REDWOOD CITY, Calif., Oct. 18, 2021 /PRNewswire/ -- Equinix, Inc. (Nasdaq: EQIX), the world's digital infrastructure company™, and PGIM Real Estate, the real estate investment and financing arm of Prudential Financial's global asset management business, today announced an agreement to establish a US$575 million joint venture in the form of a limited liability partnership to develop and operate two xScale data centers in Sydney, Australia.

The facilities in the joint venture, which will be known as SY9x and SY10x, are expected to provide more than 55 megawatts (MW) of power capacity to serve the unique core workload deployment needs of a targeted group of hyperscale companies, including the world's largest cloud service providers. The first xScale data center in Sydney – SY9x is expected to open in Q1 2022.

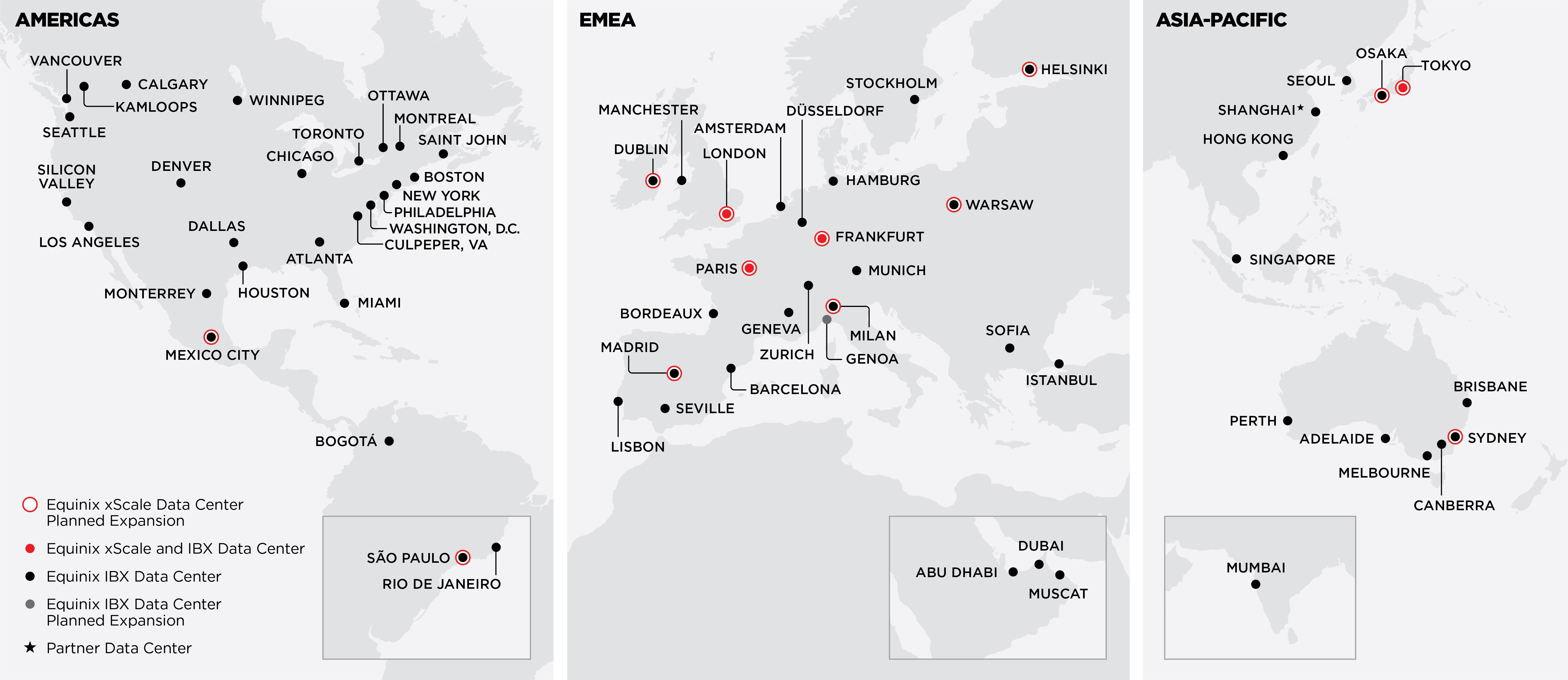

Combined with Equinix's existing hyperscale joint ventures in Europe, Asia-Pacific and the Americas, this joint venture will bring the global xScale data center portfolio to more than $7.5 billion across 34 facilities, and an expected greater than 675 MW of power capacity when completed and fully constructed.

To date, six xScale data centers have been opened in Asia-Pacific, EMEA and LATAM, including TY12x in Tokyo, PA8x and PA9x in Paris, LD11x and LD13x in London, and SP5x in São Paulo, with more currently under development.

Highlights/Key Facts:

- Equinix is the leading data center provider in Australia with 17 International Business Exchange™ (IBX®) data centers, which will increase to 18 when PE3 in Perth opens later this year.

- Under the terms of the agreement, PGIM Real Estate will control an 80% equity interest in the joint venture, and Equinix will own the remaining 20% equity interest. The joint venture is expected to close in Q4 2021, pending regulatory approval and other closing conditions.

- As one of the largest real estate managers in the world, PGIM Real Estate will contribute market insight and support to the joint venture with its deep knowledge of local real estate equity and debt markets applied through its 1,100+ experienced professionals across 31 offices worldwide. By deploying research-led initiatives such as this new program with Equinix, PGIM Real Estate strives to deliver exceptional performance for both its partners and investors.

- Structure Research forecasts that hyperscale colocation market in Sydney and Melbourne, in terms of built-out critical MW capacity, will grow at a compound annual growth rate (CAGR) of 22% from 2021 to 2026.1 With xScale data centers in Australia, hyperscale companies can add core deployments to their existing access-point footprints at Equinix, enabling their growth on a single platform that can immediately span 65 global metros and offer direct interconnection—within robust ecosystems—to their customers and strategic business partners.

- Currently, Platform Equinix® features more than 40% of the private on-ramps to the top global cloud service providers—more than any other provider. For years, the world's largest cloud service providers, including Alibaba Cloud, Amazon Web Services, Google Cloud, IBM Cloud, Microsoft Azure and Oracle Cloud Infrastructure, have partnered with Equinix to leverage its global platform of more than 230 data centers to directly connect to their strategic business partners and customers. With the xScale program, these hyperscalers can continue to grow at Equinix, in close proximity to an ecosystem of 10,000 customers.

- According to an independent Global Tech Trends report released by Equinix in May this year, which surveyed 2,600 IT decision-makers across 26 countries, hybrid and multicloud deployments in Australia were trending up from 28% to 47% year-on-year.2 The xScale program in Australia will enable enterprises to directly connect and operate in proximity to the largest global cloud operators to build and grow their hybrid multicloud infrastructure.

- Equinix is a leader in data center sustainability and is greening the supply chains of its customers. Equinix is the first data center operator to commit to reaching climate-neutral by 2030 globally, backed by science-based targets and a sustainability innovation agenda. The company's long-term goal of using 100% clean and renewable energy for its global platform has resulted in significant increases in renewable energy coverage globally. Most recently, Equinix, together with HSBC Bank, Nike Australia, Goldman Sachs and Hennes & Mauritz (H&M), also received determination from the Australian Competition and Consumer Commission (ACCC) for joint renewable energy purchasing in Australia. Equinix has continued to make advancements in the way it designs, builds and operates its data centers with high energy-efficiency standards, and all xScale data centers are expected to be LEED certified (or the equivalent regional certification).

- Citi served as exclusive financial advisor to Equinix in connection with this transaction.

Quotes:

- Jabez Tan, Head of Research, Structure Research:

"Australia is set to build out its next wave of capacity, with the hyperscale market expected to grow about double the rate of the retail segment by 2026. There have been unprecedented levels of cloud adoption in the country. Equinix's expansion into Australia's hyperscale market is a timely move to address the aggressive demand among hyperscalers in Australia and will further accelerate digital transformation in the country." - Eric Adler, Chief Executive Officer, PGIM Real Estate:

"We are extremely pleased to partner with Equinix on this investment in Sydney, and we look forward to expanding this strategic relationship in other markets, thereby providing our investors further access to the increasingly important digital infrastructure sector. This is a highly symbiotic venture between two market-leading firms with complementary business models and global capabilities." - Charles Meyers, President and CEO, Equinix:

"As digital transformation accelerates across all industries, hybrid multicloud is becoming the IT architecture of choice for leading businesses. These companies recognize that digital infrastructure is a source of competitive advantage, and they are leveraging Platform Equinix to directly connect and operate close to the largest cloud companies powering this infrastructure. Our new relationship with PGIM Real Estate follows our successful partnership with GIC and will enable the world's largest hyperscalers to expand within the Equinix ecosystem in Australia."

Additional Resources

- Hyperscale Data Center Expansion Goes into Hyperdrive [Equinix Blog]

- Equinix and GIC to Add $3.9B to Expand xScale Data Center Program [press release]

- Hyperscale Connectivity Drives $3 Billion in Data Center Projects by Equinix and JV Partners [press release]

- Equinix and GIC to Form Greater than US$1.0 Billion Joint Venture to Develop and Operate Hyperscale Data Centers in Japan [press release]

- Equinix and GIC Complete Formation of Greater than US$1.0 Billion European Data Center Joint Venture [press release]

- How Hyperscale Data Centers Can Power Cloud Provider Success [Equinix Blog]

- Learn more about Platform Equinix [website]

About Equinix

Equinix, Inc. (Nasdaq: EQIX) is the world's digital infrastructure company, enabling digital leaders to harness a trusted platform to bring together and interconnect the foundational infrastructure that powers their success. Equinix enables today's businesses to access all the right places, partners and possibilities they need to accelerate advantage. With Equinix, they can scale with agility, speed the launch of digital services, deliver world-class experiences and multiply their value.

About PGIM Real Estate

As one of the largest real estate managers in the world with US$195 billion in gross assets under management and administration,3 PGIM Real Estate strives to deliver exceptional outcomes for investors and borrowers through a range of real estate equity and debt solutions across the risk-return spectrum. PGIM Real Estate is a business of PGIM, the US$1.5 trillion global asset management business of Prudential Financial, Inc. (NYSE: PRU).

PGIM Real Estate's rigorous risk management, seamless execution, and extensive industry insights are backed by a 50-year legacy of investing in commercial real estate, a 140-year history of real estate financing, and the deep local expertise of professionals in 32 cities globally. Through its investment, financing,4 asset management, and talent management approach, PGIM Real Estate engages in practices that ignite positive environmental and social impact, while pursuing activities that strengthen communities around the world. For more information visit pgimrealestate.com.

Forward-Looking Statements

This press release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially from expectations discussed in such forward-looking statements. Factors that might cause such differences include, but are not limited to, risks related to Equinix's ability to complete the closing of the joint ventures on the proposed terms and schedule; risks related to Equinix or PGIM Real Estate being able to satisfy their respective closing conditions related to the joint ventures, including obtaining regulatory approval; any inability of Equinix, PGIM Real Estate or the joint ventures to obtain financing as needed; risks related to whether the data centers which will be developed and contributed to the joint ventures will be integrated successfully, and whether such development and integration may be more difficult, time-consuming or costly

than expected; risks that the expected benefits of the joint ventures will not occur; the challenges of operating and managing data centers and developing, deploying and delivering Equinix services; the ability to generate sufficient cash flow or otherwise obtain funds to repay new or outstanding indebtedness; competition from existing and new competitors; the loss or decline in business from key hyperscale companies; disruption from the joint ventures making it more difficult to conduct business as usual or maintain relationships with customers, employees or suppliers; and other risks described from time to time in Equinix's filings with the Securities and Exchange Commission. In particular, see recent Equinix quarterly and annual reports filed with the Securities and Exchange Commission, copies of which are available upon request from Equinix. Equinix does not assume any

obligation to update the forward-looking information contained in this press release.

1 Australia (Sydney & Melbourne) DCI Report 2021: Data Centre Colocation, Hyperscale Cloud & Interconnection

2 Equinix Global Tech Trends Survey 2021

3 As of June 30, 2021. AUM reflected as gross. Net AUM is $130B and AUA is $43B.

4 Includes legacy lending through PGIM's parent company, Prudential Financial, Inc.

CONTACT: Equinix Media Relations: press@equinix.com; Equinix Investor Relations: invest@equinix.com; PGIM Real Estate Media Contact (Global), Kristin Meza, +1 973 367-4104, Kristin.Meza@pgim.com; PGIM Real Estate Media Contact (Asia-Pacific), Morgan Laughlin, +81 3-6205-8244, Morgan.laughlin@pgim.com