UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ Preliminary Proxy Statement

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to §240.14a-12 |

¨ Confidential, for Use of the Commission Only (as Permitted by Rule 14a-6(e)(2)) |

EQUINIX, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| 1. | Title of each class of securities to which transaction applies: |

| 2. | Aggregate number of securities to which transaction applies: |

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4. | Proposed maximum aggregate value of transaction: |

| 5. | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1. | Amount Previously Paid: |

| 2. | Form, Schedule or Registration Statement No.: |

| 3. | Filing Party: |

| 4. | Date Filed: |

EQUINIX, INC.

301 Velocity Way, Fifth Floor

Foster City, CA 94404

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held June 12, 2008

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders (the “Annual Meeting”) of Equinix, Inc., a Delaware corporation (“Equinix”). The meeting will be held at our headquarters located at 301 Velocity Way, Foster City, California, on Thursday, June 12, 2008, at 10:30 a.m. for the following purposes:

1. To elect eight directors to the Board of Directors to serve until the next Annual Meeting or until their successors have been duly elected and qualified;

2. To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2008; and

3. To transact such other business as may properly come before the meeting or any adjournments or postponements thereof.

The foregoing items of business are more fully described in the attached Proxy Statement.

Only stockholders of record at the close of business on April 25, 2008 are entitled to notice of, and to vote at, the Annual Meeting and at any adjournments or postponements thereof. A list of such stockholders will be available for inspection at our headquarters located at 301 Velocity Way, Fifth Floor, Foster City, California, during ordinary business hours for the 10-day period prior to the Annual Meeting.

BY ORDER OF THE BOARD OF

DIRECTORS,

/s/ Peter F. Van Camp

Peter F. Van Camp

Executive Chair

Foster City, California

May 1, 2008

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE COMPLETE, SIGN, DATE AND PROMPTLY RETURN THE ACCOMPANYING PROXY IN THE ENCLOSED POSTAGE-PAID ENVELOPE, OR FOLLOW THE INSTRUCTIONS BELOW TO SUBMIT YOUR PROXY BY TELEPHONE OR ON THE INTERNET. YOU MAY REVOKE YOUR PROXY AT ANY TIME PRIOR TO THE ANNUAL MEETING. IF YOU DECIDE TO ATTEND THE ANNUAL MEETING AND WISH TO CHANGE YOUR PROXY VOTE, YOU MAY DO SO AUTOMATICALLY BY VOTING IN PERSON AT THE MEETING. PLEASE NOTE, HOWEVER, THAT IF YOUR SHARES ARE HELD OF RECORD BY A BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO VOTE AT THE MEETING, YOU MUST OBTAIN A PROXY ISSUED IN YOUR NAME FROM THAT RECORD HOLDER.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

ANNUAL MEETING TO BE HELD ON JUNE 12, 2008:

THE PROXY STATEMENT AND ANNUAL REPORT TO STOCKHOLDERS ON FORM 10-K ARE AVAILABLE AT HTTP://INVEST.EQUINIX.COM/PHOENIX.ZHTML?C=122662&P=PROXY.

EQUINIX, INC.

301 Velocity Way, Fifth Floor

Foster City, CA 94404

PROXY STATEMENT

FOR THE 2008 ANNUAL MEETING OF STOCKHOLDERS

June 12, 2008

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why am I receiving these materials?

We sent you this proxy statement and the enclosed proxy card because the Board of Directors of Equinix, Inc. (“Equinix”) is soliciting your proxy to vote at the 2008 Annual Meeting of Stockholders (the “Annual Meeting”). You are invited to attend the Annual Meeting to vote on the proposals described in this proxy statement. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card, or follow the instructions below to submit your proxy over the telephone or on the Internet.

We intend to mail this proxy statement and accompanying proxy card on or about May 1, 2008 to all stockholders of record entitled to vote at the Annual Meeting.

Can I obtain an on-line version of the materials?

This proxy statement and Equinix’s annual report on Form 10-K are available on-line at http://invest.equinix.com/phoenix.zhtml?c=122662&p=proxy.

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on April 25, 2008 will be entitled to vote at the Annual Meeting. On this record date, there were 36,863,480 shares of common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If, on April 25, 2008, your shares were registered directly in your name with Equinix’s transfer agent, Computershare, then you are a stockholder of record. As a stockholder of record, you may vote in person at the meeting or vote by proxy. Whether or not you plan to attend the meeting, we urge you to fill out and return the enclosed proxy card or vote by proxy over the telephone or on the Internet as instructed below to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If, on April 25, 2008, your shares were held in an account at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the meeting unless you request and obtain a valid proxy from your broker or other agent.

Who may attend the Annual Meeting?

Only persons with evidence of stock ownership or who are guests of Equinix may attend and be admitted to the Annual Meeting. Photo identification will be required (a valid driver’s license or passport is preferred). If your shares are held in an account at a brokerage firm, bank, dealer, or other similar organization, you will need

1

to bring a proxy or a letter from that broker, trust, bank or other nominee, or your most recent brokerage account statement, that confirms that you are the beneficial owner of those shares.

What am I voting on?

There are two matters scheduled for a vote:

| Ø | Election of eight directors. |

| Ø | Ratification of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2008. |

How do I vote?

You may either vote “For” all the nominees to the Board of Directors or you may abstain from voting for any nominee you specify. For the other matter to be voted on, you may vote “For” or “Against” or abstain from voting. The procedures for voting are fairly simple:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person at the Annual Meeting, vote by proxy using the enclosed proxy card, vote by proxy over the telephone, or vote by proxy on the Internet. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the meeting and vote in person if you have already voted by proxy.

| Ø | To vote in person, come to the Annual Meeting and we will give you a ballot when you arrive. |

| Ø | To vote using the proxy card, simply complete, sign and date the enclosed proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct. |

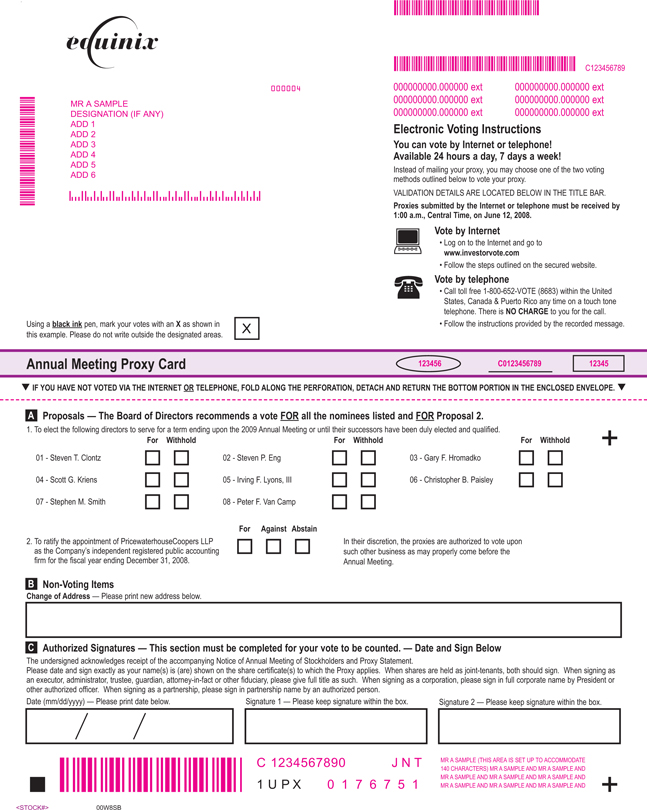

| Ø | To vote over the telephone, dial toll-free (from the U.S., Canada or Puerto Rico) 1-800-652-VOTE (8683) using a touch-tone phone and follow the recorded instructions. You will be asked to provide the company number and control number from the enclosed proxy card. Your vote must be received by 1:00 a.m., Central Time, on June 12, 2008 to be counted. |

| Ø | To vote on the Internet, go to www.investorvote.com to complete an electronic proxy card. You will be asked to provide the company number and control number from the enclosed proxy card. Your vote must be received by 1:00 a.m., Central Time, on June 12, 2008 to be counted. |

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received a proxy card and voting instructions with these proxy materials from that organization rather than from Equinix. Simply complete and mail the proxy card to ensure that your vote is counted. Alternatively, you may vote by telephone or on the Internet as instructed by your broker or bank. To vote in person at the Annual Meeting, you must obtain a valid proxy from your broker, bank, or other agent. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a proxy form.

| We provide Internet proxy voting to allow you to vote your shares on-line with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your Internet access, such as usage charges from Internet access providers and telephone companies.

|

2

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of April 25, 2008.

What if I return a proxy card but do not make specific choices?

If you return a signed and dated proxy card without marking any voting selections, your shares will be voted “For” the election of all eight nominees for director and “For” the ratification of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2008.

If any other matter is properly presented at the meeting, your proxy (one of the individuals named on your proxy card) will vote your shares using his best judgment.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these mailed proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, your shares are registered in more than one name or are registered in different accounts. Please complete, sign and return each proxy card to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the meeting. You may revoke your proxy in any one of three ways:

| Ø | You may submit another properly completed proxy card with a later date. |

| Ø | You may send a written notice that you are revoking your proxy to Equinix’s Secretary at 301 Velocity Way, Fifth Floor, Foster City, CA 94404. |

| Ø | You may attend the Annual Meeting and vote in person. Simply attending the meeting will not, by itself, revoke your proxy. |

How are votes counted?

Votes will be counted by the inspector of election appointed for the meeting, who will separately count “For” and (with respect to proposals other than the election of directors) “Against” votes, abstentions and broker non-votes. Abstentions will be counted towards the vote total for each proposal, and will have the same effect as “Against” votes. Broker non-votes have no effect and will not be counted towards the vote total for any proposal.

If your shares are held by your broker as your nominee (that is, in “street name”), you will need to obtain a proxy form from the institution that holds your shares and follow the instructions included on that form regarding how to instruct your broker to vote your shares. If you do not give instructions to your broker, your broker can vote your shares with respect to “discretionary” items, but not with respect to “non-discretionary” items. Discretionary items are proposals considered routine under the rules of the New York Stock Exchange on which

3

your broker may vote shares held in street name in the absence of your voting instructions. On non-discretionary items for which you do not give your broker instructions, the shares will be treated as broker non-votes.

How many votes are needed to approve each proposal?

| Ø | For the election of directors, the eight nominees receiving the most “For” votes (among votes properly cast in person or by proxy) will be elected. Broker non-votes will have no effect. |

| Ø | To be approved, Proposal No. 2, the ratification of PricewaterhouseCoopers LLP as Equinix’s independent registered public accounting firm for the fiscal year ending December 31, 2008, must receive a “For” vote from the majority of shares present and entitled to vote either in person or by proxy. If you “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will have no effect. |

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if at least a majority of the outstanding shares are represented by stockholders present at the meeting or by proxy. On the record date, there were 36,863,480 shares outstanding and entitled to vote. Thus 18,431,741 shares must be represented by stockholders present at the meeting or by proxy to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy vote or vote at the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, a majority of the votes present at the meeting may adjourn the meeting to another date.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. Final voting results will be published in our quarterly report on Form 10-Q for the second quarter of 2008.

4

PROPOSAL 1

ELECTION OF DIRECTORS

Equinix’s Board of Directors currently consists of eight directors. Equinix’s bylaws provide that the number of directors will be determined by the Board of Directors and the number of directors is currently set at nine. Thus, there is one vacant seat on Equinix’s Board of Directors that Equinix does not intend to fill at this Annual Meeting. Proxies cannot be voted for a greater number of persons than the number of nominees named. There are eight nominees for director this year. Each director to be elected will hold office until the next annual meeting of stockholders and until his or her successor is elected, or until the director’s death, resignation or removal.

Directors are elected by a plurality of the votes properly cast in person or by proxy. The eight nominees receiving the highest number of affirmative votes will be elected. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the eight nominees named below. If any nominee becomes unavailable for election as a result of an unexpected occurrence, your shares will be voted for the election of a substitute nominee proposed by Equinix’s Board of Directors. Each person nominated for election has agreed to serve if elected. Our Board of Directors has no reason to believe that any nominee will be unable to serve.

The eight directors who are being nominated for election by the holders of common stock to the Board of Directors, their ages as of March 31, 2008, their positions and offices held with Equinix and certain biographical information are set forth below.

| Nominees |

Age | Positions and Offices Held with Equinix | ||

| Steven T. Clontz |

57 | Director | ||

| Steven P. Eng |

51 | Director | ||

| Gary F. Hromadko |

55 | Director | ||

| Scott G. Kriens |

50 | Director | ||

| Irving F. Lyons, III |

58 | Director | ||

| Christopher B. Paisley |

55 | Director | ||

| Stephen M. Smith |

51 | Director, Chief Executive Officer and President | ||

| Peter F. Van Camp |

52 | Executive Chair |

Steven T. Clontz has served as a director of Equinix since April 2005. Mr. Clontz has been president and chief executive officer of StarHub Ltd., a telecommunications and cable television company, since January 1999. Mr. Clontz serves on the board of directors of InterDigital Communications Corp. and StarHub Ltd., both public companies, and one privately held company. Mr. Clontz is also a non-director member of the Executive Committee of Global Crossing Limited.

Steven P. Eng has served as a director of Equinix since December 2002. Mr. Eng has been a vice president of solutions architecture at Multimax, Inc. (formerly Netco Government Services, and prior to that, WAM!NET Government Services, Inc.), a data communications company, since April 2002. Prior to joining WAM!NET, Mr. Eng served as vice president of Exodus Communications from March 1995 to September 2001. Mr. Eng served on the board of directors of i-STT Singapore prior to its merger with Equinix.

Gary F. Hromadko has served as a director of Equinix since June 2003. Mr. Hromadko has been a venture partner at Crosslink Capital, a venture capital firm, since June 2002. In addition to his responsibilities with Crosslink Capital, Mr. Hromadko has been active as a private investor since 1993. Mr. Hromadko serves on the board of directors of several privately held companies.

Scott G. Kriens has served as a director of Equinix since July 2000. Mr. Kriens has been chief executive officer and chairman of the board of directors of Juniper Networks, Inc., an Internet infrastructure solutions

5

company, since October 1996. From April 1986 to January 1996, Mr. Kriens served as vice president of sales and vice president of operations at StrataCom, Inc., a telecommunications equipment company, which he co-founded in 1986. Mr. Kriens serves on the board of directors of Juniper Networks, Inc. and Verisign, Inc., both public companies.

Irving F. Lyons, III has served as a director of Equinix since February 2007. Mr. Lyons has been a principal of Lyons Asset Management, a California-based private investment firm, since January 2005. From December 1993 to January 2005, Mr. Lyons was employed at ProLogis, a global provider of distribution facilities and services, where he served as chief investment officer from March 1997 to December 2004 and as vice chairman of the board from December 2001 to January 2005. Mr. Lyons serves on the board of directors of BRE Properties, Inc. a public company.

Christopher B. Paisley has served as a director of Equinix since July 2007. Mr. Paisley has been the Dean’s Executive Professor of Accounting and Finance at the Leavey School of Business at Santa Clara University since January 2001. From September 1985 until May 2000, Mr. Paisley was the Senior Vice President of Finance and Chief Financial Officer of 3Com Corporation. Mr. Paisley currently serves as a director of 3Par Data Systems, Electronics for Imaging, Inc. and Volterra Semiconductor Corporation, all public companies, and several privately held companies.

Stephen M. Smith has served as a director of Equinix and as Equinix’s chief executive officer and president since April 2007. Prior to joining Equinix, Mr. Smith served as senior vice president at HP Services, a business segment of Hewlett-Packard Co., from January 2005 to October 2006. Prior to joining Hewlett-Packard Co., Mr. Smith served as vice president of global professional and managed services at Lucent Technologies Inc., a communications solutions provider, from September 2003 to January 2005. From October 1987 to September 2003, he spent 17 years with Electronic Data Systems Corporation (“EDS”), a business and technology solutions company, in a variety of positions, including chief sales officer, president of EDS Asia-Pacific, and president of EDS Western Region. Mr. Smith serves on the board of directors of one privately held company.

Peter F. Van Camp has served as Equinix’s executive chair since April 2007. Prior to becoming executive chair, Mr. Van Camp served as Equinix’s chief executive officer and as a director since May 2000 and as president since March 2006. In addition, in December 2005, Mr. Van Camp was re-elected as chairman of the board, having previously served in that capacity from June 2001 to December 2002. From January 1997 to May 2000, Mr. Van Camp was employed at UUNET, the Internet division of MCI (formerly known as WorldCom), where he served as president of Internet markets and as president of the Americas region. During the period from May 1995 to January 1997, Mr. Van Camp was president of Compuserve Network Services, an Internet access provider. Before holding this position, Mr. Van Camp held various positions at Compuserve, Inc. during the period from October 1982 to May 1995. Mr. Van Camp currently serves as a director of Packeteer, Inc., a public company.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE “FOR” EACH NAMED NOMINEE

6

CORPORATE GOVERNANCE

Corporate Governance Guidelines

The Board of Directors follows the Equinix, Inc. Board of Directors Guidelines on Significant Corporate Governance Issues (the “Guidelines”) published on the corporate governance section of Equinix’s website at www.equinix.com. The Guidelines reflect the Board of Director’s dedication to monitoring the effectiveness of policy and decision-making at the Board of Director’s level. The Board of Directors will continue to monitor the effectiveness of these Guidelines. In addition, the Board of Directors has elected to address governance issues as a full board, as opposed to establishing a separate governance committee, and will review issues and developments related to corporate governance as business and corporate governance needs dictate.

Director Independence

The Board of Directors is comprised of eight directors, six of whom qualify as independent directors pursuant to the rules adopted by the Securities and Exchange Commission applicable to the corporate governance standards for companies listed on the NASDAQ National Market System. The Board of Directors has determined that all of Equinix’s directors are independent directors within the meaning of the applicable NASDAQ listing standards, except for Mr. Smith, Equinix’s chief executive officer and president, and Mr. Van Camp, Equinix’s executive chair. The Board of Directors committee structure includes Audit, Compensation, Nominating and Real Estate committees consisting entirely of independent directors. In addition, the Board of Directors has a Stock Award Committee composed of a non-independent director.

Nomination of Directors

The Nominating Committee of the Board of Directors (the “Nominating Committee”) operates pursuant to a written charter and has the exclusive right to recommend candidates for election as directors to the Board of Directors. The Nominating Committee believes that candidates for director should have certain minimum qualifications, including being able to read and understand basic financial statements, having high moral character, having business experience, and being over 21 years of age. The Nominating Committee’s process for identifying and evaluating nominees is as follows: in the case of incumbent directors whose terms of office are set to expire, the Nominating Committee reviews such directors’ overall service to Equinix during their term, including the number of meetings attended, level of participation, quality of performance, and any transactions of such directors with Equinix during their term. In the case of new director candidates, the Nominating Committee first determines whether the nominee must be independent for NASDAQ purposes, which determination is based upon Equinix’s certificate of incorporation and bylaws, applicable securities laws, the rules and regulations of the Securities and Exchange Commission, the rules of the National Association of Securities Dealers, and the advice of counsel, if necessary. The Nominating Committee may then use its network of contacts to compile a list of potential candidates, but may also engage, if it deems appropriate, a professional search firm. The Nominating Committee will then meet to discuss and consider such candidates’ qualifications and choose candidate(s) for recommendation to the Board of Directors. At the Annual Meeting, one director, Mr. Christopher B. Paisley, will stand for election by Equinix’s stockholders for the first time. Mr. Paisley was initially identified by Spencer Stuart, an executive search firm, and was evaluated and formally nominated for election by Equinix’s Nominating Committee in accordance with the procedures described above.

The Nominating Committee will consider candidates recommended by stockholders. Stockholders wishing to recommend candidates for consideration by the Nominating Committee may do so by writing to the Secretary of Equinix and providing the candidate’s name, biographical data and qualifications. The Nominating Committee does not intend to alter the manner in which it evaluates candidates, including the minimum criteria set forth above, based on whether the candidate was recommended by a stockholder.

A more detailed description on the functions of the Nominating Committee can be found in the Nominating Committee Charter, published on the corporate governance section of Equinix’s website at www.equinix.com.

7

Stockholder Communications with the Board of Directors

Interested parties may contact the Board of Directors by sending correspondence to the attention of Equinix’s Secretary, c/o Equinix, Inc., 301 Velocity Way, Fifth Floor, Foster City, California 94404. Any mail received by the Secretary, except improper commercial solicitations, will be forwarded to the members of Equinix’s Audit Committee for their further action, if necessary. Equinix does not have a policy requiring attendance by members of the Board of Directors at Equinix’s annual meetings. At Equinix’s 2007 Annual Meeting, Messrs. Smith and Van Camp were in attendance and available for questions.

Code of Ethics and Business Conduct

Equinix has always taken the issue of corporate governance seriously. The Board of Directors has adopted (1) a Code of Business Conduct which applies to all directors, officers and employees and (2) an additional Code of Ethics for Chief Executive Officer and Senior Financial Officers. These documents can be found on the corporate governance section of Equinix’s website at www.equinix.com. In addition, an anonymous reporting hotline has been established to facilitate reporting of violations of financial and non-financial policies.

INFORMATION REGARDING THE BOARD OF DIRECTORS AND ITS COMMITTEES

During the fiscal year ended December 31, 2007, the Board of Directors held six meetings and acted by written consent on eight occasions. For the fiscal year, during his period of service, each of the incumbent directors attended or participated in at least 80% of the aggregate of (i) the total number of meetings of the Board of Directors and (ii) the total number of meetings held by all committees of the Board of Directors on which each such director served. In the event any director missed a meeting, he would separately discuss material items with Messrs. Smith or Van Camp. The Board of Directors has five standing committees: the Audit Committee, the Compensation Committee, the Nominating Committee, the Real Estate Committee and the Stock Award Committee. The following table provides membership information for the incumbent directors for fiscal 2007 for such committees of the Board of Directors:

| Name |

Audit | Compensation | Nominating | Real Estate | Stock Award | ||||||||

| Steven T. Clontz |

|||||||||||||

| Steven P. Eng |

X | X | (1) | X | (1) | ||||||||

| Gary F. Hromadko |

X | X | X | ||||||||||

| Scott G. Kriens |

X | X | |||||||||||

| Irving F. Lyons, III |

X | X | |||||||||||

| Christopher B. Paisley |

X | (1) | X | ||||||||||

| Stephen M. Smith |

X | ||||||||||||

| Peter F. Van Camp |

| (1) | Committee Chairman |

The Audit Committee (the “Audit Committee”) was created on July 19, 2000. A detailed description of the Audit Committee can be found in the section entitled “Report of the Audit Committee of the Board of Directors” elsewhere in this proxy statement. The members of the Audit Committee are Messrs. Eng, Hromadko and Paisley. Mr. Paisley is chairman of the Audit Committee and considered its financial expert. During the fiscal year ended December 31, 2007, the Audit Committee held nine meetings.

The Compensation Committee (the “Compensation Committee”) was created on July 19, 2000. A detailed description of the Compensation Committee can be found in the section entitled “Compensation Discussion and Analysis” elsewhere in this proxy statement. The members of the Compensation Committee are Messrs. Eng, Kriens and Lyons. Mr. Eng is chairman of the Compensation Committee. During the fiscal year ended December 31, 2007, the Compensation Committee held five meetings and acted by written consent on five occasions.

8

The Nominating Committee was created on December 30, 2002 and its functions are described above in the section entitled “Nomination of Directors”. The members of the Nominating Committee are Messrs. Eng, Hromadko and Kriens. Mr. Eng is chairman of the Nominating Committee. During the fiscal year ended December 31, 2007, the Nominating Committee held one meeting and acted by written consent on one occasion.

The Stock Award Committee (the “Stock Award Committee”) was created on July 19, 2000. The Board of Directors has delegated to the Stock Award Committee the authority to approve the grant of stock awards to non-officer employees and other individuals. The sole member of the Stock Award Committee is Mr. Smith. During the fiscal year ended December 31, 2007, the Stock Award Committee held no meetings and acted by written consent on 25 occasions.

The Real Estate Committee (the “Real Estate Committee”) was created on August 11, 2005. The Board of Directors has delegated to the Real Estate Committee the authority to analyze, negotiate and approve the purchase of, or the option to purchase, real property, analyze, negotiate and approve the lease or sublease of, or the option to lease or sublease, real property, approve certain expenditures in connection with real estate development, expansion or acquisition and certain adjustments to previously approved expenditures, and, subject to the general terms approved by the full Board of Directors, analyze, negotiate and approve financing transactions for the sale, lease or sublease of real property. The members of the Real Estate Committee are Messrs. Hromadko, Lyons and Paisley. During the fiscal year ended December 31, 2007, the Real Estate Committee held five meetings and acted by written consent on one occasion.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The Compensation Committee was formed on July 19, 2000 and the current members of the Compensation Committee are Messrs. Eng, Kriens and Lyons. None of the members of the Compensation Committee was at any time during the 2007 fiscal year or at any other time an officer or employee of Equinix. No executive officer of Equinix serves as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of the Board of Directors or Compensation Committee.

2007 DIRECTOR COMPENSATION

Equinix uses a combination of cash and equity-based incentive compensation to attract and retain qualified candidates to serve on the Board of Directors. In setting director compensation, Equinix considers the competitive compensation trends for directors in the high-technology market, the demands of the various roles that directors hold, and the time required to fulfill their duties to Equinix.

Non-employee directors are eligible to receive compensation of $6,000 per quarter in connection with their service on the Board of Directors. In addition, non-employee directors are eligible to receive compensation of $3,000 per meeting of a committee of the Board of Directors actually attended and the chairman of a committee receives compensation of $5,000 per committee meeting actually attended. Non-employee directors are also reimbursed for their out-of-pocket expenses incurred in connection with serving on the Board of Directors or any committee of the Board of Directors.

Non-employee directors are eligible to receive options under Equinix’s 2000 Director Option Plan (the “Directors’ Plan”). Directors are also eligible to receive options as well as shares of common stock under Equinix’s 2000 Equity Incentive Plan (the “Incentive Plan”) and directors who are also employees of Equinix, but who do not beneficially own 5% or more of the common stock of Equinix, are eligible to participate in Equinix’s Employee Stock Purchase Plan. Each non-employee director receives an option for 15,000 shares of Equinix’s common stock upon joining the Board of Directors, or 20,000 shares if the new non-employee director is chairman of the Audit Committee. The option becomes exercisable and vests in four equal annual installments

9

from the date of grant. In addition, at each of Equinix’s annual stockholders’ meetings, each non-employee director who will continue to be a director after that meeting is automatically granted an option to purchase 5,000 shares of Equinix’s common stock. This option becomes fully vested on the earlier of the first anniversary of the date of grant or the date of the regular annual stockholders’ meeting held in the following year. However, a new non-employee director who receives an initial option will not receive an annual option in the same calendar year.

The following table sets forth all of the compensation awarded to, earned by, or paid to each person who served as a director during fiscal year 2007, other than a director who also served as a named executive officer.

| Name | Fees Earned or Paid in Cash(1) ($) |

Option Awards(8)(9)(10) |

Total ($) |

|||||||||||||||

| Steven T. Clontz |

$ | 24,000 | $ | 306,256 | $ | 330,256 | ||||||||||||

| Steven P. Eng |

$ | 81,000 | (2) | $ | 224,947 | $ | 305,947 | |||||||||||

| Gary F. Hromadko |

$ | 90,000 | (3) | $ | 224,947 | $ | 314,947 | |||||||||||

| Scott G. Kriens |

$ | 42,000 | (4) | $ | 224,947 | $ | 266,947 | |||||||||||

| Louis J. Lavigne, Jr. |

$ | 10,533 | (5) | ($ | 83,793 | ) | $ | 0 | (11) | |||||||||

| Irving F. Lyons, III |

$ | 51,000 | (6) | $ | 158,569 | $ | 209,569 | |||||||||||

| Christopher B. Paisley |

$ | 39,826 | (7) | $ | 117,572 | $ | 157,398 | |||||||||||

| (1) | Amounts listed in this column include a retainer of $6,000 per quarter paid to each of our non-employee directors in 2007. When a director joins or resigns from the Board of Directors, the retainer is prorated based on the number of days the director served on the Board of Directors during the quarter. |

| (2) | Mr. Eng is the chairman of the Compensation Committee and the Nominating Committee. He is also a member of the Audit Committee. Amount includes fees for five Compensation Committee meetings, nine Audit Committee meetings and one Nominating Committee meeting. |

| (3) | Mr. Hromadko is a member of the Audit, Nominating and Real Estate Committees. He also served on the Transaction Committee, a special purpose committee which met in connection with an acquisition, and the Financing Committee, a special purpose committee which met in connection with various financing events. The retainer and meeting fees earned by Mr. Hromadko are paid to Crosslink Capital, Inc., of which Mr. Hromadko is an affiliate. Amount includes fees paid for five Real Estate Committee meetings, nine Audit Committee meetings, one Nominating Committee meeting, three Transaction Committee meetings and four Financing Committee meetings. |

| (4) | Mr. Kriens is a member of the Compensation and Nominating Committees. Amount includes fees paid for five Compensation Committee meetings and one Nominating Committee meeting. |

| (5) | Mr. Lavigne resigned from Equinix’s Board of Directors and its committees on February 8, 2007. Prior to his resignation, Mr. Lavigne was the chairman of the Audit Committee and a member of the Real Estate Committee. Amount includes fees paid for one Audit Committee meeting and one Real Estate Committee meeting. |

| (6) | Mr. Lyons joined the Board of Directors on February 15, 2007. He is a member of the Compensation and Real Estate Committees. He also served on the Financing Committee. The retainer and meetings fees earned by Mr. Lyons are paid to Lyons Asset Management, of which Mr. Lyons is an affiliate. Amount includes fees paid for three Compensation Committee meetings, four Real Estate Committee meetings and three Financing Committee meetings. |

| (7) | Mr. Paisley joined the Board of Directors on July 19, 2007. He is the chairman of the Audit Committee and is a member of the Real Estate Committee. He also served on the Financing Committee. Amount includes fees paid for four Audit Committee meetings, one Real Estate Committee meeting and two Financing Committee meetings. |

| (8) | On June 7, 2007, Equinix granted options to purchase a total of 5,000 shares of Equinix’s common stock to each of Messrs. Clontz, Eng, and Kriens and to Crosslink Capital, Inc., which is an affiliate of Mr. Hromadko, at an exercise price per share of $85.61 under the Directors’ Plan and the Incentive Plan. On February 15, 2007, Equinix granted options to purchase a total of 15,000 shares of Equinix’s common stock to Mr. Lyons at an exercise price of $86.02 per share under the Directors’ Plan and the Incentive Plan. On July 19, 2007, Equinix granted options to purchase a total of 20,000 shares of Equinix’s common stock to Mr. Paisley at an exercise price of $94.49 per share under the Directors’ Plan and the Incentive Plan. |

| (9) | Reflects the dollar amount recognized for financial statement reporting purposes for the fiscal year ended December 31, 2007 in accordance with FAS 123(R), excluding any forfeiture estimates, and thus includes amounts from awards granted in and prior to 2007. See Note 10 of the notes to our consolidated financial statements in our Annual Report on Form 10-K filed with the Securities and Exchange Commission on February 27, 2008 for a discussion of all assumptions made by Equinix in determining the FAS 123(R) values of our equity awards. Amounts consist of (a) $79,377 per director with respect to the options granted to each director who remained on the Board of Directors on June 8, 2006, the date of our 2006 Annual Meeting of Stockholders (the aggregate grant date fair value of each |

10

| such option was $182,219), (b) $145,570 per director with respect to each director who remained on the Board of Directors on June 7, 2007, the date of our 2007 Annual Meeting of Stockholders (the aggregate grant date fair value of each such option was $257,285), (c) $81,309 with respect to the option granted to Mr. Clontz on August 11, 2005 (the grant date fair value of which was $347,885), (d) $158,569 with respect to the option granted to Mr. Lyons on February 15, 2007 (the grant date fair value of which was $726,234), (e) $117,572 with respect to the option granted to Mr. Paisley on July 19, 2007 (the grant date fair value of which was $1,041,046). Due to Mr. Lavigne’s resignation, the amount includes a $271,582 forfeiture adjustment (see footnote 11). |

| (10) | As of December 31, 2007, Mr. Clontz held outstanding options to purchase 25,000 shares of our common stock; Mr. Eng held outstanding options to purchase 24,500 shares of our common stock; Mr. Kriens held outstanding options to purchase 19,376 shares of our common stock; Mr. Lavigne held no outstanding options; Mr. Lyons held outstanding options to purchase 15,000 shares of our common stock; and Mr. Paisley held outstanding options to purchase 20,000 shares of our common stock. Mr. Hromadko held no outstanding options; however Crosslink Capital, Inc., of which Mr. Hromadko is an affiliate, held outstanding options to purchase 12,500 shares of our common stock. |

| (11) | Due to Mr. Lavigne’s resignation, the dollar amount recognized for financial statement reporting purposes for the fiscal year was a negative number because of a $271,582 forfeiture adjustment, due to the fact that his initial stock option grants were expensed on an accelerated basis. The actual amount paid to Mr. Lavigne was $10,533, the amount of the cash retainer and fees earned by Mr. Lavigne. |

11

OTHER EXECUTIVE OFFICERS

The following are additional executive officers, and former executive officers, of Equinix, their ages as of March 31, 2008, their positions and offices held with Equinix and certain biographical information. All serve at the discretion of the Board of Directors.

| Executive Officers |

Age | Positions and Offices Held with Equinix | ||

| Marjorie S. Backaus |

46 | Chief Business Officer | ||

| Peter T. Ferris |

51 | President, Equinix US | ||

| Sushil K. Kapoor |

61 | Chief Operations Officer | ||

| Renée F. Lanam |

45 | Executive Advisor to Executive Chair | ||

| Keith D. Taylor |

46 | Chief Financial Officer | ||

| Guy de Rohan Willner(1) |

44 | President, Equinix Europe |

| (1) | Mr. Willner will step down as president, Equinix Europe on June 1, 2008. |

Marjorie S. Backaus has served as Equinix’s chief business officer since June 2003. Prior to June 2003, Ms. Backaus served as Equinix’s chief marketing officer from November 1999, and as vice president of market strategy from February 2000. During the period from August 1996 to November 1999, Ms. Backaus was vice president of marketing at Global One, an international telecommunications company. From November 1987 to August 1996, Ms. Backaus served in various positions at AT&T, a telecommunications company, including positions in regulatory, product management and strategic alliances.

Peter T. Ferris has served as Equinix’s president, Equinix US since January 2008. Previously, he served as senior vice president, worldwide sales from December 2006 to January 2008 and as vice president, worldwide sales from July 1999 to December 2006. During the period from June 1997 to July 1999, Mr. Ferris was vice president of sales for Frontier Global Center, a provider of complex web site hosting services. From June 1996 to June 1997, Mr. Ferris served as vice president, eastern sales at Genuity Inc., an Internet services provider. From December 1993 to June 1996, Mr. Ferris was vice president, mid-Atlantic sales at MFS DataNet Inc., a telecommunications services provider.

Sushil K. Kapoor has served as Equinix’s chief operations officer since January 2008. Previously, he was senior vice president, IBX operations from December 2006 to January 2008 and vice president, operations from March 2001 to December 2006. Prior to joining Equinix, Mr. Kapoor was vice president of hosting operations at UUNET, the Internet division of MCI (formerly known as WorldCom), from November 1999 to February 2001. From May 1995 to November 1999, he served as vice president, global network technology for Compuserve Network Services, an Internet access provider.

Renée F. Lanam has served as executive advisor to the executive chair since January 2008. She served as Equinix’s chief development officer from September 2005 to January 2008 and secretary from February 2002 to January 2008. Ms. Lanam also served as Equinix’s chief financial officer from February 2002 to September 2005, as general counsel from April 2000 to January 2003 and as assistant secretary from April 2000 to February 2002. In addition, Ms. Lanam served as vice president of corporate finance from November 2001 to February 2002. Before joining Equinix, Ms. Lanam was employed at Gunderson Dettmer Stough Villeneuve Franklin and Hachigian, LLP (“Gunderson Dettmer”), where she was an associate from January 1996 to January 2000 and a partner from January 2000 to April 2000. Prior to joining Gunderson Dettmer, Ms. Lanam was an associate at the law firms of Jackson, Tufts, Cole & Black and Brobeck, Phleger & Harrison, LLP.

Keith D. Taylor has served as Equinix’s chief financial officer since September 2005. From February 2001 to September 2005, Mr. Taylor served as Equinix’s vice president, finance and chief accounting officer. In addition, from February 1999 to February 2001, Mr. Taylor served as Equinix’s director of finance and administration. Before joining Equinix, Mr. Taylor was employed by International Wireless Communications,

12

Inc., an operator, owner and developer of wireless communication networks, as vice president finance and interim chief financial officer. Prior to joining International Wireless Communications, Inc., Mr. Taylor was employed by Becton Dickinson & Company, a medical and diagnostic device manufacturer, as a senior sector analyst for the diagnostic businesses in Asia, Latin America and Europe.

Guy de Rohan Willner has served as Equinix’s president, Equinix Europe since September 2007. Before joining Equinix, Mr. Willner served chief executive officer of IXEurope, a European datacenter company, which he co-founded in 1998, and which was acquired by Equinix in 2007. Prior to co-founding IXEurope, Mr. Willner worked for Vivendi Group between 1992 and 1998, both in the UK and in Hungary, and began his career with Philips NV in Paris working in Compact Disc Interactive, Smart Card and telematics technologies. As previously announced, Mr. Willner will step down as president, Equinix Europe on June 1, 2008.

13

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of March 31, 2008, certain information with respect to shares beneficially owned by (i) each person who is known by Equinix to be the beneficial owner of more than five percent of Equinix’s outstanding shares of common stock, (ii) each of Equinix’s directors and nominees, (iii) each of the executive officers named in Executive Compensation and Related Information, and (iv) all current directors and executive officers as a group. Beneficial ownership has been determined in accordance with Rule 13d-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Under this rule, certain shares may be deemed to be beneficially owned by more than one person (if, for example, persons share the power to vote or the power to dispose of the shares). In addition, shares are deemed to be beneficially owned by a person if the person has the right to acquire shares (for example, upon exercise of an option or warrant) within 60 days of the date as of which the information is provided. In computing the percentage ownership of any person, the amount of shares is deemed to include the amount of shares beneficially owned by such person (and only such person) by reason of such acquisition rights. As a result, the percentage of outstanding shares of any person as shown in the following table does not necessarily reflect the person’s actual voting power at any particular date. Unless otherwise indicated, the address for each listed stockholder is c/o Equinix, Inc., 301 Velocity Way, Fifth Floor, Foster City, California 94404.

| Shares Beneficially Owned | ||||

| Name of Beneficial Owner |

Number of Shares |

Percentage of Total | ||

| Steven T. Clontz(1) |

12,500 | * | ||

| Steven P. Eng(2) |

19,500 | * | ||

| Gary F. Hromadko(3) |

185,918 | * | ||

| Scott G. Kriens(4) |

71,376 | * | ||

| Irving F. Lyons, III(5) |

6,250 | * | ||

| Christopher B. Paisley |

5,000 | * | ||

| Peter F. Van Camp(6) |

318,256 | * | ||

| Stephen M. Smith(7) |

84,497 | * | ||

| Peter T. Ferris(8) |

90,253 | * | ||

| Sushil K. Kapoor(9) |

76,081 | * | ||

| Renée F. Lanam(10) |

62,838 | * | ||

| Keith D. Taylor(11) |

100,655 | * | ||

| Wellington Management Co. LLP(12) 75 State Street |

4,867,876 | 13.24 | ||

| i-STT Investments (Bermuda) Ltd.(13) 51 Cuppage Road, #10-11/17 |

4,300,000 | 11.70 | ||

| Wells Capital Management, Inc.(14) 525 Market Street 10th floor |

3,967,626 | 10.79 | ||

| Fidelity Management & Research(15) 82 Devonshire Street |

3,863,862 | 10.51 | ||

| Morgan Stanley Investment Management, Inc(16) 522 Fifth Avenue |

2,799,350 | 7.61 | ||

| All current directors and executive officers as a group (12 persons)(17) |

962,154 | 2.59 | ||

14

| * | Less than 1%. |

| (1) | Represents 12,500 shares subject to options exercisable within 60 days of March 31, 2008. |

| (2) | Represents 19,500 shares subject to options exercisable within 60 days of March 31, 2008. |

| (3) | Includes 33,500 shares owned by Octave Fund L.P., of which a limited liability company controlled by Mr. Hromadko is the general partner, and as to which Mr. Hromadko disclaims beneficial ownership except to the extent of his pecuniary interest therein. Mr. Hromadko is a venture partner of Crosslink Capital, Inc. Based on a Form 4 filed with the Securities and Exchange Commission on March 12, 2008, Crosslink Capital, Inc. and its affiliates own an aggregate of 662,165 shares of common stock of Equinix. Crosslink Capital, Inc. and its affiliates also own 7,500 shares subject to options exercisable within 60 days of March 31, 2008. However, Mr. Hromadko is not deemed to beneficially own the shares of common stock or the stock options that are beneficially owned by Crosslink Capital, Inc. and its affiliates. Crosslink Capital, Inc. and each of its affiliates also disclaim beneficial ownership of such securities except to the extent of that person’s pecuniary interest therein. |

| (4) | Includes 1,250 shares subject to options exercisable within 60 days of March 31, 2008. |

| (5) | Includes 3,750 shares subject to options exercisable within 60 days of March 31, 2008. |

| (6) | Includes 256,346 shares subject to options exercisable within 60 days of March 31, 2008. Also includes 30,000 shares subject to forfeiture pursuant to a restricted stock grant. |

| (7) | Includes 84,000 shares subject to forfeiture pursuant to restricted stock grants. |

| (8) | Includes 24,850 shares subject to options exercisable within 60 days of March 31, 2008 and 37,332 shares subject to forfeiture pursuant to restricted stock grants. Also includes 276 shares held by Mr. Ferris as custodian for his children; Mr. Ferris disclaims beneficial ownership of these shares. |

| (9) | Includes 23,375 shares subject to options exercisable within 60 days of March 31, 2008. Also includes 35,832 shares subject to forfeiture pursuant to restricted stock grants. |

| (10) | Includes 13,751 shares subject to options exercisable within 60 days of March 31, 2008. Also includes 35,832 shares subject to forfeiture pursuant to restricted stock grants. |

| (11) | Includes 50,282 shares subject to options exercisable within 60 days of March 31, 2008. Also includes 38,166 shares subject to forfeiture pursuant to restricted stock grants. |

| (12) | Based on a Schedule 13-G filed with the Securities and Exchange Commission on February 14, 2008. |

| (13) | Based on a Directors’, Officers’ and 5% Stockholders’ Questionnaire dated March 28, 2008. The record holder of the shares is i-STT Investments (Bermuda) Ltd. (“i-STT Bermuda”). i-STT Bermuda is an indirect, wholly-owned subsidiary of STT Communications Ltd. (“STTC”). The direct and indirect parents of i-STT Bermuda (including STTC) may be deemed to beneficially own the shares in which i-STT Bermuda has the power to vote. The 4,300,000 shares of Equinix common stock referred to above were sold by i-STT Bermuda to Credit Suisse First Boston Capital LLC (“CSFB Capital”) pursuant to a Forward Purchase Agreement (the “Purchase Agreement”) under which i-STT Bermuda will (subject to its right to settle its obligations under the Purchase Agreement in cash) be obligated to deliver up to 4,300,000 shares of Equinix common stock on November 15, 2008 in settlement of its obligations under the Purchase Agreement. These 4,300,000 shares of Equinix common stock are currently pledged by i-STT Bermuda to CSFB Capital. |

| (14) | Based on a Schedule 13-G/A filed with the Securities and Exchange Commission on February 4, 2008. |

| (15) | Based on a Schedule 13-G/A filed with the Securities and Exchange Commission on February 14, 2008. |

| (16) | Based on a Schedule 13-G/A filed with the Securities and Exchange Commission on February 14, 2008. |

| (17) | Includes an aggregate of 413,104 shares subject to options exercisable within 60 days of March 31, 2008. Also includes 261,162 shares subject to forfeiture pursuant to restricted stock grants. |

15

EXECUTIVE COMPENSATION AND RELATED INFORMATION

Compensation Discussion and Analysis

Introduction

This section describes Equinix’s executive compensation program as it relates to the individuals who served as Equinix’s chief executive officer and chief financial officer during 2007, as well as the other individuals included in the 2007 Summary Compensation Table in this proxy statement, referred to as the named executive officers:

| • Stephen Smith: |

Chief Executive Officer and President | |

| • Peter Van Camp: |

Executive Chair (Former Chief Executive Officer and President) | |

| • Keith Taylor: |

Chief Financial Officer | |

| • Peter Ferris: |

Senior Vice President, Worldwide Sales (Became President, Equinix U.S. effective January 2008) | |

| • Renée Lanam: |

Chief Development Officer (Transitioned to Executive Advisor to Executive Chair effective January 2008) | |

| • Sushil Kapoor: |

Senior Vice President, IBX Operations (Became Chief Operations Officer effective January 2008) | |

In October 2006, Mr. Van Camp announced his intention to transition from his role as chief executive officer and president of Equinix to the role of executive chair. At that time, a search began for his replacement. In March 2007, Equinix extended an offer to Stephen Smith to serve as chief executive officer and president. Mr. Smith commenced employment with Equinix in April 2007. Mr. Van Camp and Mr. Smith’s compensation arrangements are discussed in greater detail throughout this discussion and elsewhere in this proxy statement.

In December 2007, Ms. Lanam announced her intention to step down from her role as chief development officer and to reduce her work hours beginning January 15, 2008 to 50% of a full-time equivalent. It is expected that Ms. Lanam will further reduce her work hours beginning May 2, 2008 to 20% of a full-time equivalent. Ms. Lanam will be the executive advisor to the executive chair and will be responsible for special projects. Further details on Equinix’s agreement with Ms. Lanam can be found elsewhere in this discussion and proxy statement.

The Compensation Committee of the Equinix Board of Directors is comprised of independent directors and oversees, reviews and administers all of Equinix’s compensation, equity and employee benefit plans and programs relating to executive officers, including the named executive officers, approves the global guidelines for the compensation program for Equinix’s non-executive employees and approves Equinix’s projected global equity usage. The Compensation Committee also acts periodically to evaluate the effectiveness of the compensation programs at Equinix and considers recommendations from management regarding new compensation programs and changes to those already in existence. In addition, the Compensation Committee is consulted to approve the compensation package of a newly hired executive or of an executive whose scope of responsibility has changed significantly. A more detailed description of the functions of the Compensation Committee can be found in the Compensation Committee Charter, published on the corporate governance section of Equinix’s website at www.equinix.com. At the beginning of 2007, the Compensation Committee was comprised of Steven Eng and Scott Kriens. Irving Lyons joined the Compensation Committee in May of 2007.

16

Overview

Program Philosophy and Objectives

Equinix’s overall compensation philosophy is designed to provide a competitive total compensation package that attracts, inspires and retains top performing employees, including our named executive officers. The Compensation Committee and the management of Equinix believe that the quality, skills and dedication of Equinix’s executive officers are critical factors affecting our long-term value. The various elements of compensation are designed to link and reward individual performance and the performance of Equinix in achieving financial and non-financial objectives. The Compensation Committee and the management of Equinix also believe that the proportion of compensation at risk should rise as an employee’s level of responsibility increases. This philosophy is reflected in Equinix’s key strategic compensation design priorities: pay for performance, employee retention, cost management, internal pay equity, and alignment with stockholders’ interests.

The Compensation Committee’s objectives are to align executive compensation with Equinix’s long-term and short-term business objectives and performance and to ensure that the compensation paid to each named executive officer reflects Equinix’s performance and the named executive officer’s own contribution to Equinix and his or her level of performance. The Compensation Committee applies its judgment in determining the amount and mix of compensation elements for each named executive officer. A significant percentage of total compensation is tied to performance as a result of the philosophy mentioned above. Though the Compensation Committee balances each compensation element for each executive officer individually, in 2007 the average overall pay mix for our named executive officers was as follows:

| • | Base Salary: 12% |

| • | Annual Incentive Compensation: 7% |

| • | Long-Term Equity Compensation: 81% |

(Based on the market value of the equity awards on the date of grant.)

(Excluding Mr. Smith, who received equity awards representing 89% of his total compensation package (based on their market value on the date of grant) as a new hire and Mr. Van Camp who did not receive an equity grant for 2007.)

In making compensation decisions for the 2007 fiscal year, the Compensation Committee assessed compensation levels and approved compensation plans taking into account individual performance and our competitive market for talent, including a peer group of companies against which we benchmark our performance and compensation programs. The Compensation Committee also took into account Equinix’s strong corporate performance in 2006, including:

| • | Revenue growth of 30% over 2005 |

| • | EBITDA (defined below) growth of 46% over 2005 |

| • | Stock price performance growth of approximately 86% during 2006 |

Benchmarking

Our goal is to provide cash compensation targeted between the 50th and 75th percentiles of market competitive pay practices when targeted levels of performance are achieved as determined by the annual operating plan approved by the Board of Directors. We generally target equity at the 75th percentile; however, if

17

performance or specific retention concerns justify it, we may go above this threshold. In 2006, Equinix participated in the AON/Radford High Technology survey as well as benchmarked to a competitive market of select sectors and select Radford companies chosen to reflect those businesses in our revenue and market segment with which we compete for talent and to allow for increased benchmarking accuracy of competitive target compensation. Our competitive market includes Bay Area companies with revenues between $200.0 million and $1.0 billion, focusing on companies with average revenues of approximately $277.0-$501.0 million, with an average market capitalization of approximately $2.5 billion. Compared to our competitive market, our annual revenues were $419.4 million and our year-end market capitalization was $3.7 billion in 2007. In addition, a peer group was chosen from our competitive market based on a review of companies most closely aligned to Equinix in terms of size, type of business, organizational make-up, membership in the Russell 3000 index, and competition for employees and business. Our peer group will be reviewed annually to ensure it reflects changes in our market and competitors for business and talent. For 2007, our peer group consisted of the following companies:

| • Akamai Technologies |

• Covad Communications | |

| • Cybersource |

• Digital Realty Trust | |

| • Digital River |

• Internap | |

| • Internet Security Systems |

• Level 3 Communications | |

| • Navisite |

• Neustar | |

| • Opsware |

• Savvis Communications | |

| • Terremark |

• Verisign | |

Removed from the 2007 peer group were Ariba, Brocade and Informatica. These product companies were removed as other companies were deemed to be more closely aligned to the Equinix business segment of a service-based internet-related company.

Pay Positioning

The Compensation Committee targets pay positioning for the named executive officers between the 50th and 75th market percentiles to provide competitive base salary, annual incentive compensation and health and welfare benefits that will attract and retain top talent, while offering above market long-term equity compensation in recognition of strong corporate performance that will set us apart from our competitors and serve as a market place differentiator. Annually, all compensation is reviewed to determine where compensation elements fall compared to our competitive market and peer group. After this review, if an element of compensation is found to be below the targeted level, a recommendation may be made to adjust that element of compensation to be comparable to our benchmarks. Likewise, if the review shows an element of our compensation to be above the targeted level, that data is also taken into consideration in determining compensation position and movement for that individual.

Principal Elements of Executive Compensation

Base Salary

Base salary for the named executive officers is established based on the underlying scope of their respective responsibilities, taking into account competitive market compensation data by benchmarking salaries paid in our competitive market. Salary adjustments are based on competitive market salaries and general levels of market increases in salaries, individual performance and experience, internal equity, changes in job duties and responsibilities, and overall financial results. In November 2006, the Compensation Committee conducted its annual review of executive base salaries. As a result of that review, in December 2006 the Compensation Committee approved a March 1, 2007 increase in the salaries of certain of our named executive officers as reflected in the 2007 Summary Compensation Table in this proxy statement. For 2007, base salary increases for our named executive officers ranged from approximately 0% to 13.4%, based upon role, performance and market data.

18

A base salary of $450,000 was also approved by the Compensation Committee for Mr. Smith in March 2007, prior to his commencement of employment, as reflected in the 2007 Summary Compensation Table. This positioned his base salary in-line with our stated philosophy and current competitive market data. At that time, the Compensation Committee approved a prorated base salary of $210,000 (50% of his previous salary of $420,000) for Mr. Van Camp for his role as executive chair, reflecting a 50% time position. Mr. Van Camp further reduced his hours to a 15% time position beginning September 1, 2007 and began receiving a prorated base salary of $63,000.

Annual Incentive Compensation

Annual incentive compensation for the named executive officers is linked to the attainment of Equinix’s corporate goals through a cash incentive plan that calculates payouts based on Equinix’s growth. Accordingly, in 2007, the Compensation Committee adopted the 2007 annual incentive plan, pursuant to which all regular non-sales commissioned part-time and full-time employees were eligible to earn annual cash bonuses.

Under the 2007 annual incentive plan, the Compensation Committee assigned each named executive officer an annual maximum bonus amount tied to the achievement of specific goals related to revenue and EBITDA (defined as income or loss from operations before depreciation, amortization, accretion, stock-based compensation expense, restructuring charges and any gains or losses from asset sales) as set forth in the 2007 operating plan approved by the Board of Directors. The maximum bonus set for each named executive officer was based on targets for comparable positions in our competitive market and was stated in terms of a percentage of the named executive officer’s base salary for the year. Under the 2007 annual incentive plan, as a percentage of base salary, maximum bonuses were as follows:

| • Chief Executive Officer: |

70% | |

| • Chief Financial Officer: |

60% | |

| • Chief Development Officer: |

60% | |

| • Senior Vice President, IBX Operations: |

50% | |

| • Senior Vice President, Worldwide Sales: |

20% | |

In recruiting Mr. Smith, in March 2007 the Compensation Committee approved a maximum bonus under the 2007 annual incentive plan equal to 100% of his base salary, prorated and guaranteed for 2007, to provide a competitive offer for Mr. Smith and to align with market practices. At that time, the Compensation Committee also approved Mr. Van Camp’s continued participation in the 2007 annual incentive plan on a prorated basis based upon actual hours worked.

50% of the 2007 annual incentive plan was to be funded if Equinix achieved the Board of Directors approved revenue and EBITDA goals in the 2007 operating plan, and the remaining 50% or portion thereof was to be funded if Equinix over-achieved against such goals. The over-achievement portion would be funded only if Equinix’s revenues and EBITDA met certain performance targets. For every 1% below operating plan for revenue and EBITDA, the bonuses would be reduced by 10% and there would be no bonuses if either revenue or EBITDA was less than 95% of operating plan target. Under the 2007 annual incentive plan design, the revenue and EBITDA goals would be adjusted for extraordinary events, such as expansion centers or acquisitions, not contemplated in the operating plan. The Board of Directors approved revenue and EBITDA goals for 2007 were $361.5 million and $140.5 million, respectively. After adjusting the goals for certain events not contemplated in the operating plan, such as expansions in Singapore and Tokyo, the sale of our EMS business in Singapore, and our acquisition of IXEurope, the revenue and EBITDA goals for 2007 were $401.6 million and $146.9 million, respectively. To fund the over-achievement portion, Equinix would have to generate $7.2 million of incremental EBITDA over the adjusted operating plan target, assuming a 40% EBITDA flow-through on revenues above the adjusted operating plan revenue target of $401.6. In addition, Equinix would have to generate $3.8 million of incremental EBITDA to fully-fund the over-achievement portion of the 2007 annual incentive plan.

19

In 2007, we reported revenues of $419.4 million and EBITDA of $155.4 million – increases of 46% and 52%, respectively, over the prior year. Thus, for 2007, Equinix met the “at-plan” component of our performance goals and achieved results that funded 100% of the “over-performance” component. Cash bonus awards paid reflected these results. The 2007 Summary Compensation Table in this proxy statement sets forth the actual incentive compensation earned by the named executive officers for performance in 2007 (paid in full by February of 2008).

In addition to the 2007 annual incentive plan, a 2007 sales incentive plan applied to our senior vice president, worldwide sales, Peter Ferris. Under the 2007 sales incentive plan, Mr. Ferris had the opportunity to earn up to $140,000 based on quarterly bookings of new monthly recurring and non-recurring revenue and territory revenue quotas. For 2007, Mr. Ferris earned $120,000 under the 2007 sales incentive plan. Mr. Ferris became president, Equinix U.S. effective January 2008.

For fiscal 2008, the Compensation Committee has implemented the 2008 annual incentive plan pursuant to which bonuses are linked to the attainment of Equinix’s corporate goals through a cash incentive plan that calculates payouts based on Equinix’s achievement of EBITDA targets. In 2007, we continued to remain focused on driving revenue to achieve a market leadership position, in addition to increasing EBITDA, a measure of profitability. In 2008, having achieved a global market leadership position, we have become more focused on the ability to drive increased EBITDA, consistent with the expectations of a company in a market leadership position, and have thus tied the 2008 annual incentive plan to solely that metric. Under the 2008 annual incentive plan, as a percentage of base salary, maximum bonuses are as follows:

| • Chief Executive Officer: |

100% | |

| • Chief Financial Officer: |

60% | |

| • Other Named Executive Officers: |

50% | |

In addition, Mr. Ferris can earn up to 20% of his base salary based upon quarterly revenue targets.

The actual bonuses can range from 0% to 100% of the target amounts. The payout percentage depends on the degree to which we attain or exceed Equinix’s approved operating plan and each individual’s performance. The 2008 EBITDA goal set by the Board of Directors is designed to motivate management to fully capitalize on Equinix’s potential and deliver maximum value to stockholders. The goal is consistent with bookings growth we have experienced in the past, while taking into account the available inventory in each of our markets. The goal also contemplates strong growth in Europe and Asia and contemplates investment in headcount and key areas to scale Equinix to the appropriate operating level. In addition, given the acquisition of IXEurope in 2007, Equinix has committed to invest in Europe and will continue to expand in key markets where inventory is limited or will become limited in the current year. Any single failure to achieve this revenue growth, a delay in anticipated inventory becoming available to us to sell, or over-spending on integration or other corporate initiatives will negatively affect our ability to meet the EBITDA goal.

Long-Term Equity Compensation

Since 2005, all equity awards to the named executive officers of Equinix have primarily been grants of performance-based restricted stock. A grant of restricted stock gives the named executive officer the right to receive a specified number of shares of Equinix common stock, at no cost to the executive officer, if he or she remains employed by Equinix until the award vests. Unlike a stock option, whether or not a restricted stock grant has compensation value does not depend solely on future stock price increases. Restricted stock can therefore deliver greater share for share compensation value at grant than stock options. This issuance of fewer shares has a favorable impact on our burn rate resulting in less dilution for our stockholders. To date, the restricted stock awards to our named executive officers have contained both service and performance vesting triggers, with the exception of the transition awards described below. The Compensation Committee believes that restricted stock awards with performance-based vesting encourage executive performance by focusing on long-term growth and profitability which it believes are the primary drivers of stockholder value creation.

20

Generally, a market competitive equity grant is made in the year that an executive officer commences employment with Equinix. Thereafter, a refresh grant is generally made at the beginning of each fiscal year. The size of each grant is set at a level that the Compensation Committee deems appropriate to create a meaningful opportunity to realize value from equity based upon the individual’s position with Equinix, the individual’s potential for future responsibility and promotion, the individual’s performance in the recent period, Equinix’s performance in the recent period, the competitive marketplace trends, and the retention value of unvested options or shares held by the individual at the time of the new grant.

In January 2007, the Compensation Committee granted two separate awards of restricted stock to Equinix’s named executive officers (with the exception of Mr. Van Camp who was not granted any equity awards in anticipation of his transition to the role of executive chair). The first was a grant of performance-based restricted stock with both service and stock price appreciation vesting triggers. These performance awards are subject to three-year, semi-annual vesting commencing a year from the date of grant. Vesting will occur when the stock appreciates to pre-determined levels tied to a calculation utilizing a Russell 3000 Index growth rate and the service-based triggers are met. Equinix’s stock price must grow at a rate equal to or better then the Russell 3000 Index 10 year average (compounded annually) in order for each six month stock price target to be met. The vesting schedule and the number of shares granted were established to ensure a meaningful incentive in each year following the year of grant. These performance awards strongly align a significant portion of executive pay to a continued appreciation of our stock price over time, thereby focusing executive and corporate performance on continued stockholder returns.

In addition, each named executive officer was also granted a second restricted stock award in anticipation of the transition of a new chief executive officer in 2007. These transition awards are subject to two-year semi-annual vesting, with 1/3 vesting during the first year and 2/3 vesting the second year. The vesting schedule and the number of shares granted were established to ensure retention of the executive team at a time when Equinix was experiencing rapid business expansion and opportunity for significant growth in our markets. Maintaining this business momentum during the transition to a new chief executive officer was the key goal for offering a meaningful incentive to each executive officer.

In April 2007, in connection with his commencement of employment, Mr. Smith was granted an award of 24,000 shares of restricted stock, which will vest over four years, with the initial 25% vesting upon Mr. Smith’s completion of one year of employment and the balance vesting in equal semi-annual installments thereafter. Mr. Smith was also granted an award of 60,000 shares of performance-based restricted stock, which will vest on the later of attainment of price appreciation targets and completion of four years of service, with the initial 25% vesting upon Mr. Smith’s completion of one year of employment and the balance vesting in equal semi-annual installments thereafter, provided the price appreciation targets have been met.

The 2007 Grants of Plan-Based Awards table in this proxy statement sets forth the restricted stock awards received by the named executive officers in 2007.

Sign-On Bonus

In March 2007, the Compensation Committee approved a sign-on bonus of $100,000 for Mr. Smith, payable at the first payroll date following Mr. Smith’s commencement of employment, to replace a benefit he was receiving from a prior employer.

Retirement Benefits; Life, Health and other Welfare Benefits

Retirement, life, health and other welfare benefits at Equinix are the same for all eligible employees, including the named executive officers, and are designed to be aligned to our competitive market. Equinix shares the cost of health and welfare benefits with all of our eligible employees and offers an employer 401(k) match, which all employees, including the named executive officers, are eligible for.

21

Severance, Change-in-Control and other Post-Employment Programs