UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the quarterly period ended March 31, 2020

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

Commission File Number 000-31293

(Exact name of registrant as specified in its charter)

(State of incorporation) | (I.R.S. Employer Identification No.) | |

(Address of principal executive offices, including ZIP code)

(650 ) 598-6000

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading symbol | Name of each exchange on which registered | ||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one):

☒ | Accelerated filer | ☐ | |

Non-accelerated filer | ☐ | Smaller reporting company | |

Emerging growth company | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The number of shares outstanding of the registrant's Common Stock as of May 6, 2020 was 85,927,044 .

EQUINIX, INC.

INDEX

Page No. | ||

Item 1. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 1. | ||

Item 1A. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 5. | ||

Item 6. | ||

3

PART I - FINANCIAL INFORMATION

Item 1. Condensed Consolidated Financial Statements

EQUINIX, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share data)

March 31, 2020 | December 31, 2019 | ||||||

(Unaudited) | |||||||

Assets | |||||||

Current assets: | |||||||

Cash and cash equivalents | $ | $ | |||||

Short-term investments | |||||||

Accounts receivable, net of allowance for doubtful accounts of $14,793 and $13,026 | |||||||

Other current assets | |||||||

Total current assets | |||||||

Property, plant and equipment, net | |||||||

Operating lease right-of-use assets | |||||||

Goodwill | |||||||

Intangible assets, net | |||||||

Other assets | |||||||

Total assets | $ | $ | |||||

Liabilities and Stockholders' Equity | |||||||

Current liabilities: | |||||||

Accounts payable and accrued expenses | $ | $ | |||||

Accrued property, plant and equipment | |||||||

Current portion of operating lease liabilities | |||||||

Current portion of finance lease liabilities | |||||||

Current portion of mortgage and loans payable | |||||||

Current portion of senior notes | |||||||

Other current liabilities | |||||||

Total current liabilities | |||||||

Operating lease liabilities, less current portion | |||||||

Finance lease liabilities, less current portion | |||||||

Mortgage and loans payable, less current portion | |||||||

Senior notes, less current portion | |||||||

Other liabilities | |||||||

Total liabilities | |||||||

Commitments and contingencies (Note 10) | |||||||

Equinix stockholders' equity | |||||||

Common stock, $0.001 par value per share: 300,000,000 shares authorized; 86,269,033 issued and 85,927,060 outstanding in 2020 and 85,700,953 issued and 85,308,386 outstanding in 2019 | |||||||

Additional paid-in capital | |||||||

Treasury stock, at cost; 341,973 shares in 2020 and 392,567 shares in 2019 | ( | ) | ( | ) | |||

Accumulated dividends | ( | ) | ( | ) | |||

Accumulated other comprehensive loss | ( | ) | ( | ) | |||

Retained earnings | |||||||

Total Equinix stockholders' equity | |||||||

Non-controlling interests | ( | ) | ( | ) | |||

Total stockholders' equity | |||||||

Total liabilities and stockholders' equity | $ | $ | |||||

See accompanying notes to condensed consolidated financial statements.

4

EQUINIX, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share data)

Three Months Ended March 31, | |||||||

2020 | 2019 | ||||||

(Unaudited) | |||||||

Revenues | $ | $ | |||||

Costs and operating expenses: | |||||||

Cost of revenues | |||||||

Sales and marketing | |||||||

General and administrative | |||||||

Transaction costs | |||||||

Impairment charges | |||||||

Loss on asset sales | |||||||

Total costs and operating expenses | |||||||

Income from operations | |||||||

Interest income | |||||||

Interest expense | ( | ) | ( | ) | |||

Other income (expense) | ( | ) | |||||

Loss on debt extinguishment | ( | ) | ( | ) | |||

Income before income taxes | |||||||

Income tax expense | ( | ) | ( | ) | |||

Net income | |||||||

Net (income) loss attributable to non-controlling interests | ( | ) | |||||

Net income attributable to Equinix | $ | $ | |||||

Earnings per share ("EPS") attributable to Equinix: | |||||||

Basic EPS | $ | $ | |||||

Weighted-average shares for basic EPS | |||||||

Diluted EPS | $ | $ | |||||

Weighted-average shares for diluted EPS | |||||||

See accompanying notes to condensed consolidated financial statements.

5

EQUINIX, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(in thousands)

Three Months Ended March 31, | |||||||

2020 | 2019 | ||||||

(Unaudited) | |||||||

Net income | $ | $ | |||||

Other comprehensive income (loss), net of tax: | |||||||

Foreign currency translation adjustment ("CTA") loss, net of tax effects of $0 and $(10) | ( | ) | ( | ) | |||

Net investment hedge CTA gain, net of tax effect of $0 and $10 | |||||||

Unrealized gain (loss) on cash flow hedges, net of tax effects of $(6,367) and $(2,741) | ( | ) | |||||

Net actuarial gain (loss) on defined benefit plans, net of tax effects of $9 and $(1) | ( | ) | |||||

Total other comprehensive income (loss), net of tax | ( | ) | |||||

Comprehensive income (loss), net of tax | ( | ) | |||||

Net (income) loss attributable to non-controlling interests | ( | ) | |||||

Other comprehensive (income) loss attributable to non-controlling interests | ( | ) | |||||

Comprehensive income (loss) attributable to Equinix | $ | ( | ) | $ | |||

See accompanying notes to condensed consolidated financial statements.

6

EQUINIX, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

Three Months Ended March 31, | |||||||

2020 | 2019 | ||||||

(Unaudited) | |||||||

Cash flows from operating activities: | |||||||

Net income | $ | $ | |||||

Adjustments to reconcile net income to net cash provided by operating activities: | |||||||

Depreciation | |||||||

Stock-based compensation | |||||||

Amortization of intangible assets | |||||||

Amortization of debt issuance costs and debt discounts and premiums | |||||||

Provision for allowance for doubtful accounts | |||||||

Impairment charges | |||||||

Loss on asset sales | |||||||

Loss on debt extinguishment | |||||||

Other items | |||||||

Changes in operating assets and liabilities: | |||||||

Accounts receivable | ( | ) | |||||

Income taxes, net | |||||||

Other assets | ( | ) | ( | ) | |||

Operating lease right-of-use assets | |||||||

Operating lease liabilities | ( | ) | ( | ) | |||

Accounts payable and accrued expenses | ( | ) | ( | ) | |||

Other liabilities | ( | ) | |||||

Net cash provided by operating activities | |||||||

Cash flows from investing activities: | |||||||

Purchases of investments | ( | ) | ( | ) | |||

Sales of investments | |||||||

Business acquisitions, net of cash and restricted cash acquired | ( | ) | |||||

Purchases of real estate | ( | ) | ( | ) | |||

Purchases of other property, plant and equipment | ( | ) | ( | ) | |||

Net cash used in investing activities | ( | ) | ( | ) | |||

Cash flows from financing activities: | |||||||

Proceeds from employee equity awards | |||||||

Payment of dividends and special distribution | ( | ) | ( | ) | |||

Proceeds from public offering of common stock, net of issuance costs | |||||||

Proceeds from revolving credit facility | |||||||

Repayments of finance lease liabilities | ( | ) | ( | ) | |||

Repayments of mortgage and loans payable | ( | ) | ( | ) | |||

Repayment of senior notes | ( | ) | |||||

Debt extinguishment costs | ( | ) | |||||

Net cash provided by (used in) financing activities | ( | ) | |||||

Effect of foreign currency exchange rates on cash, cash equivalents and restricted cash | ( | ) | ( | ) | |||

Net increase (decrease) in cash, cash equivalents and restricted cash | ( | ) | |||||

Cash, cash equivalents and restricted cash at beginning of period | |||||||

Cash, cash equivalents and restricted cash at end of period | $ | $ | |||||

Cash and cash equivalents | $ | $ | |||||

Current portion of restricted cash included in other current assets | |||||||

Non-current portion of restricted cash included in other assets | |||||||

Total cash, cash equivalents, and restricted cash shown in the condensed consolidated statement of cash flows | $ | $ | |||||

See accompanying notes to condensed consolidated financial statements.

7

EQUINIX, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. Basis of Presentation and Significant Accounting Policies

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements have been prepared by Equinix, Inc. ("Equinix" or the "Company") and reflect all adjustments, consisting only of normal recurring adjustments, which in the opinion of management are necessary to fairly state the financial position and the results of operations for the interim periods presented. The condensed consolidated balance sheet data as of December 31, 2019 has been derived from audited consolidated financial statements as of that date. The condensed consolidated financial statements have been prepared in accordance with the regulations of the Securities and Exchange Commission ("SEC"), but omit certain information and footnote disclosure necessary to present the statements in accordance with generally accepted accounting principles in the United States of America ("U.S. GAAP"). For further information, refer to the Consolidated Financial Statements and Notes thereto included in Equinix's Form 10-K as filed with the SEC on February 21, 2020. Results for the interim periods are not necessarily indicative of results for the entire fiscal year.

Consolidation

The accompanying unaudited condensed consolidated financial statements include the accounts of Equinix and its subsidiaries, including the acquisitions of Packet Host, Inc. from March 2, 2020, three data centers in Mexico acquired from Axtel S.A.B. de C.V from January 8, 2020, and Switch Datacenters' AMS1 data center business in Amsterdam, Netherlands from April 18, 2019. All intercompany accounts and transactions have been eliminated in consolidation.

Income Taxes

The Company elected to be taxed as a real estate investment trust for U.S. federal income tax purposes ("REIT") beginning with its 2015 taxable year. As a result, the Company may deduct the distributions made to its stockholders from taxable income generated by the Company and its qualified REIT subsidiaries ("QRSs"). The Company's dividends paid deduction generally eliminates the U.S. federal taxable income of the Company and its QRSs, resulting in no U.S. federal income tax due. However, the Company's domestic taxable REIT subsidiaries ("TRSs") are subject to U.S. corporate income taxes on any taxable income generated by them. In addition, the foreign operations of the Company are subject to local income taxes regardless of whether the foreign operations are operated as QRSs or TRSs.

The Company provides for income taxes during interim periods based on the estimated effective tax rate for the year. The effective tax rate is subject to change in the future due to various factors such as the operating performance of the Company, tax law changes and future business acquisitions.

The Company's effective tax rates were 20.2 % and 26.6 % for the three months ended March 31, 2020 and 2019, respectively.

Coronavirus (COVID-19) Update

In December 2019, a novel strain of coronavirus, referred to as Coronavirus disease 2019, or COVID-19, emerged. On February 29, 2020, the World Health Organization (“WHO”) raised the COVID-19 threat from high to very high, and on March 11, 2020, the WHO characterized COVID-19 as a global pandemic. The extent to which the Company’s operations will be impacted by COVID-19 will depend largely on future developments, which are highly uncertain and cannot be accurately predicted, including new information which may emerge concerning the severity of the outbreak and actions by government authorities to contain the outbreak or treat its impact, among other things. As of the date of issuance of the financial statements, the Company is not aware of any specific event or circumstance that would require it to update its estimates, judgments or revise the carrying value of its assets or liabilities. These estimates may change, as new events occur and additional information is obtained, and will be recognized in the condensed consolidated financial statements as soon as they become known. Actual results could differ from these estimates.

8

EQUINIX, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

(Unaudited)

Recent Accounting Pronouncements

Accounting Standards Not Yet Adopted

In December 2019, Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") 2019-12, Income Taxes ("Topic 740"): Simplifying the Accounting for Income Taxes. The ASU simplifies accounting for income taxes by removing certain exceptions to the general principles in Topic 740. The ASU also improves consistent application of and simplifies generally accepted accounting principles ("GAAP") for other areas of Topic 740 by clarifying and amending existing guidance. For public entities, the ASU is effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2020, with early adoption permitted including adoption in any interim period for periods for which financial statements have not yet been issued. The Company is currently evaluating the extent of the impact that the adoption of this standard will have on its condensed consolidated financial statements.

Accounting Standards Adopted

In March 2020, FASB issued ASU 2020-04, Reference Rate Reform ("Topic 848"): Facilitation of the Effects of Reference Rate Reform on Financial Reporting. The ASU provides optional expedients and exceptions for applying GAAP to contracts, hedging relationships, and other transactions affected by reference rate reform if certain criteria are met. The ASU is effective for all entities as of March 12, 2020 through December 31, 2022. The Company adopted the ASU upon its issuance and there was no impact on the Company's condensed consolidated financial statements for the three months ended March 31, 2020 as a result of adopting this standard. The Company will evaluate its debt, derivative and lease contracts that are eligible for modification relief and may apply the elections prospectively as needed.

In June 2016, FASB issued ASU 2016-13, Financial Instruments - Credit Losses ("Topic 326"): Measurement of Credit Losses on Financial Instruments. The ASU requires the measurement of all expected credit losses for financial assets held at the reporting date based on historical experience, current conditions, and reasonable and supportable forecasts. The ASU requires enhanced qualitative and quantitative disclosures to help investors and other financial statement users better understand significant estimates and judgments used in estimating credit losses, as well as the credit quality and underwriting standards of an organization's portfolio. The ASU is effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2019, with early adoption permitted. The Company adopted this new ASU on January 1, 2020 using the modified retrospective approach and recorded a net decrease to retained earnings of $0.9 million and a corresponding increase to allowance for doubtful accounts. The adoption did not have any significant impact on other financial assets within the scope of ASC 326, such as contract asset.

Accounts receivable, net, consisted of the following as of March 31, 2020 and December 31, 2019 (in thousands):

March 31, 2020 | December 31, 2019 | ||||||

Accounts receivable | $ | $ | |||||

Allowance for doubtful accounts | ( | ) | ( | ) | |||

Accounts receivable, net | $ | $ | |||||

9

EQUINIX, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

(Unaudited)

The following table summarizes the activity of the Company's allowance for doubtful accounts (in thousands):

Balance at December 31, 2019 | $ | ||

Adjustments due to adoption of ASU 2016-13 | |||

Provision for allowance for doubtful accounts | |||

Net write-offs and recoveries | ( | ) | |

Impact of foreign currency exchange and others | ( | ) | |

Balance at March 31, 2020 | $ | ||

2. Revenue

Contract Balances

The following table summarizes the opening and closing balances of the Company's accounts receivable, net; contract asset, current; contract asset, non-current; deferred revenue, current; and deferred revenue, non-current (in thousands):

Accounts receivable, net | Contract asset, current | Contract asset, non-current | Deferred revenue, current | Deferred revenue, non-current | |||||||||||||||

Beginning balances as of January 1, 2020 | $ | $ | $ | $ | $ | ||||||||||||||

Closing balances as of March 31, 2020 | |||||||||||||||||||

Increase/(decrease) | $ | ( | ) | $ | $ | $ | $ | ||||||||||||

Remaining performance obligations

As of March 31, 2020, approximately $7.2 billion of total revenues including deferred installation revenues are expected to be recognized in future periods, the majority of which will be recognized over the next 24 months. While initial contract terms vary in length, substantially all contracts thereafter automatically renew in one-year increments. Included in the remaining performance obligations is either 1) remaining performance obligations under the initial contract terms or 2) remaining performance obligations related to contracts in the renewal period once the initial terms have lapsed. The remaining performance obligations do not include variable consideration related to unsatisfied performance obligations such as the usage of metered power, service fees from xScaleTM data centers, which are calculated based on future events or actual costs incurred in the future, or any contracts that could be terminated without any significant penalties such as the majority of interconnection revenues. The remaining performance obligations above include revenues to be recognized in the future related to arrangements where the Company is considered the lessor.

10

EQUINIX, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

(Unaudited)

3. Earnings Per Share

The following table sets forth the computation of basic and diluted earnings per share ("EPS") for the periods presented (in thousands, except per share amounts):

Three Months Ended March 31, | |||||||

2020 | 2019 | ||||||

Net income | $ | $ | |||||

Net (income) loss attributable to non-controlling interests | ( | ) | |||||

Net income attributable to Equinix | $ | $ | |||||

Weighted-average shares used to calculate basic EPS | |||||||

Effect of dilutive securities: | |||||||

Employee equity awards | |||||||

Weighted-average shares used to calculate diluted EPS | |||||||

EPS attributable to Equinix: | |||||||

Basic EPS | $ | $ | |||||

Diluted EPS | $ | $ | |||||

The Company has excluded common stock related to employee equity awards in the diluted EPS calculation above of approximately 45,000 shares and 469,000 shares for the three months ended March 31, 2020 and 2019, respectively, because their effect would be anti-dilutive.

4. Acquisitions

2020 Acquisitions

On March 2, 2020, the Company acquired all outstanding shares and equity awards of Packet Host, Inc. (“Packet”), a leading bare metal automation platform for a total purchase consideration of approximately $290.3 million in cash. In addition, the Company paid $16.1 million in cash to accelerate the vesting of unvested Packet equity awards for certain Packet employees, which was recorded as stock-based compensation expense during the three months ended March 31, 2020. In connection with the acquisition, the Company also issued restricted stock awards with an aggregated fair value of $30.2 million and a three-year vesting period, which will be recognized as stock-based compensation costs over the vesting period. The acquisition, combined with the Company’s own organic bare metal service in development, is expected to accelerate Equinix's strategy to help enterprises deploy hybrid multicloud architectures on Equinix's data center platform.

On January 8, 2020, the Company completed the acquisition of three data centers in Mexico from Axtel S.A.B. de C.V. (“Axtel”) for a total purchase consideration of approximately $189.0 million, including $175.0 million in cash and $14.0 million the Company paid to the seller for recoverable value-added taxes ("VAT") incurred prior to the acquisition, which related to a corresponding VAT receivable acquired upon acquisition. The acquisition supports the Company’s ongoing expansion to meet customer demand in the Americas region.

Both acquisitions constitute a business under the accounting standard for business combinations and, therefore, were accounted for as business combinations using the acquisition method of accounting. Under the acquisition method of accounting, the total purchase price is allocated to the assets acquired and liabilities assumed measured at fair value on the date of acquisition. As of March 31, 2020, the Company had not completed the detailed valuation analysis to derive the fair value of assets acquired and liabilities assumed, including property, plant and equipment, intangible assets and the related tax impacts; therefore, the purchase price allocation is based on provisional estimates and subject to continuing management analysis.

11

EQUINIX, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

(Unaudited)

A summary of the preliminary allocation of total purchase consideration is presented as follows (in thousands):

Packet | Axtel | ||||||

Cash and cash equivalents | $ | $ | |||||

Accounts receivable | |||||||

Other current assets | |||||||

Property, plant and equipment | |||||||

Operating lease right-of-use assets | |||||||

Intangible assets | |||||||

Goodwill | |||||||

Other assets | |||||||

Total assets acquired | |||||||

Accounts payable and accrued liabilities | ( | ) | ( | ) | |||

Other current liabilities | ( | ) | |||||

Operating lease liabilities | ( | ) | ( | ) | |||

Finance lease liabilities | ( | ) | |||||

Other liabilities | ( | ) | |||||

Deferred tax liabilities | ( | ) | ( | ) | |||

Net assets acquired | $ | $ | |||||

The following table presents certain information on the acquired intangible assets (in thousands):

Intangible Assets | Fair Value | Estimated Useful Lives (Years) | Weighted-average Estimated Useful Lives (Years) | |||||

Packet: | ||||||||

Trade names | $ | |||||||

Existing technology | ||||||||

Customer relationships | ||||||||

Axtel: | ||||||||

Customer relationships | ||||||||

The fair value of the Packet trade name was estimated using the relief from royalty method under the income approach. The Company applied a relief from royalty rate of 1.0 % and a discount rate of 8.0 %. The fair value of existing technology was estimated under the cost approach by projecting the cost to recreate a new asset with an equivalent utility of the existing technology. The key assumptions of the cost approach include total cost, time to recreate and functional obsolescence.

The fair value of customer relationships acquired from Packet and Axtel was estimated by applying an income approach, by calculating the present value of estimated future operating cash flows generated from existing customers less costs to realize the revenue. The Company applied a discount rate of 8.0 % for Packet and 13.3 % for Axtel, which reflects the nature of the assets as they relate to the risk and uncertainty of the estimated future operating cash flows, as well as the risk of the country within which the acquired business operates.

The fair value of property, plant and equipment was estimated by applying the cost approach, with the exception of land, which was estimated by applying the market approach. The key assumptions of the cost approach include replacement cost new, physical deterioration, functional and economic obsolescence, economic useful life, remaining useful life, age and effective age.

12

EQUINIX, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

(Unaudited)

Goodwill represents the excess of the purchase price over the fair value of the net tangible and intangible assets acquired and liabilities assumed. Goodwill is attributable to the workforce of the acquired business and the projected revenue increase expected to arise from future customers after the Packet and Axtel acquisitions. Goodwill from both acquisitions is not amortizable for local tax purposes and is attributable to the Company's Americas region.

The Company incurred transaction costs of approximately $9.6 million during the three months ended March 31, 2020 for both acquisitions combined. The operating results of both acquisitions are reported in the Americas region following the date of acquisition. During the three months ended March 31, 2020, the Company's results of operations include $8.1 million of revenues and $13.6 million of net loss from operations from the combined operations of Packet and Axtel. The net loss was primarily attributable to the $16.1 million stock-based compensation expense incurred to accelerate the vesting of certain Packet employees’ unvested Packet equity awards at the close of the Packet acquisition.

2019 Acquisition

5. | Equity Method Investments |

On October 8, 2019, the Company entered into a joint venture in the form of a limited liability partnership with GIC, Singapore's sovereign wealth fund (the "EMEA Joint Venture"), to develop and operate xScaleTM data centers in Europe. xScale data centers are engineered to meet the technical and operational requirements and price points of core hyperscale workload deployments and also offer access to Equinix's comprehensive suite of interconnection and edge services.

Upon closing, GIC contributed €152.6 million in cash, or $167.4 million at the exchange rate in effect on October 8, 2019, for an 80 % partnership interest in the EMEA Joint Venture. Equinix sold certain xScale data center facilities to the EMEA Joint Venture in exchange for net cash proceeds of $351.8 million, as well as a 20 % partnership interest in the EMEA Joint Venture with a fair value of $41.9 million. The Company accounts for its investments in the EMEA Joint Venture using the equity method of accounting, whereby the investments were recorded initially at fair value, which equals to the cost of the Company's initial equity contribution, and subsequently adjusted for cash contributions and the Company's share of the income and losses of the investees.

During the three months ended March 31, 2020, the Company made an additional equity contribution of $5.1 million to the EMEA Joint Venture. As of March 31, 2020 and December 31, 2019, the Company's equity method investments were $72.7 million and $59.7 million, respectively, and were included within other assets on the consolidated balance sheet. The Company's share of the income and losses of the equity method investments was not significant for the three months ended March 31, 2020, and was included in other income on the condensed consolidated statement of operations.

13

EQUINIX, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

(Unaudited)

6. Derivatives and Hedging Activities

Derivatives Designated as Hedging Instruments

Net Investment Hedges. The Company is exposed to the impact of foreign exchange rate fluctuations on the value of investments in its foreign subsidiaries whose functional currencies are other than the U.S. Dollar. In order to mitigate the impact of foreign currency exchange rates, the Company has entered into various foreign currency debt obligations, which are designated as hedges against the Company's net investments in foreign subsidiaries. As of March 31, 2020 and December 31, 2019, the total principal amounts of foreign currency debt obligations designated as net investment hedges were $4,245.1 million and $4,078.7 million, respectively.

The Company also uses cross-currency interest rate swaps to hedge a portion of its net investment in its European operations. As of both March 31, 2020 and December 31, 2019, U.S. Dollar to Euro cross-currency interest rate swap contracts with a total notional amount of $750.0 million were outstanding, with maturity dates in April 2022, January 2024 and January 2025. At maturity of each outstanding contract, the Company will receive U.S. Dollars from and pay Euros to the contract counterparty. During the term of each contract, the Company receives interest payments in U.S. Dollars and makes interest payments in Euros based on a notional amount and fixed interest rates determined at contract inception.

Amount of gain or (loss) recognized in accumulated other comprehensive income: | |||||||||

Three Months Ended March 31, | |||||||||

2020 | 2019 | ||||||||

Foreign currency debt | $ | $ | |||||||

Cross-currency interest rate swaps (included component) (1) | |||||||||

Cross-currency interest rate swaps (excluded component) (2) | ( | ) | |||||||

Total | $ | $ | |||||||

Amount of gain or (loss) recognized in earnings: | |||||||||

Location of gain or (loss) | Three Months Ended March 31, | ||||||||

2020 | 2019 | ||||||||

Cross-currency interest rate swaps (excluded component) (2) | Interest expense | $ | $ | ||||||

Total | $ | $ | |||||||

(1) | Included component represents foreign exchange spot rates. |

(2) | Excluded component represents cross-currency basis spread and interest rates. |

14

EQUINIX, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

(Unaudited)

The Company hedges the interest rate exposure created by anticipated fixed rate debt issuances through the use of treasury locks and forward starting swaps (collectively, interest rate locks), which are designated as cash flow hedges. As of March 31, 2020, the total notional amount of interest rate locks was approximately $1.2 billion. As of December 31, 2019, the Company had no interest rate cash flow hedges outstanding. When interest rate locks are settled, any accumulated gain or loss included as a component of other comprehensive income (loss) will be amortized to interest expense over the life of the related debt. As of March 31, 2020 and December 31, 2019, the net loss and gain in accumulated other comprehensive income (loss) to be reclassified to interest expense in the next 12 months for interest rate locks is not significant.

The Company enters into intercompany hedging instruments ("intercompany derivatives") with wholly-owned subsidiaries of the Company in order to hedge certain forecasted revenues and expenses denominated in currencies other than the U.S. Dollar. Simultaneously, the Company enters into derivative contracts with unrelated third parties to externally hedge the net exposure created by such intercompany derivatives.

The effect of cash flow hedges on accumulated other comprehensive income and the condensed consolidated statements of operations for the three months ended March 31, 2020 and 2019 was as follows (in thousands):

Amount of gain or (loss) recognized in accumulated other comprehensive income: | |||||||||

Three Months Ended March 31, | |||||||||

2020 | 2019 | ||||||||

Foreign currency forward and option contracts (included component) (1) | $ | $ | |||||||

Foreign currency option contracts (excluded component) (2) | |||||||||

Interest rate locks | ( | ) | |||||||

Total | $ | $ | |||||||

Amount of gain or (loss) reclassified from accumulated other comprehensive income to income: | |||||||||

Three Months Ended March 31, | |||||||||

Location of gain or (loss) | 2020 | 2019 | |||||||

Foreign currency forward contracts | Revenues | $ | $ | ||||||

Foreign currency forward contracts | Costs and operating expenses | ( | ) | ( | ) | ||||

Interest rate locks | Interest Expense | ||||||||

Total | $ | $ | |||||||

Amount of gain or (loss) excluded from effectiveness testing included in income: | |||||||||

Three Months Ended March 31, | |||||||||

Location of gain or (loss) | 2020 | 2019 | |||||||

Foreign currency forward contracts | Other income (expense) | $ | $ | ||||||

Foreign currency option contracts (excluded component) (2) | Revenues | ( | ) | ||||||

Total | $ | ( | ) | $ | |||||

(1) | Included component represents foreign exchange spot rates. |

(2) | Excluded component represents option's time value. |

15

EQUINIX, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

(Unaudited)

Derivatives Not Designated as Hedging Instruments

Embedded Derivatives. The Company is deemed to have foreign currency forward contracts embedded in certain of the Company's customer agreements that are priced in currencies different from the functional or local currencies of the parties involved. These embedded derivatives are separated from their host contracts and carried on the Company's balance sheet at their fair value. The majority of these embedded derivatives arise as a result of the Company's foreign subsidiaries pricing their customer contracts in U.S. Dollars.

Economic Hedges of Embedded Derivatives. The Company uses foreign currency forward contracts to manage the foreign exchange risk associated with the Company's customer agreements that are priced in currencies different from the functional or local currencies of the parties involved ("economic hedges of embedded derivatives"). Foreign currency forward contracts represent agreements to exchange the currency of one country for the currency of another country at an agreed-upon price on an agreed-upon settlement date.

The following table presents the effect of derivatives not designated as hedging instruments in the Company's condensed consolidated statements of operations (in thousands):

Amount of gain or (loss) recognized in earnings: | |||||||||

Three Months Ended March 31, | |||||||||

Location of gain or (loss) | 2020 | 2019 | |||||||

Embedded derivatives | Revenues | $ | $ | ||||||

Economic hedge of embedded derivatives | Revenues | ( | ) | ( | ) | ||||

Foreign currency forward contracts | Other income (expense) | ||||||||

Total | $ | $ | |||||||

16

EQUINIX, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

(Unaudited)

Fair Value of Derivative Instruments

The following table presents the fair value of derivative instruments recognized in the Company's condensed consolidated balance sheets as of March 31, 2020 and December 31, 2019 (in thousands):

March 31, 2020 | December 31, 2019 | ||||||||||||||

Assets (1) | Liabilities (2) | Assets (1) | Liabilities (2) | ||||||||||||

Designated as hedging instruments: | |||||||||||||||

Cash flow hedges | |||||||||||||||

Foreign currency forward and option contracts | $ | $ | $ | $ | |||||||||||

Interest rate locks | |||||||||||||||

Net investment hedges | |||||||||||||||

Cross-currency interest rate swaps | |||||||||||||||

Total designated as hedging | |||||||||||||||

Not designated as hedging instruments: | |||||||||||||||

Embedded derivatives | |||||||||||||||

Economic hedges of embedded derivatives | |||||||||||||||

Foreign currency forward contracts | |||||||||||||||

Total not designated as hedging | |||||||||||||||

Total Derivatives | $ | $ | $ | $ | |||||||||||

(1) | As presented in the Company's condensed consolidated balance sheets within other current assets and other assets. |

(2) | As presented in the Company's condensed consolidated balance sheets within other current liabilities and other liabilities. |

Offsetting Derivative Assets and Liabilities

The Company presents its derivative instruments and the accrued interest related to cross-currency interest rate swaps at gross fair values in the condensed consolidated balance sheets. The Company enters into master netting agreements with its counterparties for transactions other than embedded derivatives to mitigate credit risk exposure to any single counterparty. Master netting agreements allow for individual derivative contracts with a single counterparty to offset in the event of default. For presentation on the condensed consolidated balance sheets, the Company does not offset fair value amounts recognized for derivative instruments or the accrued interest related to cross-currency interest rate swaps under master netting arrangements. The following table presents information related to these offsetting arrangements as of March 31, 2020 and December 31, 2019 (in thousands):

Gross Amounts Offset in Consolidated Balance Sheet | |||||||||||||||||||

Gross Amounts | Gross Amounts Offset in the Balance Sheet | Net Amounts | Gross Amounts not Offset in the Balance Sheet | Net | |||||||||||||||

March 31, 2020 | |||||||||||||||||||

Derivative assets | $ | $ | $ | $ | ( | ) | $ | ||||||||||||

Derivative liabilities | ( | ) | |||||||||||||||||

December 31, 2019 | |||||||||||||||||||

Derivative assets | $ | $ | $ | $ | ( | ) | $ | ||||||||||||

Derivative liabilities | ( | ) | |||||||||||||||||

17

EQUINIX, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

(Unaudited)

7. Fair Value Measurements

Valuation Methods

Fair value estimates are made as of a specific point in time based on methods using the market approach valuation method which uses prices and other relevant information generated by market transactions involving identical or comparable assets or liabilities or other valuation techniques. These techniques involve uncertainties and are affected by the assumptions used and the judgments made regarding risk characteristics of various financial instruments, discount rates, estimates of future cash flows, future expected loss experience and other factors.

Cash Equivalents and Investments. The fair value of the Company's investments in money market funds approximates their face value. Such instruments are included in cash equivalents. The Company's money market funds and publicly traded equity securities are classified within Level 1 of the fair value hierarchy because they are valued using quoted prices for identical instruments in active markets. The fair value of the Company's other investments, including certificates of deposit, approximates their face value. The fair value of these investments is priced based on the quoted market price for similar instruments or nonbinding market prices that are corroborated by observable market data. Such instruments are classified within Level 2 of the fair value hierarchy. The Company determines the fair values of its Level 2 investments by using inputs such as actual trade data, benchmark yields, broker/dealer quotes and other similar data, which are obtained from quoted market prices, custody bank, third-party pricing vendors or other sources. The Company uses such pricing data as the primary input to make its assessments and determinations as to the ultimate valuation of its investment portfolio and has not made, during the periods presented, any material adjustments to such inputs. The Company is responsible for its consolidated financial statements and underlying estimates.

The Company uses the specific identification method in computing realized gains and losses. Realized gains and losses from the sale of investments are included within other income (expense) in the Company's consolidated statements of operations. The Company's investments in publicly traded equity securities are carried at fair value. Unrealized gains and losses on publicly traded equity securities are reported within other income (expense) in the Company's consolidated statements of operations.

Derivative Assets and Liabilities. Inputs used for valuations of derivatives are based upon quoted prices for similar instruments in active markets, quoted prices for identical or similar instruments in markets that are not active, and model-based valuation techniques for which all significant inputs are observable in the market or can be corroborated by observable market data. The significant inputs used include spot currency rates and forward points, interest rate curves, and published credit default swap rates of its foreign exchange trading counterparties and other comparable companies. The Company has determined that the inputs used to value its derivatives fall within Level 2 of the fair value hierarchy, therefore the derivatives are categorized as Level 2.

The Company did not have any nonfinancial assets or liabilities measured at fair value on a recurring basis as of March 31, 2020 and December 31, 2019.

18

EQUINIX, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

(Unaudited)

The Company's financial assets and liabilities measured at fair value on a recurring basis as of March 31, 2020 were as follows (in thousands):

Fair Value at March 31, 2020 | Fair Value Measurement Using | ||||||||||

Level 1 | Level 2 | ||||||||||

Assets: | |||||||||||

Money market and deposit accounts | $ | $ | $ | ||||||||

Publicly traded equity securities | |||||||||||

Certificates of deposit | |||||||||||

Derivative instruments (1) | |||||||||||

Total | $ | $ | $ | ||||||||

Liabilities: | |||||||||||

Derivative instruments (1) | $ | $ | $ | ||||||||

(1) | Amounts are included within other current assets, other assets, others current liabilities and other liabilities in the Company's accompanying condensed consolidated balance sheet. |

The Company's financial assets and liabilities measured at fair value on a recurring basis as of December 31, 2019 were as follows (in thousands):

Fair Value at December 31, 2019 | Fair Value Measurement Using | ||||||||||

Level 1 | Level 2 | ||||||||||

Assets: | |||||||||||

Money market and deposit accounts | $ | $ | $ | ||||||||

Publicly traded equity securities | |||||||||||

Certificates of deposit | |||||||||||

Derivative instruments (1) | |||||||||||

Total | $ | $ | $ | ||||||||

Liabilities: | |||||||||||

Derivative instruments (1) | $ | $ | $ | ||||||||

(1) | Amounts are included within other current assets, other assets, other current liabilities and other liabilities in the Company's accompanying condensed consolidated balance sheet. |

The Company did not have any Level 3 financial assets or financial liabilities measured at fair value on a recurring basis as of March 31, 2020 and December 31, 2019.

8. Leases

Significant Lease Transactions

Silicon Valley 4 ("SV4") Data Center

In February 2020, the Company exercised its first renewal option available to extend the lease term for the SV4 Data Center for 5 years. After exercising the first renewal option, there are two renewal options of 5 years each remaining. The Company concluded that the two remaining renewal options of 5 years each are reasonably certain to be exercised after considering all relevant factors that create an economic incentive for the Company. Therefore, the concluded lease term is 15 years and 7 months with the lease ending on September 30, 2035. The Company assessed the lease classification of the SV4 lease at the modification date and determined the lease should be accounted for as a finance lease. During the three months ended March 31, 2020, the Company recorded finance lease ROU asset and liability of $62.8 million and $63.3 million, respectively.

19

EQUINIX, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

(Unaudited)

Hong Kong 1 ("HK1") Data Center

In March 2020, the Company entered into several lease agreements with the landlord to lease several premises in the HK1 Data Center. One of the premises commenced in March 2020 with an initial term of 18 years. The Company assessed the lease classification of that premises at the commencement date and determined the lease should be accounted for as a finance lease. The Company will assess the remaining premises when the leases commence. During the three months ended March 31, 2020, the Company recorded finance lease ROU asset and liability of 163.0 million Hong Kong dollars or $21.0 million at the exchange rate in effect on March 31, 2020.

Lease Expenses

The components of lease expenses are as follows (in thousands):

Three Months Ended March 31, 2020 | Three Months Ended March 31, 2019 | ||||||

Finance lease cost | |||||||

Amortization of right-of-use assets (1) | $ | $ | |||||

Interest on lease liabilities | |||||||

Total finance lease cost | |||||||

Operating lease cost | |||||||

Total lease cost | $ | $ | |||||

(1) Amortization of right-of-use assets is included with depreciation expense, and is recorded within cost of revenues, sales and marketing and general and administrative expenses in the condensed consolidated statements of operations.

20

EQUINIX, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

(Unaudited)

Other Information

Other information related to leases is as follows (in thousands):

Three Months Ended March 31, 2020 | Three Months Ended March 31, 2019 | ||||||

Cash paid for amounts included in the measurement of lease liabilities: | |||||||

Operating cash flows from finance leases | $ | $ | |||||

Operating cash flows from operating leases | |||||||

Financing cash flows from finance leases | |||||||

Right-of-use assets obtained in exchange for lease obligations: (1) | |||||||

Finance leases | $ | $ | |||||

Operating leases | |||||||

As of March 31, 2020 | As of December 31, 2019 | ||||||

Weighted-average remaining lease term - finance leases (2) | |||||||

Weighted-average remaining lease term - operating leases (2) | |||||||

Weighted-average discount rate - finance leases | % | % | |||||

Weighted-average discount rate - operating leases | % | % | |||||

Finance lease assets (3) | $ | $ | |||||

(1) Represents all non-cash changes in ROU assets.

(2) Includes lease renewal options that are reasonably certain to be exercised.

(3) As of March 31, 2020 and December 31, 2019, the Company recorded accumulated amortization of finance lease assets of $498.1 million and $474.8 million, respectively. Finance lease assets are recorded within property, plant and equipment, net on the condensed consolidated balance sheets.

Maturities of Lease Liabilities

Maturities of lease liabilities as of March 31, 2020 are as follows (in thousands):

Operating Leases | Finance Leases | Total | |||||||||

2020 (9 months remaining) | $ | $ | $ | ||||||||

2021 | |||||||||||

2022 | |||||||||||

2023 | |||||||||||

2024 | |||||||||||

Thereafter | |||||||||||

Total lease payments | |||||||||||

Plus amount representing residual property value | |||||||||||

Less imputed interest | ( | ) | ( | ) | ( | ) | |||||

Total | $ | $ | $ | ||||||||

The Company entered into agreements with various landlords primarily to lease data center spaces and ground leases which have not yet commenced as of March 31, 2020. These leases will commence between fiscal years 2020 and 2022, with lease terms of 2 to 49 years and a total lease commitment of approximately $680.8 million.

21

EQUINIX, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

(Unaudited)

9. Debt Facilities

Mortgage and Loans Payable

As of March 31, 2020 and December 31, 2019, the Company's mortgage and loans payable consisted of the following (in thousands):

March 31, 2020 | December 31, 2019 | ||||||

Term loans | $ | $ | |||||

Revolving credit facility | |||||||

Mortgage payable and loans payable | |||||||

Less amount representing unamortized debt discount and debt issuance cost | ( | ) | ( | ) | |||

Add amount representing unamortized mortgage premium | |||||||

Less current portion | ( | ) | ( | ) | |||

Total | $ | $ | |||||

Senior Credit Facility - Revolving Facility

On December 12, 2017, the Company entered into a credit agreement with a group of lenders for a $3,000.0 million credit facility ("Senior Credit Facility"), comprised of a $2,000.0 million senior unsecured multicurrency revolving credit facility ("Revolving Facility") and an approximately $1,000.0 million senior unsecured multicurrency term loan facility. The Revolving Facility allows the Company to borrow, repay and reborrow over its term. The Revolving Facility provides a sublimit for the issuance of letters of credit of up to $250.0 million at any one time.

In March 2020, the Company borrowed a total of $250.0 million under the Revolving Facility, which remained outstanding as of March 31, 2020. In addition, the Company had 41 irrevocable letters of credit totaling $76.1 million issued and outstanding under the Revolving Facility as of March 31, 2020. As a result, the amount available to the Company to borrow under the Revolving Facility was approximately $1.7 billion as of March 31, 2020.

22

EQUINIX, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

(Unaudited)

Senior Notes

As of March 31, 2020 and December 31, 2019, the Company's senior notes consisted of the following (in thousands):

March 31, 2020 | December 31, 2019 | ||||||||||||

Amount | Effective Rate | Amount | Effective Rate | ||||||||||

5.000% Infomart Senior Notes (1) | $ | % | $ | % | |||||||||

5.375% Senior Notes due 2022 | % | % | |||||||||||

2.625% Senior Notes due 2024 | % | % | |||||||||||

2.875% Euro Senior Notes due 2024 | % | % | |||||||||||

2.875% Euro Senior Notes due 2025 | % | % | |||||||||||

2.900% Senior Notes due 2026 | % | % | |||||||||||

5.875% Senior Notes due 2026 | % | % | |||||||||||

2.875% Euro Senior Notes due 2026 | % | % | |||||||||||

5.375% Senior Notes due 2027 | % | % | |||||||||||

3.200% Senior Notes due 2029 | % | % | |||||||||||

Less amount representing unamortized debt issuance cost | ( | ) | ( | ) | |||||||||

Add amount representing unamortized debt premium | |||||||||||||

Less current portion | ( | ) | ( | ) | |||||||||

Total | $ | $ | |||||||||||

(1) 5.000 % Infomart Senior Notes consist of three tranches due in each of April 2020, October 2020 and April 2021. The effective rate represents the weighted-average effective interest rates of the tranches outstanding at the periods presented in the table above.

On January 2, 2020, the Company redeemed the remaining $343.7 million principal amount of the 5.375 % Senior Notes due 2022. In connection with the redemption, the Company incurred $5.9 million of loss on debt extinguishment, including $4.6 million redemption premium that was paid in cash and $1.3 million related to the write-off of unamortized debt issuance costs.

Maturities of Debt Instruments

The following table sets forth maturities of the Company's debt, including mortgage and loans payable, and senior notes, gross of debt issuance costs, debt discounts and debt premiums, as of March 31, 2020 (in thousands):

Years ending: | |||

2020 (9 months remaining) | $ | ||

2021 | |||

2022 | |||

2023 | |||

2024 | |||

Thereafter | |||

Total | $ | ||

23

EQUINIX, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

(Unaudited)

Fair Value of Debt Instruments

The following table sets forth the estimated fair values of the Company's mortgage and loans payable and senior notes, including current maturities, as of (in thousands):

March 31, 2020 | December 31, 2019 | ||||||

Mortgage and loans payable | $ | $ | |||||

Senior notes | |||||||

The fair values of the mortgage and loans payable and 5.000 % Infomart Senior Notes, which are not publicly traded, were estimated by considering the Company's credit rating, current rates available to the Company for debt of the same remaining maturities and terms of the debt (Level 2). The fair value of the senior notes, which are traded in the public debt market, was based on quoted market prices (Level 1).

Interest Charges

The following table sets forth total interest costs incurred and total interest costs capitalized for the periods presented (in thousands):

Three Months Ended March 31, | |||||||

2020 | 2019 | ||||||

Interest expense | $ | $ | |||||

Interest capitalized | |||||||

Interest charges incurred | $ | $ | |||||

Total interest paid, net of capitalized interest, during the three months ended March 31, 2020 and 2019 was $119.9 million and $136.3 million, respectively.

10. Commitments and Contingencies

Purchase Commitments

As a result of the Company's various IBX data center expansion projects, as of March 31, 2020, the Company was contractually committed for approximately $0.9 billion of unaccrued capital expenditures, primarily for IBX infrastructure equipment not yet delivered and labor not yet provided, in connection with the work necessary to open these IBX data centers and make them available to customers for installation. The Company also had numerous other, non-capital purchase commitments in place as of March 31, 2020, such as commitments to purchase power in select locations through the remainder of 2020 and thereafter, and other open purchase orders for goods or services to be delivered or provided during the remainder of 2020 and thereafter. Such other miscellaneous purchase commitments totaled approximately $1.1 billion as of March 31, 2020. In addition, the Company entered into lease agreements in various locations that have not yet commenced as of March 31, 2020. For further information on lease commitments, see Note 8 above.

Equity Contribution Commitments

In connection with the EMEA Joint Venture closed in October 2019, the Company agreed to make future equity contributions to the EMEA Joint Venture. As of March 31, 2020, the Company had future equity contribution commitments of €16.1 million and £13.1 million, or $33.9 million in total at the exchange rate in effect on March 31, 2020.

Contingent Liabilities

The Company estimates exposure on certain liabilities, such as indirect and property taxes, based on the best information available at the time of determination. With respect to real and personal property taxes, the Company

24

EQUINIX, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

(Unaudited)

records what it can reasonably estimate based on prior payment history, assessed value by the assessor's office, current landlord estimates or estimates based on current or changing fixed asset values in each specific municipality, as applicable. However, there are circumstances beyond the Company's control whereby the underlying value of the property or basis for which the tax is calculated on the property may change, such as a landlord selling the underlying property of one of the Company's IBX data center leases or a municipality changing the assessment value in a jurisdiction and, as a result, the Company's property tax obligations may vary from period to period. Based upon the most current facts and circumstances, the Company makes the necessary property tax accruals for each of its reporting periods. However, revisions in the Company's estimates of the potential or actual liability could materially impact the financial position, results of operations or cash flows of the Company.

The Company's indirect and property tax filings in various jurisdictions are subject to examination by local tax authorities. Although we believe that we have adequately assessed and accounted for our potential tax liabilities, and that our tax estimates are reasonable, there can be no certainty that additional taxes will not be due upon audit of our tax returns or as a result of further changes to the tax laws and interpretations thereof. For example, we are currently undergoing audits and appealing the tentative assessments in a number of jurisdictions where we operate, such as France and Brazil. The final results of these audits and the outcomes of the appeals are uncertain and may not be resolved in our favor. The Company regularly assesses the likelihood of adverse outcomes resulting from these examinations and appeals that would affect the adequacy of its tax accruals for each of the reporting periods. If any issues arising from the tax examinations and appeals are resolved in a manner inconsistent with the Company's expectations, the revision of the estimates of the potential or actual liabilities could materially impact the financial position, results of operations, or cash flows of the Company.

25

EQUINIX, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

(Unaudited)

11. Stockholders' Equity

Stockholders' Equity Rollforward

The following tables provide a rollforward of stockholders' equity for the three months ended March 31, 2020 and 2019 (in thousands):

AOCI (Loss) | Retained Earnings | Equinix Stockholders' Equity | Non-controlling Interests | Total Stockholders' Equity | |||||||||||||||||||||||||||||||||||||

Common Stock | Treasury Stock | Additional Paid-in Capital | Accumulated Dividends | ||||||||||||||||||||||||||||||||||||||

Shares | Amount | Shares | Amount | ||||||||||||||||||||||||||||||||||||||

Balance as of December 31, 2019 | $ | ( | ) | $ | ( | ) | $ | $ | ( | ) | $ | ( | ) | $ | $ | $ | ( | ) | $ | ||||||||||||||||||||||

Adjustment from adoption of new accounting standard update | — | — | — | — | — | — | — | ( | ) | ( | ) | — | ( | ) | |||||||||||||||||||||||||||

Net income | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

Other comprehensive loss | — | — | — | — | — | — | ( | ) | — | ( | ) | ( | ) | ( | ) | ||||||||||||||||||||||||||

Issuance of common stock and release of treasury stock for employee equity awards | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||

Issuance of common stock under ATM Program | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||

Dividend distribution on common stock, $2.66 per share | — | — | — | — | — | ( | ) | — | — | ( | ) | — | ( | ) | |||||||||||||||||||||||||||

Settlement of accrued dividends on vested equity awards | — | — | — | — | ( | ) | — | — | ( | ) | — | ( | ) | ||||||||||||||||||||||||||||

Accrued dividends on unvested equity awards | — | — | — | — | — | ( | ) | — | — | ( | ) | — | ( | ) | |||||||||||||||||||||||||||

Stock-based compensation, net of estimated forfeitures | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||

Balance as of March 31, 2020 | $ | ( | ) | $ | ( | ) | $ | $ | ( | ) | $ | ( | ) | $ | $ | $ | ( | ) | $ | ||||||||||||||||||||||

26

EQUINIX, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

(Unaudited)

Additional Paid-in Capital | Accumulated Dividends | AOCI (Loss) | Retained Earnings | Equinix Stockholders' Equity | Non-controlling interests | Total Stockholders' Equity | |||||||||||||||||||||||||||||||||||

Common Stock | Treasury Stock | ||||||||||||||||||||||||||||||||||||||||

Shares | Amount | Shares | Amount | ||||||||||||||||||||||||||||||||||||||

Balance as of December 31, 2018 | $ | ( | ) | $ | ( | ) | $ | $ | ( | ) | $ | ( | ) | $ | $ | $ | $ | ||||||||||||||||||||||||

Adjustment from adoption of new accounting standard update | — | — | — | — | — | — | ( | ) | ( | ) | — | ( | ) | ||||||||||||||||||||||||||||

Net income (loss) | — | — | — | — | — | — | — | ( | ) | ||||||||||||||||||||||||||||||||

Other comprehensive income | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

Issuance of common stock and release of treasury stock for employee equity awards | — | — | — | — | |||||||||||||||||||||||||||||||||||||

Issuance of common stock for equity offering | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||

Dividend distribution on common stock, $2.46 per share | — | — | — | — | — | ( | ) | — | — | ( | ) | — | ( | ) | |||||||||||||||||||||||||||

Settlement of accrued dividends on vested equity awards | — | — | — | — | ( | ) | — | — | ( | ) | — | ( | ) | ||||||||||||||||||||||||||||

Accrued dividends on unvested equity awards | — | — | — | — | — | ( | ) | — | — | ( | ) | — | ( | ) | |||||||||||||||||||||||||||

Stock-based compensation, net of estimated forfeitures | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||

Balance as of March 31, 2019 | $ | ( | ) | $ | ( | ) | $ | $ | ( | ) | $ | ( | ) | $ | $ | $ | ( | ) | $ | ||||||||||||||||||||||

27

EQUINIX, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

(Unaudited)

Accumulated Other Comprehensive Loss

The changes in accumulated other comprehensive loss, net of tax, by components are as follows (in thousands):

Balance as of December 31, 2019 | Net Change | Balance as of March 31, 2020 | |||||||||

Foreign currency translation adjustment ("CTA") loss | $ | ( | ) | $ | ( | ) | $ | ( | ) | ||

Unrealized gain on cash flow hedges (1) | ( | ) | |||||||||

Net investment hedge CTA gain (1) | |||||||||||

Net actuarial loss on defined benefit plans (2) | ( | ) | ( | ) | |||||||

Accumulated other comprehensive loss attributable to Equinix | $ | ( | ) | $ | ( | ) | $ | ( | ) | ||

(1) | Refer to Note 6 for a discussion of the amounts reclassified from accumulated other comprehensive loss to net income. |

(2) | The Company has a defined benefit pension plan covering all employees in one country where such plan is mandated by law. The Company does not have any defined benefit plans in any other countries. The unamortized gain (loss) on defined benefit plans includes gains or losses resulting from a change in the value of either the projected benefit obligation or the plan assets resulting from a change in an actuarial assumption, net of amortization. |

Changes in foreign currencies can have a significant impact to the Company's consolidated balance sheets (as evidenced above in the Company's foreign currency translation loss), as well as its consolidated results of operations, as amounts in foreign currencies are generally translated into more U.S. Dollars when the U.S. Dollar weakens or fewer U.S. Dollars when the U.S. Dollar strengthens. As of March 31, 2020, the U.S. Dollar was generally stronger relative to certain of the currencies of the foreign countries in which the Company operates as compared to December 31, 2019. This overall strengthening of the U.S. Dollar had an overall unfavorable impact on the Company's condensed consolidated financial position because the foreign denominations translated into fewer U.S. Dollars as evidenced by an increase in foreign currency translation loss for the three months ended March 31, 2020 as reflected in the above table. The volatility of the U.S. Dollar as compared to the other currencies in which the Company operates could have a significant impact on its condensed consolidated financial position and results of operations including the amount of revenue that the Company reports in future periods.

Common Stock

In March 2019, the Company issued and sold 2,985,575 shares of common stock in a public offering pursuant to a registration statement and a related prospectus and prospectus supplement. The Company received net proceeds of approximately $1,213.4 million, net of underwriting discounts, commissions and offering expenses.

In December 2018, the Company launched an ATM program, under which it may offer and sell from time to time up to an aggregate of $750.0 million of its common stock in "at the market" transactions (the "ATM Program"). For the three months ended March 31, 2020, the Company sold 162,530 shares under the ATM Program, for approximately $101.8 million, net of payment of commissions to sales agents and other offering expenses. During the quarter ended March 31, 2019, no sales were made under the ATM Program.

Stock-Based Compensation

For the three months ended March 31, 2020, the Compensation Committee and/or the Stock Award Committee of the Company's Board of Directors, as the case may be, approved the issuance of an aggregate of 653,281 shares of restricted stock units to certain employees, including executive officers, pursuant to the 2000 Equity Incentive Plan. These equity awards are subject to vesting provisions and have a weighted-average grant date fair value of $579.24 and a weighted-average requisite service period of 3.31 years. The valuation of restricted stock units with only a service condition or a service and performance condition requires no significant assumptions as the fair value for these types of equity awards is based solely on the fair value of the Company's stock price on the date of grant. The Company used revenues and adjusted funds from operations ("AFFO") per share as the performance measurements in the restricted stock units with both service and performance conditions that were granted in the three months ended March 31, 2020.

28

EQUINIX, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

(Unaudited)

The Company uses a Monte Carlo simulation option-pricing model to determine the fair value of restricted stock units with a service and market condition. The Company used total shareholder return ("TSR") as the performance measurement in the restricted stock units with a service and market condition that were granted in the three months ended March 31, 2020. There were no significant changes in the assumptions used to determine the fair value of restricted stock units with a service and market condition that were granted in 2020 compared to the prior year.

The following table presents, by operating expense category, the Company's stock-based compensation expense recognized in the Company's condensed consolidated statements of operations (in thousands):

Three Months Ended March 31, | |||||||

2020 | 2019 | ||||||

Cost of revenues | $ | $ | |||||

Sales and marketing | |||||||

General and administrative | |||||||

Total | $ | $ | |||||

12. Segment Information

29

EQUINIX, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

(Unaudited)

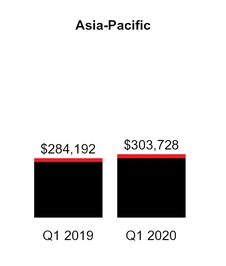

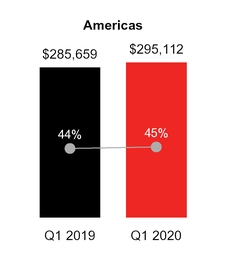

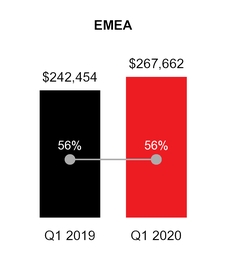

The following tables present revenue information disaggregated by product lines and geographic areas (in thousands):

Three Months Ended March 31, 2020 | |||||||||||||||

Americas | EMEA | Asia-Pacific | Total | ||||||||||||

Colocation (1) | $ | $ | $ | $ | |||||||||||

Interconnection | |||||||||||||||

Managed infrastructure | |||||||||||||||

Other (1) | |||||||||||||||

Recurring revenues | |||||||||||||||

Non-recurring revenues | |||||||||||||||

Total | $ | $ | $ | $ | |||||||||||

(1) Includes some leasing and hedging activities.

Three Months Ended March 31, 2019 | |||||||||||||||

Americas | EMEA | Asia-Pacific | Total | ||||||||||||

Colocation (1) | $ | $ | $ | $ | |||||||||||

Interconnection | |||||||||||||||

Managed infrastructure | |||||||||||||||

Other (1) | |||||||||||||||

Recurring revenues | |||||||||||||||

Non-recurring revenues | |||||||||||||||

Total | $ | $ | $ | $ | |||||||||||

(1) Includes some leasing and hedging activities.

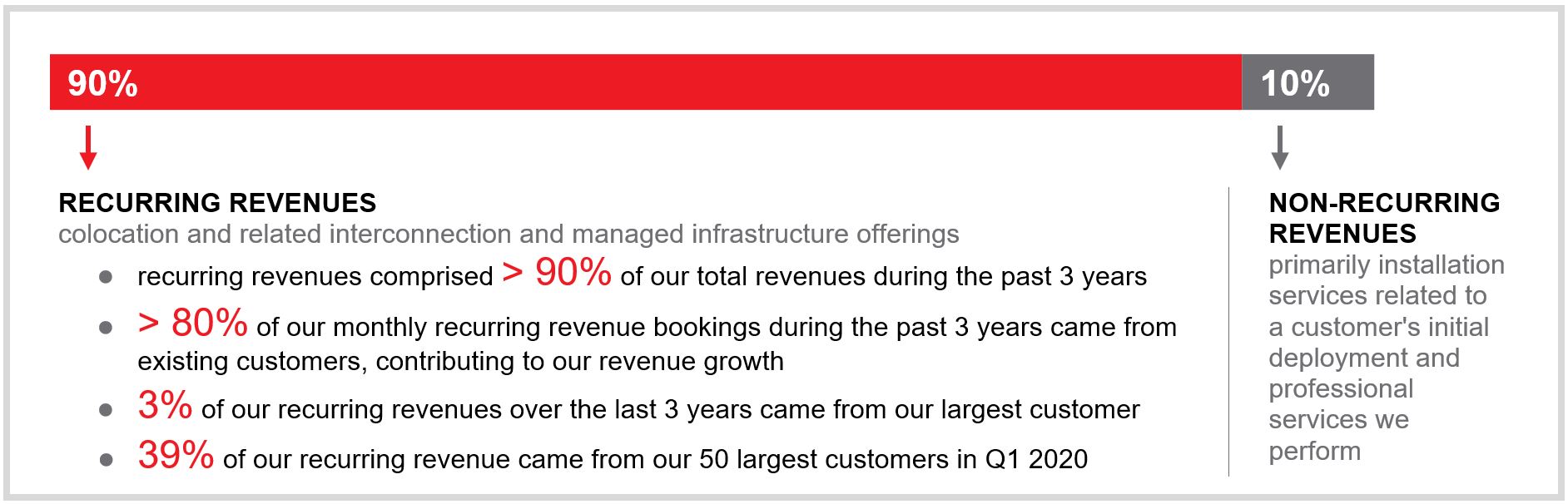

No single customer accounted for 10% or greater of the Company's accounts receivable or revenues for the three months ended March 31, 2020 and 2019.

The Company defines adjusted EBITDA as income from operations excluding depreciation, amortization, accretion, stock-based compensation expense, restructuring charges, impairment charges, transaction costs and gain or loss on asset sales as presented below (in thousands):

Three Months Ended March 31, | |||||||

2020 | 2019 | ||||||

Adjusted EBITDA: | |||||||

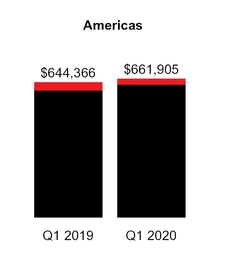

Americas | $ | $ | |||||

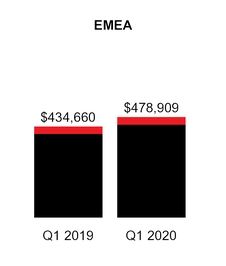

EMEA | |||||||

Asia-Pacific | |||||||

Total adjusted EBITDA | |||||||

Depreciation, amortization and accretion expense | ( | ) | ( | ) | |||

Stock-based compensation expense | ( | ) | ( | ) | |||

Impairment charges | ( | ) | |||||

Transaction costs | ( | ) | ( | ) | |||

Loss on asset sales | ( | ) | |||||

Income from operations | $ | $ | |||||

30

EQUINIX, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

(Unaudited)

The Company also provides the following additional segment disclosures (in thousands):

Three Months Ended March 31, | |||||||

2020 | 2019 | ||||||

Depreciation and amortization: | |||||||

Americas | $ | $ | |||||

EMEA | |||||||

Asia-Pacific | |||||||

Total | $ | $ | |||||

Capital expenditures: | |||||||

Americas | $ | $ | |||||

EMEA | |||||||

Asia-Pacific | |||||||

Total | $ | $ | |||||

The Company's long-lived assets, including property, plant and equipment, net and operating lease right-of-use assets, located in the following geographic areas as of (in thousands):

March 31, 2020 | December 31, 2019 | ||||||

Americas | $ | $ | |||||

EMEA | |||||||

Asia-Pacific | |||||||

Total Property, plant and equipment, net | $ | $ | |||||

Americas | $ | $ | |||||

EMEA | |||||||

Asia-Pacific | |||||||

Total Operating lease right-of-use assets | $ | $ | |||||

31

EQUINIX, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

(Unaudited)

13. Subsequent Events

On April 15, 2020, the Company entered into a credit agreement which provides for senior unsecured 364 -day term loan facilities in an aggregate principal amount of $750.0 million, comprised of $500.0 million available to be borrowed on the closing date (the "Closing Date Facility") and $250.0 million available to be borrowed on or prior to July 14, 2020 (the "Delayed Draw Facility"). On April 15, 2020, Equinix borrowed $391.0 million, as well as €100.0 million or $109.8 million at the exchange rate in effect on that date, under the Closing Date Facility. Borrowings under these term loan facilities must be repaid in full on or prior to April 14, 2021.

On April 18, 2020, the Company entered into an agreement to form a second joint venture in the form of a limited liability partnership with GIC to develop and operate xScale data centers in Asia-Pacific (the “Asia-Pacific Joint Venture”). Upon closing, GIC will contribute cash in exchange for an 80 % partnership interest in the Asia-Pacific Joint Venture. The Company will contribute three development sites in Japan to the Asia-Pacific Joint Venture in exchange for a 20 % partnership interest in the Asia-Pacific Joint Venture and cash proceeds. The completion of the Asia-Pacific Joint Venture is subject to closing conditions.

On May 6, 2020, the Company repaid a total of $250.0 million under the Revolving Facility, which was outstanding as of March 31, 2020. As a result, the amount available to the Company to borrow under the Revolving Facility was approximately $1.9 billion after the repayment.

On May 6, 2020, the Company declared a quarterly cash dividend of $2.66 per share, which is payable on June 17, 2020 to the Company's common stockholders of record as of the close of business on May 20, 2020.

32

Item 2. | Management's Discussion and Analysis of Financial Condition and Results of Operations |

The information in this discussion contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements are based upon current expectations that involve risks and uncertainties. Any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements. For example, the words "believes," "anticipates," "plans," "expects," "intends" and similar expressions are intended to identify forward-looking statements. Our actual results and the timing of certain events may differ significantly from the results discussed in the forward-looking statements. Factors that might cause such a discrepancy include, but are not limited to, those discussed in "Liquidity and Capital Resources" below and "Risk Factors" in Item 1A of Part II of this Quarterly Report on Form 10-Q. All forward-looking statements in this document are based on information available to us as of the date of this Report and we assume no obligation to update any such forward-looking statements.

Our management's discussion and analysis of financial condition and results of operations is intended to assist readers in understanding our financial information from our management's perspective and is presented as follows:

• | Overview |

• | Results of Operations |

• | Non-GAAP Financial Measures |

• | Liquidity and Capital Resources |

• | Contractual Obligations and Off-Balance-Sheet Arrangements |

• | Critical Accounting Policies and Estimates |

• | Recent Accounting Pronouncements |

Overview

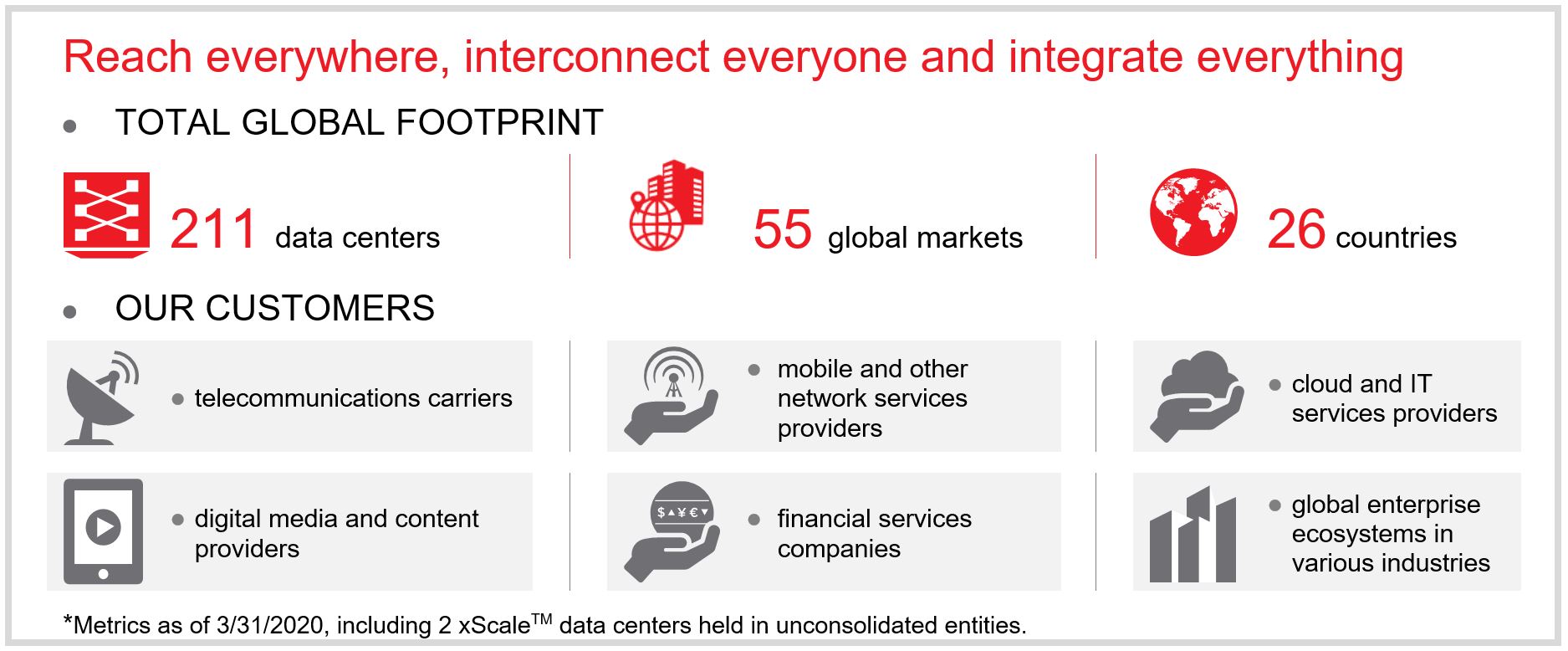

Equinix provides a global, vendor-neutral data center, interconnection and edge services platform with offerings that aim to enable our customers to reach everywhere, interconnect everyone and integrate everything. Global enterprises, service providers and business ecosystems of industry partners rely on Equinix IBX data centers and expertise around the world for the safe housing of their critical IT equipment and to protect and connect the world's most valued information assets. They also look to Platform Equinix® for the ability to directly and securely interconnect to the networks, clouds and content that enable today's information-driven global digital economy. Recent Equinix IBX data center openings and acquisitions, as well as xScale data center investments, have expanded our total global footprint to 211 IBX and xScale data centers across 55 markets around the world. Equinix offers the following solutions:

• | premium data center colocation; |

• | interconnection and data exchange solutions; |

33

• | edge services for deploying networking, security and hardware; and |

• | remote expert support and professional services. |