cash credits taken into account in establishing Borrowing Group EBITDA; and |

| (F) | any dividend or other distribution permitted pursuant to Clause 22.16 (Dividends and other payments on subordinated debt). |

and so that no amount shall be included more than once and no amounts related to a B&S Finance Lease shall be added or deducted.

“Charged Property” means all of the assets of the Obligors which from time to time are, or are expressed to be, the subject of the Transaction Security.

7

“Closing Date” means the date on which the Administrative Agent confirms in writing to the Company and the Lenders that the documents and other evidence referred to in Clause 4.1(Initial Conditions Precedent) has been received.

“Commitment” means a Facility A Commitment, a Facility B Commitment or a Facility C Commitment.

“Compliance Certificate” means a certificate substantially in the form set out in Schedule 8 (Form of Compliance Certificate).

“Consolidated Total Finance Charges” means, in respect of any period:

| (A) | the aggregate amount of the interest (including the interest element of payments made under Finance Leases other than a B&S Finance Lease), commission, fees (excluding all front end, arrangement and participation fees paid on or about the Closing Date under the Finance Documents and up-front premium or front end fees under any hedging arrangement), discounts, prepayment penalties or premiums and other finance payments payable in cash by any member of the Borrowing Group in respect of Financial Indebtedness, including in respect of any interest rate hedging arrangement; less |

| (B) | the aggregate of any commission, fees, discounts and other finance payments received in cash by any member of the Borrowing Group under any interest rate hedging arrangement, |

provided that any amounts payable by one member of the Borrowing Group to another member of the Borrowing Group shall not be included in the calculation of Consolidated Total Finance Charges.

“Current Assets” means the aggregate of inventory, trade and other receivables of each member of the Borrowing Group including sundry debtors (but excluding cash at bank) maturing within twelve months from the date of computation and excluding:

| (A) | receivables in relation to Tax; |

| (B) | extraordinary items, exceptional items and other non-operating items; |

| (C) | insurance claims; and |

| (D) | any accrued interest owing to any member of the Borrowing Group. |

“Current Liabilities” means the aggregate of all liabilities (including trade creditors, accruals, provisions and prepayments) of each member of the Borrowing Group falling due within twelve months from the date of computation but excluding:

| (A) | liabilities in respect of the Facilities; |

| (B) | liabilities for Tax; |

| (C) | extraordinary items, exceptional items and other non-operating items; |

| (D) | insurance claims; and |

| (E) | liabilities in relation to dividends declared but not paid by the Company. |

8

“Default” means an Event of Default or any event or circumstance which would with the expiry of a grace period and/or the giving of notice, in each case, under Clause 23 (Events of Default), be an Event of Default.

“Default Rate” has the meaning ascribed to it in the definition of Margin.

“Delegate” means any delegate, agent, attorney or co-trustee appointed by the Security Trustee.

“Disposal” means a sale, lease, transfer, loan or other disposal by a person of any asset, undertaking or business (whether voluntary or involuntary and whether as a single transaction or a series of transactions).

“Dormant Subsidiary” means a member of the Group which does not trade (for itself or as agent for any person) and does not own, legally or beneficially, assets which in aggregate have a value of £50,000 or more or its equivalent in other currencies (excluding historic VAT reclaims).

“Dutch Financial Supervision Act” means the Dutch Financial Supervision Act (Wet op het financieel toezicht).

“Dutch Obligor” means an Obligor incorporated under Dutch law.

“EBITDA” means the consolidated profits of the Group for a Relevant Period:

| (A) | before deducting any Total Interest Costs; |

| (B) | before deducting any amount attributable to the amortisation of intangible assets, the depreciation of tangible assets or the amortisation of any fees, costs and expenses incurred in connection with the Finance Documents; |

| (C) | before taking into account any accrued interest owing to any member of the Group; |

| (D) | before taking into account any items treated as exceptional or extraordinary items; |

| (E) | after deducting the amount of any profit of any member of the Group which is attributable to minority interests; |

| (F) | after deducting the amount of any profit of any investment or entity (which is not itself a member of the Group) in which any member of the Group has an ownership interest to the extent that the amount of such profit included in the financial statements of the Group exceeds the amount (net of applicable withholding tax) received in cash by members of the Group through distributions by such investment or entity; |

| (G) | before taking into account any realised and unrealised exchange gains and losses including those arising on translation of currency debt; |

| (H) | before taking into account any gain or loss arising from an upward or downward revaluation of any asset; and |

| (I) | after taking into account the adjustment for options included in the schedule of charges (as agreed with BDO Stoy Hayward and reviewed from time to time under IFRS rules) in respect of the same Relevant Period and any other adjustments agreed by the Administrative Agent, in each case, to the extent added, deducted or taken into account, as the case may be, for the purposes of determining profits of the Group from ordinary activities before taxation. |

9

“Eligible Deposit Bank” means any bank or financial institution with a short term rating of at least A1 granted by Standard and Poors Corporation or P1 granted by Moody’s Investor’s Services Inc.

“Enforcement Action” means any action to:

| (A) | demand payment, declare prematurely due and payable or otherwise seek to accelerate payment of all or part of any liability owing or due to any Finance Party under any Finance Document; |

| (B) | enforce (or require any other person to enforce) any Security (whether by sale, possession, appointment of an administrator or otherwise) or any guarantee; |

| (C) | discharge, sue for or commence proceedings to recover all or part of any liability or obtain or enforce any judgment against any member of the Group in relation to all or part of any liability owing or due to any Finance Party under any Finance Document; |

| (D) | declare an early termination date under any Hedging Agreement or demand payment of all or part of any amount which would become payable following an early termination date; |

| (E) | petition for, apply for or vote in favour of any resolution for the winding up, dissolution, administration or implementation of a voluntary arrangement in relation to any member of the Group; or |

| (F) | recover or receive all or part of any liability owing or due to any Finance Party under any Finance Document (including by exercising any rights of set-off or combination of accounts) other than in accordance with this Agreement. |

“Environmental Claim” means any claim, proceeding or investigation by any person in respect of any Environmental Law.

“Environmental Law” means any applicable law or regulation which relates to:

| (A) | the pollution or protection of the environment; |

| (B) | harm to or the protection of human health; or |

| (C) | the health of animals or plants. |

“Environmental Permits” means any permit, licence, consent, approval and other authorisation and the filing of any notification, report or assessment required under any Environmental Law for the operation of the business of any member of the Group conducted on or from the properties owned or used by any member of the Group.

“EURIBOR” means, in relation to any Loan in euro:

| (A) | the applicable Screen Rate; or |

| (B) | (if no Screen Rate is available for the Interest Period of that Loan) the arithmetic mean of the rates (rounded upwards to four decimal places) as supplied to the Administrative Agent at its request quoted by the Reference Banks to leading banks in the European interbank market, as of the Specified Time on the Quotation Day for the offering of deposits in euro for a period comparable to the Interest Period of the relevant Loan. |

10

“Event of Default” means any event or circumstance specified as such in Clause 23 (Events of Default).

“Existing Financial Indebtedness” means all Financial Indebtedness of the Group incurred under or pursuant a senior facilities agreement dated 26 July 2006 made between, amongst others, (1) the Company (as the company), (2) the Arranger (as the arranger) and (3) the Administrative Agent (as administrative agent), as amended and restated on 28 February 2007.

“Facility” means Facility A, Facility B, Facility C or Facility D;

“Facility A” means the term loan facility made available under this Agreement as described in Clause 2.1.1 (The Facilities).

“Facility A Commitment” means:

| (A) | in relation to an Original Lender, the amount in the Base Currency set opposite its name under the heading “Facility A Commitment” in Part III of Schedule 1 (The Original Lenders) and the amount of any other Facility A Commitment transferred to it under this Agreement; and |

| (B) | in relation to any other Lender, the amount in the Base Currency of any Facility A Commitment transferred to it under this Agreement, |

to the extent not cancelled, reduced or transferred by it under this Agreement.

“Facility A Loan” means a loan made or to be made under Facility A or the principal amount outstanding for the time being of that loan.

“Facility A Repayment Date” means each of the dates specified in Clause 7.1.1 (Repayment of Facility A and B Loans) as Facility A Repayment Dates, but if any such date is not a Business Day, then that Facility A Repayment Date shall be deemed to be the next Business Day.

“Facility A Repayment Instalment” means each instalment for repayment of the Facility A Loans referred to in Clause 7.1.1 (Repayment of Facility A and B Loans).

“Facility B” means the term loan facility made available under this Agreement as described in Clause 2.1.2 (The Facilities).

“Facility B Commitment” means:

| (A) | in relation to an Original Lender, the amount in the Base Currency set opposite its name under the heading “Facility B Commitment” in Part III of Schedule 1 (The Original Lenders) and the amount of any other Facility B Commitment transferred to it under this Agreement; and |

| (B) | in relation to any other Lender, the amount in the Base Currency of any Facility B Commitment transferred to it under this Agreement, |

to the extent not cancelled, reduced or transferred by it under this Agreement.

“Facility B Loan” means a loan made or to be made under Facility B or the principal amount outstanding for the time being of that loan.

11

“Facility B Repayment Date” means each of the dates specified in Clause 7.1.2 (Repayment of Facility A and B Loans) as Facility B Repayment Dates, but if any such date is not a Business Day, then that Facility B Repayment Date shall be deemed to be the next Business Day.

“Facility B Repayment Instalment” means each instalment for repayment of the Facility B Loans referred to in Clause 7.1.2 (Repayment of Facility A and B Loans).

“Facility C” means the revolving loan facility made available under this Agreement as described in Clause 2.1.3 (The Facilities).

“Facility C Commitment” means:

| (A) | in relation to an Original Lender, the amount in the Base Currency set opposite its name under the heading “Facility C Commitment” in Part III of Schedule 1 (The Original Lenders) and the amount of any other Facility C Commitment transferred to it under this Agreement; and |

| (B) | in relation to any other Lender, the amount of any Facility C Commitment transferred to it under this Agreement, |

to the extent not cancelled, reduced or transferred by it under this Agreement,

“Facility C Loan” means a loan made or to be made under Facility C or the principal amount outstanding for the time being of that loan.

“Facility D” means the uncommitted term loan facility to be made available under, and in accordance with the terms and conditions of, this Agreement as described in Clause 2.2 (Facility D).

“Facility D Loan” means a loan made or to be made under Facility D or the principal amount outstanding for the time being of that loan.

“Facility Office” means the office or offices notified by a Lender to the Administrative Agent in writing on or before the date it becomes a Lender (or, following that date, by not less than five Business Days’ written notice) as the office or offices through which it will perform its obligations under this Agreement.

“Fee Letter” means any letter or letters dated on or about the date of this Agreement between the Arranger and the Company (or the Administrative Agent and the Company or the Security Trustee and the Company) setting out any of the fees referred to in Clause 12 (Fees).

“Finance Document” means this Agreement, the Hedging Letter, the Hedging Documents, any Fee Letter, any Accession Letter, any Resignation Letter, any Transaction Security Document and any other document designated as a “Finance Document” by the Administrative Agent and the Company.

“Finance Lease” means a contract treated as a finance or capital lease in accordance with generally accepted accounting principles in the relevant jurisdiction.

“Finance Party” means the Administrative Agent, the Arranger, the Security Trustee, a Hedge Counterparty and each Lender.

“Financial Indebtedness” means any indebtedness for or in respect of:

| (A) | monies borrowed or raised; |

12

| (B) | any amount raised by acceptance under any acceptance credit facility or by a bill discounting or factoring credit facility or any dematerialised equivalent; |

| (C) | any amount raised pursuant to any note purchase facility or the issue of bonds, notes, debentures, loan stock or any similar instrument; |

| (D) | any liability in respect of any lease or hire purchase contract or other agreement which would, in accordance with the Accounting Principles, be treated as a finance or capital lease; |

| (E) | receivables sold or discounted (other than any receivables to the extent they are sold on a non-recourse basis); |

| (F) | any derivative transaction entered into in connection with protection against or benefit from fluctuation in any rate or price (and, when calculating the value of any derivative transaction, only the marked to market value shall be taken into account); |

| (G) | any counter-indemnity obligation in respect of a guarantee, indemnity, bond, standby or documentary letter of credit or any other instrument issued by a bank or financial institution; |

| (H) | any amount raised by the issue of redeemable shares; |

| (I) | any liability under an advance or deferred purchase agreement if such agreement was entered into primarily as a method of raising finance; |

| (J) | any liability for the supply of goods or services which is more than 90 days past the expiry of the period customarily allowed by the relevant supplier after the due date (other than as a result of a bona fide dispute); |

| (K) | any arrangement entered into primarily as a method of raising finance pursuant to which an asset sold or otherwise disposed of by that person may be re-acquired by a member of the Group (whether following the exercise of an option or otherwise); |

| (L) | any amount raised under any other transaction (including any forward sale or purchase agreement) having the commercial effect of a borrowing; and |

| (M) | (without double counting) any liability in respect of any guarantee or indemnity or similar assurance against financial loss for any of the items referred to in the preceding paragraphs of this definition and any agreement to maintain the solvency of any person whether by investing in, lending to or purchasing the assets of such person. |

“Financial Quarter” means the period commencing on the day after one Quarter Date and ending on the next Quarter Date.

“French Borrower” means any Borrower that is incorporated in France.

“French Guarantor” means any Guarantor that is incorporated in France.

“German Obligor” means any Obligor that is incorporated or established (as the case may be) in the Federal Republic of Germany.

“German Subsidiary” means companies which are dependent enterprises of the relevant Holding Company, or any company in respect of which such term is used, within the meaning of section 17 German Stock Corporation Act (AktG) and subsidiaries within the meaning of section 290 German Commercial Code (HGB).

13

“Group” means the Company and each of its Subsidiaries for the time being.

“Group Structure Chart” means the group structure chart as at the date hereof set out in Schedule 10 (Group Structure Chart).

“Guarantor” means an Original Guarantor or an Additional Guarantor, unless it has ceased to be a Guarantor in accordance with Clause 25 (Changes to the Obligors).

“Guidelines” means, together, the guideline “Syndicated Loans” of January 2000 (S-02.128) (Merkblatt S-02.128 vom January 2000 betreffend Steuerliche Behandlung von Konsortialdarlehen, Schuldscheindarlehen, Wechseln und Unterbeteiligungen) and the guideline “Bonds” of April 1999 (S-02-122.1) (Merkblatt S-02.122.1 vom April 1999 betreffend Obligationen) as issued by the Swiss Federal Tax Administration.

“Hedge Counterparty” means the Original Hedge Counterparty and any other person who enters into Hedging Agreement with a Borrower.

“Hedging Agreement” means any master agreement, confirmation, schedule or other agreement entered into by a Borrower and a person permitted under Clause 29.1 (Identity of Hedge Counterparties) for the purpose of hedging interest rate liabilities in relation to the Term Facilities in accordance with the Hedging Letter.

“Hedging Document” means a Hedging Agreement or any document entered into under or in connection with it.

“Hedging Letter” means the letter addressed from the Administrative Agent to the Company dated on or about the date of this Agreement relating to the hedging strategy of the Group in the form agreed between the Company and the Administrative Agent.

“Hedging Liability” means any liability of any member of the Group to a Hedge Counterparty under any Hedging Agreement.

“Holding Company” means, in relation to a company or corporation, any other company or corporation in respect of which it is a Subsidiary.

“Indebtedness for Borrowed Money” means Financial Indebtedness save for indebtedness in respect of paragraphs (E), (F), (H) and (J) or, to the extent it relates to indebtedness under paragraphs (E), (F), (H) or (J), paragraph (M) of the definition of Financial Indebtedness.

“Information Memorandum” means any document approved by the Company in writing (acting reasonably) concerning the Group which is to be prepared hereafter in relation to this transaction and to be distributed by the Arranger to selected financial institutions prior to the Syndication Date in connection with the syndication of the Facilities.

“Information Package” means the bundle of documents relating to the Group supplied by the Group to the Arranger on or about 12 June 2007 to enable the Arranger, the Administrative Agent, the Security Trustee and the Lenders to assess the credit worthiness of the Group together with such further information and documents relating to the businesses, assets, liabilities and affairs of the Group supplied by any member of the Group to the Administrative Agent or the Arranger in writing since 12 June 2007.

“Intellectual Property” means:

| (A) | any patents, trade marks, service marks, designs, business names, copyrights, design rights, moral rights, inventions, confidential information, knowhow and other intellectual property rights and interests, whether registered or unregistered; and |

14

| (B) | the benefit of all applications and rights to use such assets of each member of the Group. |

“Interest Period” means, in relation to a Loan, each period determined in accordance with Clause 10 (Interest Periods) and, in relation to an Unpaid Sum, each period determined in accordance with Clause 9.3 (Default interest).

“ITA” means the Income Tax Act 2007.

“Legal Opinions” means the legal opinions delivered to the Administrative Agent pursuant to Clause 4.1 (Initial Conditions Precedent) or Clause 25 (Changes to the Obligors).

“Legal Reservations” means:

| (A) | the principal that equitable remedies may be granted or refused at the discretion of a court, the limitation of enforcement by laws relating to insolvency, reorganisation and other laws generally affecting the rights of creditors; |

| (B) | the time barring of claims under the Limitation Acts or equivalent legislation in any Relevant Jurisdiction, the possibility that an undertaking to assume liability for or indemnify a person against non-payment of the UK stamp duty may be void and defences of set-off or counterclaim; and |

| (C) | any general principles which are set out in the qualifications as to matters of law in the Legal Opinions. |

“Lender” means:

| (A) | any Original Lender; and |

| (B) | any bank, financial institution (including a trust), fund, vehicle or other entity in each case which is engaged in or established for the making of or purchasing or investing in Loans and/or securities which has become a Party in accordance with Clause 24 (Changes to the Lenders), |

which in each case has not ceased to be a Party in accordance with the terms of this Agreement.

“Lender’s Commitment” means, in relation to a Lender, that Lender’s commitment in respect of a Facility as set out at Part III of Schedule 1 (The Original Lenders).

“LIBOR” means, in relation to any Loan:

| (A) | the applicable Screen Rate; or |

| (B) | (if no Screen Rate is available for the currency or Interest Period of that Loan) the arithmetic mean of the rates (rounded upwards to four decimal places) as supplied to the Administrative Agent at its request quoted by the Reference Banks to leading banks in the London interbank market, |

as of the Specified Time on the Quotation Day for the offering of deposits in the currency of that Loan and for a period comparable to the Interest Period for that Loan.

“Loan” means a Term Loan or a Revolving Loan.

15

“London 4” means a datacentre to be owned and operated by Interconnect Exchange Europe Limited within the building to be constructed by Slough Trading Estate Limited at 2 Buckingham Avenue, Slough in accordance with the agreement to lease signed by Interconnect Exchange Europe Limited on 12 June 2006.

“Majority Lenders” means:

| (A) |

if there are no Loans then outstanding, a Lender or Lenders whose Commitments aggregate more than 66 2/3 per cent. of the Total Commitments (or, if the Total Commitments have been reduced to zero, aggregated more than 66 2/3 per cent. of the Total Commitments immediately prior to that reduction); or |

| (B) |

at any other time, a Lender or Lenders whose participations in the Loans then outstanding aggregate more than 66 2/3 of all the Loans then outstanding. |

“Mandatory Cost” means the percentage rate per annum calculated by the Administrative Agent in accordance with Schedule 4 (Mandatory Cost Formulae).

“Mandatory Prepayment/Holding Account” means an interest-bearing account:

| (A) | identified in a letter to be agreed hereafter between the Company and the Administrative Agent (in each case acting reasonably) as a Mandatory Prepayment Account (as the same may be redesignated, substituted or replaced from time to time); |

| (B) | subject to Security in favour of the Security Trustee which Security is in form and substance satisfactory to the Administrative Agent and the Security Trustee; and |

| (C) | from which no withdrawals may be made by any members of the Group save other than as permitted under this Agreement. |

“Margin” means:

| (A) | in relation to a Facility A Loan or a Facility C Loan, 2.00 per cent. per annum; |

| (B) | in relation to a Facility B Loan, 2.25 per cent. per annum, |

but if:

| (1) | no Event of Default has occurred and is continuing; and |

| (2) | at any Quarter Date after the Closing Date, the ratio of Total Debt at the end of the most recently completed Relevant Period to Pro Forma Borrowing Group EBITDA for such Relevant Period is within a range set out in the table below, |

then the Margin for each Loan will thereafter be the percentage per annum set out below opposite that range:

| Total Debt to Pro Forma Borrowing Group EBITDA |

Facility A/Facility C Margin (% p.a.) |

Facility B Margin (% p.a.) | ||

| Greater than 3.75:1 |

2.00 | 2.25 | ||

| Less than or equal to 3.75:1 but greater than 3.50:1 |

2.00 | 2.00 | ||

| Less than or equal to 3.50:1 but greater than 3.00:1 |

1.75 | 1.75 | ||

| Less than or equal to 3.00:1 but greater than 2.50:1 |

1.50 | 1.50 |

16

| Less than or equal to 2.50:1 but greater than 2.00:1 |

1.25 | 1.25 | ||

| Less than or equal to 2.00:1 but greater than 1.50:1 |

1.00 | 1.00 | ||

| Less than or equal to 1.50:1 |

0.75 | 0.75 |

and;

| (C) | in relation to a Facility D Loan, the rate(s) agreed between the Obligors’ Agent, the Administrative Agent and each Lender in respect of Facility D from time to time. |

Any change in that Margin shall take effect from and on the fifth Business Day after receipt by the Administrative Agent of the Quarterly Financial Statements and Compliance Certificate for that Relevant Period.

If an Event of Default is outstanding, the Margin will be increased by 2.00 per cent. per annum above the then applicable rate (the “Default Rate”) provided that upon the remedy or waiver, as the case may be, of the said Event of Default, the said Margin will be recalculated on the basis set out above, and any change shall take effect as of the date the relevant Event of Default is remedied or waived.

“Material Adverse Effect” means a material adverse effect on:

| (A) | the business, assets or financial condition of the Group taken as a whole; or |

| (B) | the ability of an Obligor to perform its payment obligations under the Finance Documents or result in the invalidity or unenforceability of any Finance Document or have a material adverse effect on the effectiveness or ranking of any material Security granted or purporting to be granted pursuant to any of the Finance Documents; or |

| (C) | the ability of the Group to comply with its obligations under Clause 21.1 (Financial condition) of this Agreement. |

“Material Company” means, at any time:

| (A) | an Obligor; |

| (B) | a Subsidiary of the Company which: |

| (1) | has earnings before interest, tax, depreciation and amortisation (calculated on the same basis as EBITDA) representing 5 per cent. or more of Borrowing Group EBITDA; or |

| (2) | has gross assets (excluding intra-group items) representing 5 per cent. or more of the gross assets of the Borrowing Group, |

in each case calculated on a consolidated basis; and

| (C) | each Holding Company (which is also a member of the Group) of a member of the Group which is a “Material Group Company” pursuant to paragraph (A) or (B). |

Compliance with the conditions set out in paragraphs (B)(1) and (2) above shall be determined by reference to the most recent Compliance Certificate supplied by the Company and/or shall be assessed on a quarterly basis by reference to the latest monthly management accounts of that Subsidiary and on an annual basis by reference to the latest audited consolidated financial statements of the Group.

17

“Month” means a period starting on one day in a calendar month and ending on the numerically corresponding day in the next calendar month, except that:

| (A) | (subject to paragraph (C) below) if the numerically corresponding day is not a Business Day, that period shall end on the next Business Day in that calendar month in which that period is to end if there is one, or if there is not, on the immediately preceding Business Day; |

| (B) | if there is no numerically corresponding day in the calendar month in which that period is to end, that period shall end on the last Business Day in that calendar month; and |

| (C) | if an Interest Period begins on the last Business Day of a calendar month, that Interest Period shall end on the last Business Day in the calendar month in which that Interest Period is to end. |

The above rules will only apply to the last Month of any period. “Monthly” shall be construed accordingly.

“Non-Bank Rules” means the Ten Non-Bank Rule and the Twenty Non-Bank Rule.

“Obligor” means a Borrower or a Guarantor.

“Obligors’ Agent” means the Company, appointed to act on behalf of each Obligor in relation to the Finance Documents pursuant to Clause 2.5 (Obligors’ Agent).

“Optional Currency” means euros or Swiss francs.

“Original Financial Statements” means:

| (A) | in relation to each Original Obligor, its audited financial statements (consolidated where applicable) for its financial year ended 31 December 2006; |

| (B) | in relation to each Original Obligor, its monthly financial statements (consolidated where applicable) for the month ending 30 April 2007; and |

| (C) | in relation to any Obligor (other than an Original Obligor), its audited financial statements delivered to the Administrative Agent as required by Clause 25 (Changes to the Obligors). |

“Original Obligor” means an Original Borrower or an Original Guarantor.

“Participating Member State” means any member state of the European Communities that adopts or has adopted the euro as its lawful currency in accordance with legislation of the European Community relating to Economic and Monetary Union.

“Party” means a party to this Agreement.

“Permitted Acquisition” means a purchase permitted in accordance with Clause 22.7 (Acquisitions)

“Permitted Carry Forward Amount” has the meaning given to such term in Clause 21 (Financial Covenants).

18

“Permitted Leases” means those Finance Leases in respect of equipment used by members of the Borrowing Group as listed in Schedule 11 (Permitted Leases) (as such list may from time to time be amended by written agreement between the Company and the Administrative Agent, such agreement not to be unreasonably withheld) and any other Finance Lease entered into from time to time with any Lender, provided that the aggregate of any Financial Indebtedness incurred by the Group under such Finance Leases shall not exceed £5,000,000.

“Pro Forma Borrowing Group EBITDA” means the notional EBITDA to be applied in respect of the Relevant Period or (in the case of Clause 21 (Financial Covenants)), Financial Quarter or other three month period (in the case of Clause 5.3.2 (Currency and amount)) (as appropriate), provided that, in the case of EBITDA received by any member of the Borrowing Group from a Significant Customer Contract, the amount of such EBITDA in the current financial year will be deducted from the calculation of EBITDA and an annualised proforma amount of 80 per cent. of the contracted monthly revenues per Financial Quarter in respect of each such Significant Customer Contract will be added back to EBITDA, in each case from the date of signature of such Significant Customer Contract until the first anniversary of such date.

“Qualifying Bank” means any legal entity which is recognised as a bank by the banking laws in force in its country of incorporation and which exercises as its main purpose a true banking activity, having bank personnel, premises, communication devices of its own and the authority of decision-making.

“Quarter Date” means each of 31 March, 30 June, 30 September and 31 December.

“Quotation Day” means, in relation to any period for which an interest rate is to be determined:

| (A) | (if the currency is sterling or Swiss francs) the first day of that period; or |

| (B) | (if the currency is euro) two TARGET Days before the first day of that period, |

unless market practice differs in the Relevant Interbank Market for a currency, in which case the Quotation Day for that currency will be determined by the Administrative Agent in accordance with market practice in the Relevant Interbank Market (and if quotations would normally be given by leading banks in the Relevant Interbank Market on more than one day, the Quotation Day will be the last of those days).

“Receiver” means a receiver or receiver and manager or administrative receiver of the whole or any part of the Charged Property.

“Reference Banks” means the principal London offices of Lloyds TSB Plc and such other banks or such of the Lenders as may be appointed by the Administrative Agent in consultation with the Company.

“Related Fund” means, in relation to a trust or fund or other entity, another trust, fund or other entity which is regularly engaged in, or established for the purpose of making, purchasing or investing in loans, securities or other financial assets and either has the same fund manager or has common ownership as such first mentioned trust or fund or other entity.

“Relevant Interbank Market” means in relation to euro, the European interbank market and, in relation to any other currency, the London interbank market.

“Relevant Jurisdiction” means, in relation to an Obligor:

| (A) | its jurisdiction of incorporation; |

19

| (B) | any jurisdiction where any asset subject to or intended to be subject to the Transaction Security to be created by it is situated; |

| (C) | any jurisdiction where it conducts its business; and |

| (D) | the jurisdiction whose laws govern the perfection of any of the Transaction Security Documents entered into by it. |

“Relevant Period” means each period of twelve months, or such shorter period commencing on the Closing Date, ending on each Quarter Date falling on or after the Closing Date.

“Repeating Representations” means each of the representations set out in Clauses 19.1 (Status) to 19.6 (Governing law and enforcement), 19.10 (No default), 19.11.5 (No misleading information), 19.12.3 and 19.12.4 (Financial condition), 19.13 (No proceedings pending or threatened) to 19.17 (Security and Financial Indebtedness) and 19.25 (Dutch Financial Supervision Act).

“Resignation Letter” means a letter substantially in the form set out in Schedule 7 (Form of Resignation Letter).

“Revolving Loan” means a Facility C Loan.

“Rollover Loan” means one or more Facility C Loans:

| (A) | made or to be made on the same day that a maturing Facility C Loan is due to be repaid; |

| (B) | the aggregate amount of which is equal to or less than the maturing Facility C Loan; |

| (C) | in the same currency as the maturing Facility C Loan; and |

| (D) | made or to be made to the same Borrower for the purpose of refinancing a maturing Facility C Loan. |

“Screen Rate” means:

| (A) | in relation to LIBOR, the British Bankers’ Association Interest Settlement Rate for the relevant currency and period; and |

| (B) | in relation to EURIBOR, the percentage rate per annum determined by the Banking Federation of the European Union for the relevant period, |

displayed on the appropriate page of the Reuters screen. If the agreed page is replaced or service ceases to be available, the Administrative Agent may specify another page or service displaying the appropriate rate after consultation with the Company and the Lenders.

“Secured Parties” means each Finance Party from time to time party to this Agreement and any Receiver or Delegate.

“Security” means a mortgage, charge, pledge, lien or other security interest securing any obligation of any person or any other agreement or arrangement having a similar effect.

“Security Company” means any member of the Group that has entered into a Transaction Security Document.

20

“Selection Notice” means a notice substantially in the form set out in Part II of Schedule 3 (Selection Notice) given in accordance with Clause 10 (Interest Periods) in relation to Facility A and/or Facility B.

“Significant Customer Contract” means a material contract entered into or to be entered into by a member of the Borrowing Group with a customer in the ordinary course of business and on arm’s length terms in such form as the Administrative Agent shall approve (acting reasonably).

“Slough Upgrade” means second phase of the upgrade in respect of London 4, as referred to in the Base Case.

“Slough Upgrade Deferred Consideration” means the amount of the consideration in respect of the Slough Upgrade that is deferred for more than 90 days after the date for initial payment of monies due under the agreement relating to the Slough Upgrade.

“Specified Time” means a time determined in accordance with Schedule 9 (Timetables).

“Subsidiary” means in relation to a company or corporation, any company or corporation:

| (A) | which is controlled, directly or indirectly, by the first-mentioned company or corporation; |

| (B) | more than half the issued share capital of which is beneficially owned, directly or indirectly, by the first-mentioned company or corporation; or |

| (C) | which is a subsidiary of another subsidiary of the first-mentioned company or corporation |

and, for these purposes, a company or corporation shall be treated as being controlled by another if that other company or corporation is able to direct its affairs and/or to control the composition of its board of directors or equivalent body.

“Swiss Borrower” means a Borrower incorporated under the laws of Switzerland or which is treated as resident in Switzerland for tax purposes.

“Swiss Obligor” means an Obligor incorporated under the laws of Switzerland or which is treated as resident in Switzerland for tax purposes.

“Swiss Withholding Tax” means any withholding tax on the payment of interest and dividends (including constructive dividends) in accordance with the Swiss Federal Withholding Tax Act of 13 October 1965 (Bundesgesetz über die Verrechnungssteuer), as amended from time to time.

“Syndication Date” means the day specified by the Arranger as the day on which primary syndication of the Facilities is completed provided that the Syndication Date shall not be more than six months after the date of the first Utilisation Request under the Facilities as the case may be.

“Syndication Letter” means the letter dated on or about the date hereof addressed by the Arranger, to the Company relating to the syndication of the Facilities.

“TARGET” means Trans-European Automated Real-time Gross Settlement Express Transfer payment system.

“TARGET Day” means any day on which TARGET is open for the settlement of payments in euro.

21

“Tax” means any tax, levy, impost, duty or other charge or withholding of a similar nature (including any penalty or interest payable in connection with any failure to pay or any delay in paying any of the same).

“Taxes Act” means the Income and Corporation Taxes Act 1988.

“Tax Deduction” means a deduction or withholding for or on account of Tax from a payment under a Finance Document.

“Tax Payment” means either an increased payment made by an Obligor to a Finance Party under Clause 13.2 (Tax gross-up) or a payment under Clause 13.3 (Tax indemnity).

“Ten Non-Bank Rule” means the rule that the aggregate number of Lenders of a Swiss Borrower under this Agreement which are not Qualifying Banks must not exceed ten (10), in each case in accordance with the meaning of the Guidelines.

“Term Facility” means Facility A, Facility B or, subject to Clause 2.2 (Facility D), Facility D.

“Term Loan” means a Facility A Loan, a Facility B Loan or, subject to Clause 2.2 (Facility D), a Facility D Loan.

“Termination Date” means 30 June 2014.

“Total Commitments” means the aggregate of the Total Facility A Commitments, the Total Facility B Commitments and the Total Facility C Commitments.

“Total Debt” means, at any time, the aggregate amount of all obligations of the Borrowing Group for or in respect of the principal amount of Indebtedness for Borrowed Money but:

| (A) | excluding any such obligations to any other member of the Borrowing Group; and |

| (B) | including: |

| (1) | in the case of Finance Leases (other than B&S Finance Leases), only the capitalised value thereof; and |

| (2) | the Slough Upgrade Deferred Consideration, |

and so that no amount shall be included or excluded more than once.

“Total Debt Service” means, in respect of any Relevant Period, the aggregate of:

| (A) | Total Interest Costs; |

| (B) | the aggregate of all scheduled repayments of any Indebtedness for Borrowed Money of the Borrowing Group; |

| (C) | the amount of the capital element of any payments in respect of that Relevant Period payable under any Finance Lease or capital lease entered into by any member of the Borrowing Group; |

| (D) | the amount of any payments in respect of that Relevant Period payable in respect of the Slough Upgrade Deferred Consideration; |

| (E) | the aggregate of any dividend or other distribution permitted pursuant to Clause 22.16 (Dividends and other payments on subordinated debt); |

22

| (F) | the aggregate of all interest, lease rentals, coupon or other payments whatsoever in respect of Financial Indebtedness of the Borrowing Group, |

and so that no amount shall be included more than once and so that, to the extent not already excluded, no amount shall be included in respect of any B&S Finance Lease.

“Total Facility A Commitments” means the aggregate of the Facility A Commitments.

“Total Facility B Commitments” means the aggregate of the Facility B Commitments.

“Total Facility C Commitments” means the aggregate of the Facility C Commitments.

“Total Funding Costs” means, in respect of any period, the aggregate of:

| (A) | Consolidated Total Finance Charges for that period; |

| (B) | scheduled repayments, and any other scheduled payments in the nature of principal, payable by any member of the Borrowing Group in that period in respect of Financial Indebtedness, other than B&S Finance Leases; and |

| (C) | to the extent not already included in paragraph (b) above, the amount of the capital element of any payments in respect of that period payable under any Finance Lease entered into by any member of the Borrowing Group, |

and so that no amount shall be included more than once but excluding any amounts falling due under any overdraft, working capital facility or revolving credit facility provided such amounts are available for simultaneous redrawing under that or any replacement facility and further, to the extent not already excluded, no amount shall be included in respect of any B&S Finance Lease.

“Total Interest Costs” means, for any Relevant Period, the aggregate amount of the accrued interest, commission, fees, discounts, prepayment penalties or premiums and other finance payments in respect of Indebtedness for Borrowed Money payable in cash by any member of the Borrowing Group in respect of that Relevant Period:

| (A) | excluding any such obligations to any other member of the Borrowing Group; |

| (B) | including only the interest element of payments payable under any finance capital lease entered into by any member of the Borrowing Group, other than a B&S Finance Lease; |

| (C) | including any accrued commission, fees, discounts and other finance payments payable by any member of the Borrowing Group under any interest rate hedging arrangement; and |

| (D) | deducting any accrued commission, fees, discounts and other finance payments owing to any member of the Borrowing Group under any interest rate hedging instrument. |

“Total Senior Debt” means, at any time, the aggregate amount of all obligations of the Borrowing Group for or in respect of the principal amount owed under the Facilities.

“Total Senior Interest Costs” means, for any Relevant Period, the Total Interest Costs attributable to Total Senior Debt.

“Transaction Security” means the Security created or expressed to be created in favour of the Security Trustee and/or the Finance Parties (or any of them) pursuant to the Transaction Security Documents.

23

“Transaction Security Documents” means each of the following documents:

| (A) | the charges, pledges and assignments and other security documents in form and substance acceptable to the Security Trustee and the Administrative Agent and identified in and delivered to the Administrative Agent in section 2.5 of Part I of Schedule 2 (Conditions Precedent to Initial Utilisation) or under Part II of Schedule 2 (Conditions Precedent to be delivered by Additional Obligors); and |

| (B) | any other document entered into by any member of the Group creating or expressed to create any Security over all or any part of its assets in respect of the obligations of any of the Obligors under any of the Finance Documents. |

“Transfer Certificate” means a certificate substantially in the form set out in Part I of Schedule 5 (Form of Transfer Certificate) or any other form agreed between the Administrative Agent and the Company.

“Transfer Date” means, in relation to a transfer, the later of:

| (A) | the proposed Transfer Date specified in the Assignment Agreement or Transfer Certificate; and |

| (B) | the date on which the Administrative Agent executes the Assignment Agreement or Transfer Certificate. |

“Trust Property” means, collectively, (i) the security, powers, rights, titles, benefits and present or future interests constituted by, and conferred on the Security Trustee under, the Transaction Security Documents, any other Finance Document or any other related document (together, the “Trust Documents”), (ii) all assets paid, transferred to, or vested in the Security Trustee (or its nominees), or received or recovered by the Security Trustee (or its nominees) in connection with the Trust Documents, and (iii) all rights, benefits, interests and other assets representing or deriving from the foregoing, including all interest, income and other sums at any time received or recoverable in respect of the same.

“Twenty Non-Bank Rule” means the rule that the aggregate number of creditors (including the Lenders), other than Qualifying Banks, of a Swiss Borrower under all outstanding loans, facilities and/or private placements (including under this Agreement) must not at any time exceed twenty (20), in each case in accordance with the meaning of the Guidelines.

“Unpaid Sum” means any sum due and payable but unpaid by an Obligor under the Finance Documents.

“Unused Amount” has the meaning given to such terms in Clause 21.1 (Financial condition).

“Utilisation” means the utilisation of a Loan.

“Utilisation Date” means the date on which a Utilisation is made.

“Utilisation Request” means a notice substantially in the form set out in Part I of Schedule 3 (Utilisation Requests).

“VAT” means value added tax as provided for in the UK Value Added Tax Act 1994 and any other tax of a similar nature in the UK or any other jurisdiction.

“Working Capital” means, on any date, Current Assets less Current Liabilities.

24

| 1.2 | Construction |

| 1.2.1 | Unless a contrary indication appears a reference in this Agreement to: |

| (A) | the “Administrative Agent”, the “Arranger”, the “Security Trustee”, any “Finance Party”, any “Secured Party”, any “Lender”, any “Obligor”, any “Party” or any other person shall be construed so as to include its successors in title, permitted assigns and permitted transferees and, in the case of the Security Trustee, any person for the time being appointed as security trustee or security trustees in accordance with this Agreement; |

| (B) | a document in “agreed form” is a document which is: |

| (1) | initialled by or on behalf of the Company and the Administrative Agent or the Arranger; or |

| (2) | executed on or before the Closing Date by the Company and the Arranger or the Administrative Agent. |

| (C) | “assets” includes present and future properties, revenues and rights of every description; |

| (D) | the “European interbank market” means the interbank market for euro operating in Participating Member States; |

| (E) | a “Finance Document” or any other agreement or instrument is a reference to that Finance Document or other agreement or instrument as amended or novated, supplemented, extended or restated (however fundamentally); |

| (F) | “guarantee” means any guarantee, letter of credit, bond, indemnity or similar assurance against loss, including a third party security arrangement, or any obligation, direct or indirect, actual or contingent, to purchase or assume any indebtedness of any person or to make an investment in or loan to any person or to purchase assets of any person where, in each case, such obligation is assumed in order to maintain or assist the ability of such person to meet its indebtedness; |

| (G) | “indebtedness” includes any obligation (whether incurred as principal or as surety) for the payment or repayment of money, whether present or future, actual or contingent; |

| (H) | “liabilities” includes any obligation whether incurred as principal or as surety, whether or not in respect of indebtedness, whether present or future, actual or contingent and whether owed jointly or severally or in any other capacity; |

| (I) | a “participation” of a Lender in a Loan, means the amount of such Loan which such Lender has made or is to make available and thereafter that part of the Loan which is owed to such Lender; |

| (J) | a “person” includes any person, firm, company, corporation, government, state or agency of a state or any association, trust or partnership (whether or not having separate legal personality) of two or more of the foregoing; |

| (K) | a “regulation” includes any regulation, rule, official directive, request or guideline (whether or not having the force of law) of any governmental, intergovernmental or supranational body, agency, department or regulatory, self-regulatory or other authority or organisation; |

25

| (L) | a provision of law is a reference to that provision as amended or re-enacted; and |

| (M) | a time of day is a reference to London time. |

| 1.2.2 | Section, Clause and Schedule headings are for ease of reference only. |

| 1.2.3 | Unless a contrary indication appears, a term used in any other Finance Document or in any notice given under or in connection with any Finance Document has the same meaning in that Finance Document or notice as in this Agreement. |

| 1.2.4 | A Default (other than an Event of Default) is “continuing” if it has not been remedied or waived and an Event of Default is “continuing” if it has not been waived. |

| 1.3 | Currency Symbols and Definitions |

“£” and “sterling” denotes lawful currency of the United Kingdom, “CHF” and “Swiss francs” denotes lawful currency of Switzerland and “€” and “euro” means the single currency unit of the Participating Member States.

| 1.4 | Third party rights |

| 1.4.1 | Unless expressly provided to the contrary in a Finance Document a person who is not a Party has no right under the Contracts (Rights of Third Parties) Act 1999 (the “Third Parties Act”) to enforce or enjoy the benefit of any term of any Finance Document. |

| 1.4.2 | Notwithstanding any term of any Finance Document, the consent of any person who is not a Party is not required to rescind or vary any Finance Document at any time. |

| 2. | THE FACILITIES |

| 2.1 | The Facilities |

Subject to the terms of this Agreement, the Lenders make available:

| 2.1.1 | to the Borrowers, a multicurrency term loan facility in an aggregate amount equal to the Total Facility A Commitments being £40,000,000 at the date of this Agreement; |

| 2.1.2 | to the Borrowers, a multicurrency term loan facility in an aggregate amount equal to the Total Facility B Commitments being £40,000,000 at the date of this Agreement; and |

| 2.1.3 | to the Borrowers, a multicurrency revolving credit facility in an aggregate amount equal to the Total Facility C Commitments being £2,000,000 at the date of this Agreement. |

| 2.2 | Facility D |

| 2.2.1 | Following a written request from the Company at any time after 31 December 2007, the Lenders (acting in their sole discretion) may make available to the Borrowers a multicurrency term loan facility in an aggregate amount of up to £15,000,000 (“Facility D”). |

| 2.2.2 | If the Lenders agree to make Facility D available to the Borrowers, the provisions of this Agreement shall apply to Facility D and any Facility D Loan as they apply to each other Term Facility and each other Term Loan, with such modifications as may be agreed between the Obligors’ Agent, Administrative Agent and the Lenders in respect of Facility D. |

26

| 2.3 | Finance Parties’ rights and obligations |

| 2.3.1 | The obligations of each Finance Party under the Finance Documents are several. Failure by a Finance Party to perform its obligations under the Finance Documents does not affect the obligations of any other Party under the Finance Documents. No Finance Party is responsible for the obligations of any other Finance Party under the Finance Documents. |

| 2.3.2 | The rights of each Finance Party under or in connection with the Finance Documents are separate and independent rights and any debt arising under the Finance Documents to a Finance Party from an Obligor shall be a separate and independent debt. |

| 2.3.3 | A Finance Party may, except as otherwise stated in the Finance Documents, separately enforce its rights under the Finance Documents. |

| 2.4 | No Further Finance Obligation |

The Obligors acknowledge that, save as expressly provided in this Agreement, the Lenders have no obligation to provide further finance or agree to any variation or amendment to the Finance Documents and shall act in their sole discretion.

| 2.5 | Obligors’ Agent |

| 2.5.1 | Each Obligor (other than the Company) by its execution of this Agreement or an Accession Letter irrevocably appoints the Company to act on its behalf as its agent in relation to the Finance Documents and irrevocably authorises: |

| (A) | the Company on its behalf to supply all information concerning itself contemplated by this Agreement to the Finance Parties and to give all notices and instructions (including, in the case of a Borrower, Utilisation Requests), to execute on its behalf any Accession Letter, to make such agreements and to effect the relevant amendments, supplements and variations capable of being given, made or effected by any Obligor notwithstanding that they may affect the Obligor, without further reference to or the consent of that Obligor; and |

| (B) | each Finance Party to give any notice, demand or other communication to that Obligor pursuant to the Finance Documents to the Company, |

and in each case the Obligor shall be bound as though the Obligor itself had given the notices and instructions (including, without limitation, any Utilisation Requests) or executed or made the agreements or effected the amendments, supplements or variations, or received the relevant notice, demand or other communication.

| 2.5.2 | Every act, omission, agreement, undertaking, settlement, waiver, amendment, supplement, variation, notice or other communication given or made by the Obligors’ Agent or given to the Obligors’ Agent under any Finance Document on behalf of another Obligor or in connection with any Finance Document (whether or not known to any other Obligor and whether occurring before or after such other Obligor became an Obligor under any Finance Document) shall be binding for all purposes on that Obligor as if that Obligor had expressly made, given or concurred with it. In the event of any conflict between any notices or other communications of the Obligors’ Agent and any other Obligor, those of the Obligors’ Agent shall prevail. |

27

| 3. | PURPOSE |

| 3.1 | Purpose |

| 3.1.1 | Each Borrower shall apply all amounts borrowed by it under the Term Facilities: |

| (A) | refinancing the Existing Financial Indebtedness; |

| (B) | financing Capital Expenditure in respect of the assets acquired by the Group through London 4; |

| (C) | payment of any fees, costs and expenses payable in respect of the Finance Documents or London 4; |

| (D) | payment to the relevant vendor of the purchase price in respect of Permitted Acquisitions; |

| (E) | payment of any fees, costs and expenses payable in respect of Permitted Acquisitions; or |

| (F) | the expansion and/or upgrading of its existing datacentres where such expansion and/or upgrading is consistent with the Base Case. |

| 3.1.2 | Each Borrower shall apply all amounts borrowed by it under Facility C towards the general corporate and working capital purposes of the Group (but not towards prepayment of any Term Loan). |

| 3.2 | Monitoring |

No Finance Party is bound to monitor or verify the application of any amount borrowed pursuant to this Agreement.

| 4. | CONDITIONS OF UTILISATION |

| 4.1 | Initial Conditions Precedent |

No Borrower may deliver a Utilisation Request unless the Administrative Agent has received all of the documents and other evidence listed in Part I of Schedule 2 (Conditions Precedent to Initial Utilisation) in form and substance satisfactory to the Administrative Agent. The Administrative Agent shall notify the Company and the Lenders promptly in writing upon being so satisfied.

| 4.2 | Further Conditions Precedent |

The Lenders will only be obliged to comply with Clause 5.4 (Lenders’ participation) if on the date of the Utilisation Request and on the proposed Utilisation Date:

| 4.2.1 | in the case of a Rollover Loan, no Event of Default is continuing or would result from the proposed Loan and, in the case of any other Loan, no Default is continuing or would result from the proposed Utilisation; and |

| 4.2.2 | in relation to any Utilisation on the Closing Date, all the representations and warranties in Clause 19 (Representations) or, in relation to any other Utilisation, the Repeating Representations to be made by each Obligor are true in all material respects. |

28

| 4.3 | Maximum number of Loans |

| 4.3.1 | A Borrower (or the Company) may not deliver a Utilisation Request if as a result of the proposed Utilisation: |

| (A) | 10 or more Facility A Loans would be outstanding; |

| (B) | 10 or more Facility B Loans would be outstanding; or |

| (C) | 10 or more Revolving Loans would be outstanding. |

| 4.3.2 | A Borrower may not request that a Term Loan be divided if, as a result of the proposed division, 20 or more Term Loans would be outstanding. |

| 5. | UTILISATION OF LOANS |

| 5.1 | Delivery of a Utilisation Request |

A Borrower may utilise a Facility by delivery to the Administrative Agent of a duly completed Utilisation Request not later than the Specified Time.

| 5.2 | Completion of a Utilisation Request |

| 5.2.1 | Each Utilisation Request is irrevocable and will not be regarded as having been duly completed unless: |

| (A) | it identifies the Facility to be utilised; |

| (B) | the proposed Utilisation Date is a Business Day within the Availability Period applicable to that Facility; |

| (C) | the currency and amount of the Utilisation comply with Clause 5.3 (Currency and amount); and |

| (D) | the proposed Interest Period complies with Clause 10 (Interest Periods). |

| 5.2.2 | Only one Utilisation may be requested in each Utilisation Request. |

| 5.3 | Currency and amount |

| 5.3.1 | The currency specified in a Utilisation Request must be the Base Currency or an Optional Currency. |

| 5.3.2 | The amount of the proposed Loan must be: |

| (A) | if the currency selected is the Base Currency, a minimum of £300,000 and an integral multiple of £50,000 or, if less, the Available Facility and if the currency selected is other than sterling, the equivalent Base Currency Amount; and |

| (B) | an amount which once utilised results in the aggregate amount of the Loans outstanding not exceeding an amount which is no greater than 16.00x Pro Forma Borrowing Group EBITDA in respect of the three month period ending on the most recent month end in respect of which the Company has delivered financial statements under Clause 20.1.3 (Financial statements) (or Clause 20.1.2 (Financial statements) where such month end is a Quarter Date) ending on the most recent Quarter Date prior to the date of the Utilisation Request. |

29

| 5.4 | Lenders’ participation |

| 5.4.1 | If the conditions set out in this Agreement have been met, each Lender shall make its participation in each Loan available by the Utilisation Date through its Facility Office. |

| 5.4.2 | The amount of each Lender’s participation in each Loan will be equal to the proportion borne by its Available Commitment to the Available Facility immediately prior to making the Loan. |

| 5.4.3 | The Administrative Agent shall determine the Base Currency Amount of each Loan which is to be made in an Optional Currency and notify each Lender of the amount, currency and the Base Currency Amount of each Loan and the amount of its participation in that Loan by the Specified Time. |

| 5.5 | Cleandown |

The Company shall ensure that for a period of not less than 10 successive Business Days in each of its financial years there are no outstanding Facility C Loans.

| 6. | OPTIONAL CURRENCY |

| 6.1 | Selection of currency |

A Borrower shall select the currency of a Loan in a Utilisation Request. Monies drawn down at the date of this Agreement shall be maintained in the currency actually drawn.

| 6.2 | Administrative Agent’s calculations |

Each Lender’s participation in a Loan will be determined in accordance with Clause 5.4.2 (Lenders’ participation).

| 7. | REPAYMENT |

| 7.1 | Repayment of Facility A and B Loans |

| 7.1.1 | The Borrowers that have drawn a Facility A Loan shall repay the aggregate Facility A Loans in instalments by repaying on each Facility A Repayment Date an amount (a “Facility A Repayment Instalment”) equal to the amount set out opposite the relevant Facility A Repayment Date below: |

| Facility A Repayment Date |

Facility A Repayment Instalment | ||

| 30 June 2008 |

£ | 500,000 | |

| 31 December 2008 |

£ | 500,000 | |

| 30 June 2009 |

£ | 2,500,000 | |

| 31 December 2009 |

£ | 2,500,000 | |

| 30 June 2010 |

£ | 2,500,000 | |

| 31 December 2010 |

£ | 2,500,000 | |

| 30 June 2011 |

£ | 3,000,000 | |

| 31 December 2011 |

£ | 3,000,000 | |

| 30 June 2012 |

£ | 3,000,000 | |

| 31 December 2012 |

£ | 3,000,000 | |

| 30 June 2013 |

£ | 4,250,000 | |

| 31 December 2013 |

£ | 4,250,000 | |

| On the Termination Date |

£ | 8,500,000 | |

30

| 7.1.2 | The Borrowers that have drawn a Facility B Loan shall repay the aggregate Facility B Loans in instalments by repaying on each Facility B Repayment Date an amount (a “Facility B Repayment Instalment”) equal to the amount set out opposite the relevant Facility B Repayment Date below: |

| Facility B Repayment Date |

Facility B Repayment Instalment | ||

| 30 June 2010 |

£ | 2,000,000 | |

| 31 December 2010 |

£ | 2,000,000 | |

| 30 June 2011 |

£ | 2,000,000 | |

| 31 December 2011 |

£ | 2,000,000 | |

| 30 June 2012 |

£ | 3,000,000 | |

| 31 December 2012 |

£ | 3,000,000 | |

| 30 June 2013 |

£ | 3,000,000 | |

| 31 December 2013 |

£ | 3,000,000 | |

| On the Termination Date |

£ | 20,000,000 | |

| 7.1.3 | No Borrower may reborrow any part of a Facility A Loan or a Facility B Loan which is repaid. |

| 7.2 | Repayment of Facility C Loans |