TERMS AND CONDITIONS OF THE NOTES

The following is the text of the terms and conditions that, save for the words in italics and subject to completion and amendment and as supplemented or varied in accordance with the provisions of the relevant Pricing Supplement, shall be applicable to the Notes in definitive form (if any) issued in exchange for the Global Note(s) or the Global Certificate representing each Series. Either (i) the full text of these terms and conditions together with the relevant provisions of the Pricing Supplement or (ii) these terms and conditions as so completed, amended, supplemented or varied (and subject to simplification by the deletion of non-applicable provisions), shall be endorsed on such Bearer Notes or on the Certificates relating to such Registered Notes.

The Notes are constituted by a Trust Deed (as amended and/or supplemented as at the date of issue of the Notes (the “Issue Date”) [and as supplemented by the Singapore Supplemental Trust Deed (as amended and/or supplemented as at the Issue Date, the “Singapore Supplemental Trust Deed”) dated 28 February 2025]1 and as further amended and/or supplemented from time to time, the “Trust Deed”) dated 28 February 2025 between Equinix Asia Financing Corporation Pte. Ltd. (the “Issuer”), Equinix, Inc. (the “Guarantor”) and DB International Trust (Singapore) Limited (the “Trustee”), which expression shall include all persons for the time being the trustee or trustees under the Trust Deed) as trustee for the Noteholders (as defined below). These terms and conditions of the Notes (the “Conditions”) include summaries of, and are subject to, the detailed provisions of the Trust Deed, which includes the form of the Bearer Notes, Certificates, Receipts, Coupons and Talons referred to below.

An Agency Agreement (as amended and/or supplemented as at the Issue Date and as further amended and/or supplemented from time to time, the “Agency Agreement”) dated 28 February 2025 has been entered into in relation to the U.S.$3,000,000,000 Euro Medium Term Note Programme (the “Programme”) between the Issuer, the Guarantor, the Trustee, Deutsche Bank AG, Hong Kong Branch as initial issuing and paying agent and (where appointed as contemplated in the Agency Agreement) as calculation agent, in respect of each Series (as defined below) of Notes (other than a Series of Notes which are cleared or, as applicable, to be cleared through the computerised system (the “CDP System”) operated by The Central Depository (Pte) Limited (“CDP”) (such Notes, the “CDP Notes”)), Deutsche Bank AG, Singapore Branch as CDP issuing and paying agent, as transfer agent and as registrar, and (where appointed as contemplated in the Agency Agreement) as calculation agent in respect of each Series of CDP Notes, Deutsche Bank AG, Hong Kong Branch as registrar and transfer agent in respect of each Series of Registered Notes other than CDP Notes and the other agents named in it.

The issuing and paying agent, the CDP issuing and paying agent, the paying agents, the registrars, the transfer agents and the calculation agent(s) for the time being (if any) are referred to below respectively as the “Issuing and Paying Agent”, the “CDP Issuing and Paying Agent”, the “Paying Agents” (which expression shall include the Issuing and Paying Agent and the CDP Issuing and Paying Agent), the “Registrars”, the “Transfer Agents” and the “Calculation Agent(s)”.

For the purposes of these Conditions, all references to the “Issuing and Paying Agent” shall with respect to the CDP Notes, be deemed to be references to the CDP Issuing and Paying Agent. Unless the context requires otherwise, all such references shall be construed accordingly. Copies of the Trust Deed and the Agency Agreement are available for inspection (i) during usual business hours (being between 9:00 a.m. and 3:00 p.m., Singapore time) at the principal office of the Trustee (presently at One Raffles Quay, #17-00 South Tower, Singapore 048583) and at the specified offices of the Paying Agents following prior written request and proof of holding and identity satisfactory to the Trustee or, as the case may be, the relevant Paying Agent or (ii) electronically to any requesting Holder, in each case following prior written request and proof of holding and identity to the satisfaction of the Trustee or, as the case may be, the Issuing and Paying Agent.

All references to the “Agents” shall mean the Issuing and Paying Agent, the other Paying Agents, the Calculation Agent(s) (as appointed under the Agency Agreement), the CDP Issuing and Paying Agent, the Registrar(s), the Transfer Agent(s) or any of them and shall include such other Agent or Agents as may be appointed from time to time under the Agency Agreement, and in each case acting solely through their respective specified offices.

1 Include for Notes governed by Singapore law.

Notes may be denominated in Singapore dollars (“Singapore Dollar Notes”) or in other currencies (“Non-Singapore Dollar Notes”). The Noteholders, the holders of the interest coupons (the “Coupons”) relating to interest bearing Notes in bearer form and, where applicable in the case of such Notes, talons for further Coupons (the “Talons”) (the “Couponholders”) and the holders of the receipts for the payment of instalments of principal (the “Receipts”) relating to Notes in bearer form of which the principal is payable in instalments are entitled to the benefit of, are bound by, and are deemed to have notice of all the provisions of the Trust Deed and are deemed to have notice of those provisions applicable to them of the Agency Agreement.

Notes to be held in and cleared through CDP are issued with the benefit of a CDP Deed of Covenant dated 28 February 2025 executed by the Issuer by way of deed poll (as amended, restated or supplemented from time to time, the “CDP Deed of Covenant”).

As used in these Conditions, “Tranche” means Notes which are identical in all respects, and a “Series” means Notes comprising one or more Tranches, whether or not issued on the same date, that (except in respect of the first payment of interest and their issue price) have identical terms on issue and are expressed to have the same series number.

All capitalised terms that are not defined in these Conditions will have the meanings given to them in the Trust Deed and the relevant Pricing Supplement. References in these Conditions to “Notes” are to the Notes of one Series only, not to all Notes that may be issued under the Programme.

1FORM, DENOMINATION AND TITLE

(a)Form: The Notes are issued in bearer form (“Bearer Notes”) or in registered form (“Registered Notes”) in each case in the Specified Denomination(s) shown hereon. Equinix Asia Financing Corporation Pte. Ltd. may issue only Notes in registered form for U.S. federal income tax purposes (and may not issue Notes in bearer form for U.S. federal income tax purposes) if the issuer of the applicable debt for U.S. federal income tax purposes is a “United Statesperson” within the meaning of Section 7701(a)(30) of the U.S. Internal Revenue Code of 1986, as amended (including, for example, if the issuer is for U.S. federal income tax purposes a disregarded entity that is owned by a “United States person”).

This Note is a Fixed Rate Note, a Floating Rate Note, a Zero Coupon Note, an Instalment Note or a Dual Currency Note, a combination of any of the foregoing or any other kind of Note, depending upon the Interest and Redemption/Payment Basis shown hereon.

Bearer Notes are serially numbered and are issued with Coupons (and, where appropriate, a Talon) attached, save in the case of Zero Coupon Notes in which case references to interest (other than in relation to interest due after the Maturity Date), Coupons and Talons in these Conditions are not applicable. Instalment Notes are issued with one or more Receipts attached.

Registered Notes are represented by registered certificates (“Certificates”) and, save as provided in Condition 2(c), each Certificate shall represent the entire holding of Registered Notes by the same holder.

All Registered Notes shall have the same Specified Denomination. Unless otherwise permitted by the then current laws and regulations, Notes which have a maturity of less than one year and in respect of which the issue proceeds are to be accepted by the Issuer in the United Kingdom or whose issue otherwise constitutes a contravention of Section 19 of the Financial Services and Markets Act 2000 will have a minimum denomination of £100,000 (or its equivalent in other currencies).

(b)Title: Title to the Bearer Notes and the Receipts, Coupons and Talons shall pass by delivery. Title to the Registered Notes shall pass by registration in the relevant register that the Issuer shall procure to be kept by the relevant Registrar in accordance with the provisions of the Agency Agreement (each such register, the “Register”). Except as ordered by a court of competent jurisdiction or as required by law, the holder (as defined below) of any Note, Receipt, Coupon or Talon shall be deemed to be and shall be treated as its absolute owner for all purposes whether or not it is overdue and regardless

of any notice of ownership, trust or an interest in it, any writing on it (or on the Certificate representing it) (other than the endorsed form of transfer) or its theft or loss or forgery (or that of the related Certificate) and no person shall be liable for so treating the holder.

In these Conditions, “Noteholder” means the bearer of any Bearer Note and the Receipts relating to it or the person in whose name a Registered Note is registered (as the case may be), “holder” (in relation to a Note, Receipt, Coupon or Talon) means the bearer of any Bearer Note, Receipt, Coupon or Talon or the person in whose name a Registered Note is registered (as the case may be) and capitalised terms have the meanings given to them hereon, the absence of any such meaning indicating that such term is not applicable to the Notes. References in these Conditions to “Coupons”, “Talons”, “Couponholders”, “Receipts” and “Receiptholders” relate to Bearer Notes only.

For so long as any of the Notes are represented by a Global Note or a Global Certificate held on behalf of Euroclear Bank SA/NV (“Euroclear”) and/or Clearstream Banking S.A. (“Clearstream”), or a sub-custodian for CDP, each person (other than Euroclear or Clearstream or CDP) who is for the time being shown in the records of Euroclear, Clearstream or CDP as the holder of a particular principal amount of such Notes (in which regard any certificate, notification, statement or other document issued by Euroclear, Clearstream or CDP as to the principal amount of such Notes standing to the account of any person shall be conclusive and binding for all purposes) shall be treated by the Issuer, the Guarantor, the Trustee and the Agents as the holder of such principal amount of such Notes for all purposes other than with respect to the payment of principal or interest on such principal amount of such Notes, for which purpose the bearer of the relevant Bearer Global Note or the registered holder of the relevant Registered Global Note shall be treated by the Issuer, the Guarantor, the Trustee and any Agent as the holder of such principal amount of such Notes in accordance with and subject to the terms of the relevant Global Note or Global Certificate. The expressions “Noteholder” and “holder of Notes” and related expressions shall be construed accordingly.

2NO EXCHANGE OF NOTES AND TRANSFERS OF REGISTERED NOTES

(a)No Exchange of Notes: Registered Notes may not be exchanged for Bearer Notes. Bearer Notes of one Specified Denomination may not be exchanged for Bearer Notes of another Specified Denomination. Bearer Notes may not be exchanged for Registered Notes.

(b)Transfer of Registered Notes: Subject to the terms of the Agency Agreement and Condition 2(f), one or more Registered Notes may be transferred upon the surrender (at the specified office of the relevant Registrar or any Transfer Agent) of the Certificate representing such Registered Notes to be transferred, together with the form of transfer endorsed on such Certificate, (or another form of transfer substantially in the same form and containing the same representations and certifications (if any), unless otherwise agreed by the Issuer), duly completed and executed and any other evidence as the relevant Registrar or the relevant Transfer Agent may require. In the case of a transfer of part only of a holding of Registered Notes represented by one Certificate, a new Certificate shall be issued to the transferee in respect of the part transferred and a further new Certificate in respect of the balance of the holding not transferred shall be issued to the transferor. All transfers of Notes and entries on the Register will be made subject to the detailed regulations concerning transfers of Notes scheduled to the Agency Agreement. The regulations may be changed by the Issuer, with the prior written approval of the relevant Registrar and the Trustee, or by the relevant Registrar, with the prior approval of the Trustee, which shall be notified to the Issuer as soon as reasonably practicable following such change by the Registrar. A copy of the current regulations will be made available by the relevant Registrar to any Noteholder following prior written request and proof of holding and identity satisfactory to the relevant Registrar.

(c)Exercise of Options or Partial Redemption in Respect of Registered Notes: In the case of an exercise of an Issuer’s or Noteholders’ option in respect of, or a partial redemption of, a holding of Registered Notes represented by a single Certificate, a new Certificate shall be issued to the holder to reflect the exercise of such option or in respect of the balance of the holding not redeemed. In the case of a partial exercise of an option resulting in Registered Notes of the same holding having

different terms, separate Certificates shall be issued in respect of those Notes of that holding that have the same terms. New Certificates shall only be issued against surrender of the existing Certificates to the relevant Registrar or any Transfer Agent. In the case of a transfer of Registered Notes to a person who is already a holder of Registered Notes, a new Certificate representing the enlarged holding shall only be issued against surrender of the Certificate representing the existing holding.

(d)Delivery of New Certificates: Each new Certificate to be issued pursuant to Conditions 2(b) or 2(c) shall be available for delivery within five business days of receipt of the form of transfer or Exercise Notice (as defined in Condition 6(e)) and surrender of the Certificate for transfer, exercise or redemption. Delivery of the new Certificate(s) shall be made at the specified office of the Transfer Agent or of the relevant Registrar (as the case may be) to whom delivery or surrender of such form of transfer, Exercise Notice or Certificate shall have been made or, at the option of the holder making such delivery or surrender as aforesaid and as specified in the relevant form of transfer, Exercise Notice or otherwise in writing, be mailed by uninsured post at the risk of the holder entitled to the new Certificate to such address as may be so specified, unless such holder requests otherwise and pays in advance to the relevant Transfer Agent or the relevant Registrar the costs of such other method of delivery and/or such insurance as it may specify. In this Condition 2(d), “business day” means a day, other than a Saturday, Sunday or public holiday, on which banks are open for business in the place of the specified office of the relevant Transfer Agent or the relevant Registrar (as the case may be).

(e)Transfers Free of Charge: Transfers of Notes and Certificates on registration, transfer, exercise of an option or partial redemption shall be effected without charge by or on behalf of the Issuer, the Registrars or the Transfer Agents, but upon (i) payment by the relevant Noteholder of any tax or other governmental charges that may be imposed in relation to it (or the giving of such indemnity and/or security and/or prefunding as the relevant Registrar or the relevant Transfer Agent (as the case may be) may require);

(ii) the relevant Registrar or the relevant Transfer Agent (as the case may be) being satisfied in its absolute discretion with the documents of title and identity of the person making the application; and (iii) the relevant Registrar or the relevant Transfer Agent (as the case may be) being satisfied in its absolute discretion that the regulations concerning transfer of Notes have been complied with).

(f)Closed Periods: No Noteholder may require the transfer of a Registered Note to be registered:

(i)during the period of 15 days ending on the due date for redemption of, or payment of any Instalment Amount in respect of, that Note;

(ii)during the period of 15 days prior to any date on which the Notes may be called for redemption by the Issuer at its option pursuant to Condition 6(d);

(iii)after any such Note has been called for redemption; or

(iv)during the period of seven days ending on (and including) any Record Date (as defined in Condition 7(b)(ii).

3GUARANTEE AND STATUS

(a)Guarantee: The Guarantor has unconditionally and irrevocably guaranteed the due payment of all sums expressed to be payable by the Issuer under the Trust Deed, the Notes, the Receipts and the Coupons relating to them. Its obligations in that respect (the “Guarantee”) are contained in the Trust Deed.

(b)Status of Notes and Guarantee: The Notes and the Receipts and Coupons relating to them constitute direct, unconditional, unsubordinated and (subject to Condition 4) unsecured obligations of the Issuer and shall at all times rank pari passu and without any preference among themselves. The payment obligations of the Issuer under the Notes and the Receipts and Coupons relating to them and

of the Guarantor under the Guarantee shall, save for such exceptions as may be provided by applicable legislation and subject to Condition 4, at all times rank at least equally with all other unsecured and unsubordinated indebtedness and monetary obligations of the Issuer and the Guarantor respectively, present and future.

4NEGATIVE PLEDGE

So long as any Note remains outstanding (as defined in the Trust Deed), the Issuer and the Guarantor will not, and will not cause or permit any of the Restricted Subsidiaries of the Guarantor to, directly or indirectly, create or permit to subsist any Security of any kind against or upon any property or assets of the Guarantor or any of its Restricted Subsidiaries, whether owned on the Issue Date or acquired after the Issue Date, or any proceeds therefrom, or assign or otherwise convey any right to receive income or profits therefrom, unless:

(a)in the case of Security securing Subordinated Indebtedness, the Notes or the Guarantee is secured by Security on such property, assets or proceeds that is senior in priority to such Security; or

(b)in all other cases, the Notes are secured equally and rateably therewith, except for:

(i)Security existing as of the Issue Date to the extent and in the manner such Security is in effect on the Issue Date;

(ii)Security securing the Obligations of the Issuer and Guarantor and the Obligations of the Restricted Subsidiaries of the Guarantor under any hedge facility;

(iii)Security securing the Notes or the Guarantee;

(iv)Security in favour of the Issuer or the Guarantor or a Wholly Owned Restricted Subsidiary of the Guarantor on assets of any Restricted Subsidiary of the Guarantor; and

(v)Permitted Security; or

(c)at the same time, or prior thereto, the Issuer’s obligations under the Notes, the Receipts, the Coupons and the Trust Deed or, as the case may be, the Guarantor’s obligations under the Guarantee have the benefit of such other security, guarantee, indemnity or other arrangement as the Trustee in its absolute discretion shall deem to be not materially less beneficial to the Noteholders or as shall be approved by an Extraordinary Resolution (as defined in the Trust Deed) of the Noteholders.

With respect to any Security securing Indebtedness that was permitted to secure such Indebtedness at the time of the incurrence of such Indebtedness, such Security shall also be permitted to secure any Increased Amount of such Indebtedness. For the purpose of these Conditions, “Increased Amount” of any Indebtedness shall mean any increase in the amount of such Indebtedness in connection with any accrual of interest, whether payable in cash or in kind, accretion or amortisation of original issue discount, imputed interest, the payment of interest in the form of additional Indebtedness with the same terms or the payment of dividends on Disqualified Capital Stock in the form of additional shares of the same class, and increases in the amount of Indebtedness outstanding solely as a result of fluctuations in the exchange rate of currencies or increases in the value of property securing Indebtedness.

For the purposes of these Conditions, the terms:

“Acquired Indebtedness” means Indebtedness of a Person or any of its Subsidiaries existing at the time such Person becomes a Restricted Subsidiary of the Guarantor or at the time it merges or consolidates with or into the Guarantor or any of its Subsidiaries or that is assumed in connection with the acquisition of assets from such Person, in each case whether or not incurred by such Person in connection with, or in anticipation or contemplation of, such Person becoming a Restricted Subsidiary of the Guarantor or such acquisition, merger or consolidation.

“Affiliate” means, with respect to any specified Person, any other Person who directly or indirectly through one or more intermediaries controls, or is controlled by, or is under common control with, such specified Person. The term “control” means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of a Person, whether through the ownership of voting securities, by contract or otherwise; and the terms “controlling” and “controlled” have meanings correlative of the foregoing.

“Attributable Debt” means, in respect of a Sale and Leaseback Transaction, the present value, discounted at the interest rate implicit in the Sale and Leaseback Transaction, of the

total obligations of the lessee for rental payments during the remaining term of the lease in the Sale and Leaseback Transaction.

“Capital Stock” means:

(a)with respect to any Person that is a corporation, any and all shares, interests, participations or other equivalents (however designated and whether or not voting) of corporate stock, including each class of Common Stock and Preferred Stock of such Person, and all options, warrants or other rights to purchase or acquire any of the foregoing; and

(b)with respect to any Person that is not a corporation, any and all partnership, membership or other equity interests of such Person, and all options, warrants or other rights to purchase or acquire any of the foregoing.

“Cash Equivalent” means:

(a)debt securities to be issued or directly and fully guaranteed or insured by any government as applicable, where the debt securities have not more than twelve months to final maturity and are not convertible into any other form of security;

(b)commercial paper maturing no more than one year from the date of creation thereof and, at the time of acquisition, having a rating of at least P1 from Moody’s and A1 from S&P;

(c)certificates of deposit having not more than twelve months to maturity issued by a bank or financial institution incorporated or having a branch in a Participating Member State in the United Kingdom or the United States, provided that the bank is rated P1 by Moody’s or A1 by S&P;

(d)any cash deposit with any commercial bank or other financial institution, in each case whose long term unsecured, unsubordinated debt rating is at least A3 by Moody’s or A- by S&P;

(e)repurchase obligations with a term of not more than seven days for underlying securities of the types described in clause (a) above entered into with any bank or financial institution meeting the qualifications specified in clause (d) above; and

(f)investments in money market funds which invest substantially all their assets in securities of the types described in clauses (a) through (e) above.

“Common Stock” of any Person means any and all shares, interests or other participations in, and other equivalents (however designated and whether voting or non-voting) of such Person’s common stock and includes, without limitation, all series and classes of such common stock.

“Currency Agreement” means any foreign exchange contract, currency swap agreement or other similar agreement or arrangement designed to protect the Guarantor or any Restricted Subsidiary of the Guarantor against fluctuations in currency values.

“Designated Revolving Commitments” means the amount or amounts of any commitments to make loans or extend credit on a revolving basis to the Guarantor or any of its Restricted Subsidiaries by any Person

other than the Guarantor or any of its Restricted Subsidiaries that has or have been designated (but only to the extent so designated) in an officers’ certificate delivered to the Trustee as “Designated Revolving Commitments” until such time as the

Obligors subsequently deliver an officers’ certificate to the Trustee to the effect that the amount or amounts of such commitments shall no longer constitute “Designated Revolving Commitments”.

“Disqualified Capital Stock” meansthat portion of any Capital Stock which, by itsterms(or by the terms of any security into which it is convertible or for which it is exchangeable at the option of the holder thereof), or upon the happening of any event, matures or is mandatorily redeemable pursuant to a sinking fund obligation or otherwise, or is redeemable at the sole option of the holder thereof, in each case, on or prior to the final maturity date of the Notes.

“Domestic Restricted Subsidiary” means a Restricted Subsidiary incorporated or otherwise organised under the laws of the United States, any State thereof or the District of Columbia.

“Finance Lease Obligation” means, as to any Person, the obligations of such Person under a lease that are required to be classified and accounted for as finance lease obligations under GAAP and, for purposes of this definition, the amount of such obligations at any date shall be the capitalised amount of such obligations at such date, determined in accordance with GAAP.

“GAAP” means generally accepted accounting principles set forth in the statements and pronouncements of the Financial Accounting Standards Board or in such other statements by such other entity as may be approved by a significant segment of the accounting profession of the United States, which are in effect as of 11 July 2011.

“Indebtedness” means with respect to any Person, without duplication:

(a)all Obligations of such Person for borrowed money;

(b)all Obligations of such Person evidenced by bonds, debentures, notes or other similar instruments;

(c)all Finance Lease Obligations and all Attributable Debt of such Person;

(d)all Obligations of such Person issued or assumed as the deferred purchase price of property, all conditional sale obligations and all Obligations under any title retention agreement (but excluding (i) trade accounts payable and other accrued liabilities arising in the ordinary course of business that are not overdue by 120 days or more or are being contested in good faith by appropriate proceedings promptly instituted and diligently conducted and (ii) any earn-out obligation until such obligation becomes a liability on the balance sheet of such Person in accordance with GAAP);

(e)all Obligations for the reimbursement of any obligor on any letter of credit, banker’s acceptance or similar credit transaction (other than obligations with respect to letters of credit (i) securing Obligations (other than Obligations described in (a)-(d) above) entered into the ordinary course of business of such Person to the extent such letters of credit are not drawn upon or, if and to the extent drawn upon, such drawing is reimbursed no later than the fifth Business Day following receipt by such Person of a demand for reimbursement following payment on the letter of credit) or (ii) that are otherwise cash collateralised;

(f)guarantees and other contingent obligations in respect of Indebtedness referred to in paragraphs (a) through (e) above and paragraph (h) below;

(g)all Obligations of any other Person of the type referred to in paragraphs (a) through (f) that are secured by any Security on any property or asset of such Person, the amount of

such Obligation being deemed to be the lesser of the fair market value of such property or asset or the amount of the Obligation so secured;

(h)all Obligations under Currency Agreements and Interest Swap Obligations of such Person;

(i)all Disqualified Capital Stock issued by such Person or Preferred Stock issued by such Person’s non-Domestic Restricted Subsidiaries with the amount of Indebtedness represented by such Disqualified Capital Stock or Preferred Stock being equal to the greater of its voluntary or involuntary liquidation preference and its maximum fixed repurchase price, but excluding accrued dividends, if any; and

(j)the aggregate amount of Designated Revolving Commitments in effect on such date.

“Interest Swap Obligations” means the obligations of any Person pursuant to any arrangement with any other Person, whereby, directly or indirectly, such Person is entitled to receive from time to time periodic payments calculated by applying either a floating or a fixed rate of interest on a stated notional amount in exchange for periodic payments made by such other Person calculated by applying a fixed or a floating rate of interest on the same notional amount and shall include, without limitation, interest rate swaps, caps, floors, collars and similar agreements.

“Material Subsidiary” means a “significant subsidiary” as defined in Rule 1-02(w) of Regulation S-X under the U.S. Securities Act of 1933, as amended.

“Moody’s” means Moody’s Investors Service, Inc., or any successor to the rating agency business thereof.

“Obligations” means all obligations for principal, premium, interest, penalties, fees, indemnifications, reimbursements, damages and other liabilities payable under the documentation governing any Indebtedness.

“Participating Member State” means each state, so described in any European Monetary Union legislation, which was a participating member state on 31 December 2003.

“Permitted Security” means the following types of security:

(a)Security for taxes, assessments or governmental charges or claims either (i) not delinquent or (ii) contested in good faith by appropriate proceedings and as to which the Guarantor or its Restricted Subsidiaries shall have set aside on its books such reserves as may be required pursuant to GAAP;

(b)statutory Security of landlords and Security of carriers, warehousemen, mechanics, suppliers, material men, repairmen and other Security imposed by law incurred in the ordinary course of business for sums not yet delinquent or being contested in good faith, if such reserve or other appropriate provision, if any, as shall be required by GAAP shall have been made in respect thereof;

(c)Security incurred or deposits made in the ordinary course of business in connection with workers’ compensation, unemployment insurance and other types of social security, including any Security securing letters of credit issued in the ordinary course of business consistent with past practice in connection therewith, or to secure the performance of tenders, statutory obligations, surety and appeal bonds, bids, leases, government contracts, performance and return-of-money bonds and other similar obligations (exclusive of obligations for the payment of borrowed money);

(d)judgment Security not giving rise to an Event of Default so long as such Security is adequately bonded and any appropriate legal proceedings which may have been duly initiated for the review of such judgment shall not have been finally terminated or the period within which such proceedings may be initiated shall not have expired;

(e)easements, rights-of-way, zoning restrictions and other similar charges or encumbrances in respect of real property not interfering in any material respect with the ordinary conduct of the business of the Guarantor or any of its Restricted Subsidiaries;

(f)any interest or title of a lessor under any Finance Lease Obligation; provided that such Security does not extend to any property or assets which is not leased property subject to such Finance Lease

Obligation (other than other property that is subject to a separate lease from such lessor or any of its Affiliates);

(g)Security securing Purchase Money Indebtedness incurred in the ordinary course of business; provided that (i) such Purchase Money Indebtedness shall not exceed the purchase price or other cost of such property or equipment and shall not be secured by any property or equipment of the Guarantor or any Restricted Subsidiary of the Guarantor other than the property and equipment so acquired or other property that was acquired from such seller or any of its Affiliates with the proceeds of Purchase Money Indebtedness and (ii) the Security securing such Purchase Money Indebtedness shall be created within 360 days of such acquisition;

(h)Security upon specific items of inventory or other goods and proceeds of any Person securing such Person’s obligations in respect of bankers’ acceptances issued or created for the account of such Person to facilitate the purchase, shipment or storage of such inventory or other goods;

(i)Security securing reimbursement obligations with respect to commercial letters of credit which encumber documents and other property relating to such letters of credit and products and proceeds thereof;

(j)Security securing Interest Swap Obligations;

(k)Security securing Indebtedness under Currency Agreements;

(l)Security securing Acquired Indebtedness; provided that:

(i)such Security secured such Acquired Indebtedness at the time of and prior to the incurrence of such Acquired Indebtedness by the Guarantor or a Restricted Subsidiary of the Guarantor and were not granted in connection with, or in anticipation of, the incurrence of such Acquired Indebtedness by the Guarantor or a Restricted Subsidiary of the Guarantor; and

(ii)such Security do not extend to or cover any property or assets of the Guarantor or of any of its Restricted Subsidiaries other than the property or assets that secured the Acquired Indebtedness prior to the time such Indebtedness became Acquired Indebtedness of the Guarantor or a Restricted Subsidiary of the Guarantor and are no more favourable to the lienholders than those securing the Acquired Indebtedness prior to the incurrence of such Acquired Indebtedness by the Guarantor or a Restricted Subsidiary of the Guarantor;

(m)Security on assets of a Restricted Subsidiary of the Guarantor;

(n)leases, subleases, licenses and sublicenses granted to others that do not materially interfere with the ordinary course of business of the Guarantor and its Restricted Subsidiaries;

(o)banker’s Security, rights of setoff and similar Security with respect to cash and Cash Equivalents on deposit in one or more bank accounts in the ordinary course of business;

(p)Security arising from filing Uniform Commercial Code financing statements regarding leases;

(q)Security in favour of customs and revenue authorities arising as a matter of law to secure payments of customs duties in connection with the importation of goods;

(r)Security (i) on inventory held by and granted to a local distribution company in the ordinary course of business and (ii) in accounts purchased and collected by and granted to a local distribution company that has agreed to make payments to the Guarantor or any of its Restricted Subsidiaries for such amounts in the ordinary course of business;

(s)Security securing Indebtedness in respect of Sale and Leaseback Transactions;

(t)Security securing Indebtedness in respect of mortgage financings; and

(u)Securitywith respect to obligations (including Indebtedness) of the Guarantor or any of its Restricted Subsidiaries otherwise permitted under the applicable Indenture that do not exceed an amount equal to (x) 3.5 times (y) the Consolidated EBITDA of the Guarantor for the Four Quarter Period to and including the most recent fiscal quarter for which financial statements are internally available immediately preceding such date.

“Person” means an individual, partnership, corporation, limited liability company, unincorporated organisation, trust or joint venture, or a governmental agency or political subdivision thereof.

“Preferred Stock” of any Person meansany Capital Stock of such Person that haspreferential rights to any other Capital Stock of such Person with respect to dividends or redemptions or upon liquidation.

“Purchase Money Indebtedness” means Indebtedness of the Guarantor and its Restricted Subsidiaries incurred in the normal course of business for the purpose of financing all or any part of the purchase price, or the cost of installation, construction or improvement, of property or equipment.

“Restricted Subsidiary” of any Person meansany Subsidiary of such Person which at the time of determination is not an Unrestricted Subsidiary.

“S&P” means Standard & Poor’s Ratings Group, Inc., or any successor to the rating agency business thereof.

“Sale and Leaseback Transactions” means any direct or indirect arrangement with any Person or to which any such Person is a party, providing for the leasing to the Guarantor or a Restricted Subsidiary of any property, whether owned by the Guarantor or any Restricted Subsidiary at the Issue Date or later acquired, which has been or is to be sold or transferred by the Guarantor or such Restricted Subsidiary to such Person or to any other Person from whom funds have been or are to be advanced by such Person on the security of such property.

“Security” means any lien, mortgage, deed of trust, pledge, security interest, charge or encumbrance of any kind (including any conditional sale or other title retention agreement, any lease in the nature thereof and any agreement to give any security interest); provided that, in any event and not in limitation of the foregoing, a lease shall not be deemed to be a Security if such lease is classified as an operating lease under GAAP.

“Subordinated Indebtedness” means Indebtedness of the Issuer or the Guarantor that is subordinated or junior in right of payment to the Notes or the Guarantee, respectively.

“Subsidiary” with respect to any Person, means:

(a)any corporation of which the outstanding Capital Stock having at least a majority of the votes entitled to be cast in the election of directors under ordinary circumstances shall at the time be owned, directly or indirectly, by such Person; or

(b)any other Person of which at least a majority of the voting interest under ordinary circumstances is at the time, directly or indirectly, owned by such Person.

“Wholly Owned Restricted Subsidiary” means a Restricted Subsidiary, all of the Capital Stock of which (other than directors’ qualifying shares) is owned by the Guarantor or another Wholly Owned Restricted Subsidiary.

“Unrestricted Subsidiary” of any Person means:

(a)any Subsidiary of such Person that at the time of determination shall be or continue to be designated an Unrestricted Subsidiary by the Board of Directors of such Person in the manner provided below; and

(b)any Subsidiary of an Unrestricted Subsidiary.

The Board of Directors of the Guarantor may designate any Subsidiary (including any newly acquired or newly formed Subsidiary) to be an Unrestricted Subsidiary unless such Subsidiary owns any Capital Stock of, or owns or holds any Security on any property of, the Guarantor or any other Subsidiary of the Guarantor that is not a Subsidiary of the Subsidiary to be so designated; provided that each Subsidiary to be so designated and each of its Subsidiaries has not at the time of designation, and does not thereafter, create, incur, issue, assume, guarantee or otherwise become directly or indirectly liable with respect to any Indebtedness pursuant to which the lender has recourse to any of the assets of the Guarantor or any of its Restricted Subsidiaries.

The Board of Directors may designate any Unrestricted Subsidiary to be a Restricted Subsidiary only if, immediately before and immediately after giving effect to such designation, no Default or Event of Default shall have occurred and be continuing. Any such designation by the Board of Directors shall be evidenced to the Trustee by promptly filing with the Trustee a copy of the Board Resolution giving effect to such designation and an officers’ certificate certifying that such designation complied with the foregoing provisions.

5INTEREST AND OTHER CALCULATIONS

The amount payable in respect of the aggregate principal amount of Notes represented by a Global Certificate or a Global Note (as the case may be) shall be made in accordance with the methods of calculation provided for in the Conditions and the applicable Pricing Supplement, save that the calculation is made in respect of the total aggregate amount of the Notes represented by a Global Certificate or a Global Note (as the case may be), together with such other sums and additional amounts(if any) as may be payable under the Conditions.

(a)Interest on Fixed Rate Notes: Each Fixed Rate Note bears interest on its outstanding principal amount from the Interest Commencement Date at the rate per annum (expressed as a percentage) equal to the Rate of Interest, such interest being payable in arrear on each Interest Payment Date. The amount of interest payable shall be determined in accordance with Condition 5(h).

(b)Interest on Floating Rate Notes (for Non-Singapore Dollar Notes only): This Condition 5(b) applies in respect of Floating Rate Notes which are Non-Singapore Dollar Notes:

(i)Interest Payment Dates: Each Floating Rate Note which is a Non-Singapore Dollar Note bears interest on its outstanding principal amount from the Interest Commencement Date at the rate per annum (expressed as a percentage) equal to the Rate of Interest, such interest being payable in arrear on each Interest Payment Date unless SORA Payment Delay is specified in the applicable Pricing Supplement, in which case interest will be payable in arrear on the specified business day as set out in the applicable Pricing Supplement following each Interest Payment Date. The amount of interest payable shall be determined in accordance with Condition 5(h). Such Interest Payment Date(s) is/are either shown hereon as Specified Interest Payment Dates or, if no Specified Interest Payment Date(s) is/are shown hereon, Interest Payment Date shall mean each date which falls the number of months or other period shown hereon as the Interest Period after the preceding Interest Payment Date or, in the case of the first Interest Payment Date, after the Interest Commencement Date.

(ii)Business Day Convention: If any date referred to in these Conditions that is specified to be subject to adjustment in accordance with a Business Day Convention would otherwise fall on a day that is not a Business Day, then, if the Business Day Convention specified is:

(A)the Floating Rate Business Day Convention, such date shall be postponed to the next day that is a Business Day unless it would thereby fall into the next calendar month, in which event:

(x)such date shall be brought forward to the immediately preceding Business Day; and

(y)each subsequent such date shall be the last Business Day of the month in which such date would have fallen had it not been subject to adjustment;

(B)the Following Business Day Convention, such date shall be postponed to the next day that is a Business Day;

(C)the Modified Following Business Day Convention, such date shall be postponed to the next day that is a Business Day unless it would thereby fall into the next calendar month, in which event such date shall be brought forward to the immediately preceding Business Day; or

(D)the Preceding Business Day Convention, such date shall be brought forward to the immediately preceding Business Day.

(iii)Rate of Interest for Floating Rate Notes which are Non-Singapore Dollar Notes: The Rate of Interest in respect of Floating Rate Notes which are Non-Singapore Dollar Notes for each Interest Accrual Period shall be determined in the manner specified hereon and the provisions below relating to either ISDA Determination or Screen Rate Determination shall apply, depending upon which is specified hereon.

(A)ISDA Determination for Floating Rate Notes

Where ISDA Determination is specified hereon as the manner in which the Rate of Interest is to be determined, the Rate of Interest for each Interest Accrual Period shall be determined by the Calculation Agent as a rate equal to the relevant ISDA Rate and notified to the relevant Paying Agent. For the purposes of this Condition 5(b)(iii)(A), “ISDA Rate” for an Interest Accrual Period means a rate equal to the Floating Rate that would be determined by the Calculation Agent (as defined in the ISDA Definitions) under a Swap Transaction under the terms of an agreement incorporating the ISDA Definitions and under which:

(x)the Floating Rate Option is as specified hereon;

(y)the Designated Maturity is a period specified hereon;

(z)the relevant Reset Date is the first day of that Interest Accrual Period unless otherwise specified hereon;

(aa) the Overnight Rate Compounding Method and the applicable number of business days for Lookback, Observation Period Shift, or Lockout as specified hereon; and

(bb) (1) Administrator/Benchmark Event shall be disapplied; and

(2) if the Temporary Non-Publication Fallback for any specified Floating Rate Option is specified to be “Temporary Non-Publication Fallback – Alternative Rate” in the Floating Rate Matrix of the 2021 ISDA Definitions, the reference to “Calculation Agent Alternative Rate Determination” in the definition of “Temporary Non-Publication Fallback – Alternative Rate” shall be replaced by “Temporary Non-Publication Fallback – Previous Day’s Rate”.

For the purposes of this Condition 5(b)(iii)(A), “Floating Rate”, “Calculation Agent”, “Floating Rate Option”, “Designated Maturity”, “Overnight Rate Compounding Method”, “Lookback”, “Observation Period Shift”, “Lockout”, “Reset Date”, “Swap Transaction”, “Administrator/Benchmark Event” and “Temporary Non-Publication Fallback” have the meanings given to those terms in the ISDA Definitions.

(B)Screen Rate Determination for Floating Rate Notes where the Reference Rate is not specified as being SOFR Benchmark

(x)Where Screen Rate Determination is specified hereon as the manner in which the Rate of Interest is to be determined, the Rate of Interest for each Interest Accrual Period will, subject as provided below, be either:

(1)the offered quotation; or

(2)the arithmetic mean (rounded up, if necessary, to the nearest 5 decimal places) of the offered quotations,

(expressed as a percentage rate per annum) for the Reference Rate which appears or appear, as the case may be, on the Relevant Screen Page as at either 11:00 a.m. (Brussels time in the case of EURIBOR) on the Interest Determination Date in question as determined by the Calculation Agent. If five or more of such offered quotations are available on the Relevant Screen Page, the highest (or, if there is more than one such highest quotation, one only of such quotations) and the lowest (or, if there is more than one such lowest quotation, one only of such quotations) shall be disregarded by the Calculation Agent for the purpose of determining the arithmetic mean of such offered quotations.

If the Reference Rate from time to time in respect of Floating Rate Notes is specified hereon as being other than EURIBOR, the Rate of Interest in respect of such Notes will be determined as provided hereon;

(y)if the Relevant Screen Page is not available, or if sub-paragraph (x)(1) of Condition 5(b)(iii)(B) applies and no such offered quotation appears on the Relevant Screen Page or if sub-paragraph (x)(2) of Condition 5(b)(iii)(B) applies and fewer than three such offered quotations appear on the Relevant Screen Page in each case as at the time specified above, subject as provided below, the Issuer (or an Independent Adviser (as defined below in this Condition 5(b) appointed by it) shall request, if the Reference Rate is EURIBOR, the principal Euro-zone office of each of the Reference Banks, to provide the Issuer (or the Independent Adviser appointed by it) with its offered quotation (expressed as a percentage rate per annum) for the Reference Rate if the Reference Rate is EURIBOR, at approximately 11:00 a.m. (Brussels time) on the Interest Determination Date in question. If two or more of the Reference Banks provide the Issuer (or the Independent Adviser appointed by it) with such offered quotations, the Rate of Interest for such Interest Accrual Period shall be the arithmetic mean of such offered quotations as notified by the Issuer to, and as determined by, the Calculation Agent; and

(z)if sub-paragraph (y) of Condition 5(b)(iii)(B) applies and the Issuer (or the Independent Adviser appointed by it) determines that fewer than two Reference Banks are providing offered quotations, then, subject as provided below, the Rate of Interest shall be the arithmetic mean of the rates per annum (expressed as a percentage) as communicated to (and at the request of) the Issuer (or the Independent Adviser appointed by it) by the Reference Banks or any two or more of them, at which such banks were offered, if the Reference Rate is

EURIBOR, at approximately 11:00 a.m. (Brussels time) on the relevant Interest Determination Date, deposits in the Specified Currency for a period equal to that

which would have been used for the Reference Rate by leading banks in, if the Reference Rate is EURIBOR, the Euro-zone interbank market, as the case may be, or, if fewer than two of the Reference Banks provide the Issuer (or the Independent Adviser appointed by it) with such offered rates, the offered rate for deposits in the Specified Currency for a period equal to that which would have been used for the Reference Rate, or the arithmetic mean of the offered rates for deposits in the Specified Currency for a period equal to that which would have been used for the Reference Rate, at which, if the Reference Rate is EURIBOR, at approximately 11:00 a.m. (Brussels time), on the relevant Interest Determination Date, any one or more banks (which bank or banks is or are in the opinion of the Issuer suitable for such purpose) informs the Issuer (or the Independent Adviser appointed by it) it is quoting to leading banks in, if the Reference Rate is EURIBOR, the Euro-zone inter-bank market, as the case may be, provided that, if the Rate of Interest cannot be determined in accordance with the foregoing provisions of this Condition 5(b)(iii)(B), the Rate of Interest shall be determined as at the last preceding Interest Determination Date (though substituting, where a different Margin or Maximum Rate of Interest or Minimum Rate of Interest is to be applied to the relevant Interest Accrual Period from that which applied to the last preceding Interest Accrual Period, the Margin or Maximum Rate of Interest or Minimum Rate of Interest relating to the relevant Interest Accrual Period, in place of the Margin or Maximum Rate of Interest or Minimum Rate of Interest relating to that last preceding Interest Accrual Period).

(C)Screen Rate Determination for Floating Rate Notes where the Reference Rate is specified as being SOFR Benchmark

Where Screen Rate Determination is specified hereon as the manner in which the Rate of Interest is to be determined where the Reference Rate is SOFR Benchmark, the Rate of Interest for each Interest Accrual Period will, subject as provided below, be equal to the relevant SOFR Benchmark plus or minus the Margin (if any) in accordance with Condition 5(g), all as determined by he Calculation Agent on the relevant Interest Determination Date.

The “SOFR Benchmark” will be determined based on Compounded Daily SOFR or SOFR Index, as follows (subject in each case to Condition 5(l)):

(x)If Compounded Daily SOFR (“Compounded Daily SOFR”) is specified hereon as the manner in which the SOFR Benchmark will be determined, the SOFR Benchmark for each Interest Accrual Period shall be equal to the compounded average of daily SOFR reference rates for each day during the relevant Interest Accrual Period (where SOFR Lookback is specified as applicable hereon to determine Compounded Daily SOFR) or the SOFR Observation Period (where SOFR Observation Shift is specified as applicable hereon to determine Compounded Daily SOFR).

Compounded Daily SOFR shall be calculated by the Calculation Agent in accordance with one of the formulas referenced below depending upon which is specified as applicable in the applicable Pricing Supplement:

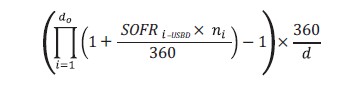

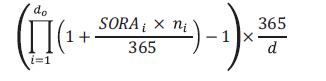

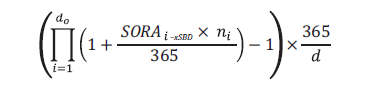

(I)SOFR Lookback:

with the resulting percentage being rounded, if necessary, to the nearest one hundred-thousandth of a percentage point, with 0.000005 per cent. being rounded upwards (e.g., 9.876541 per cent. (or 0.09876541) being rounded down to 9.87654 per cent. (or 0.0987654) and 9.876545 per cent. (or 0.09876545) being rounded up to 9.87655 per cent. (or 0.0987655) and where:

“d” means the number of calendar days in the relevant Interest Accrual Period;

“do” means the number of U.S. Government Securities Business Days in the relevant Interest Accrual Period;

“i” means a series of whole numbers ascending from one to do representing each relevant U.S. Government Securities Business Day from (and including) the first U.S. Government Securities Business Day in the relevant Interest Accrual Period (each a “U.S. Government Securities Business Day(i)”);

“Lookback Days” means five U.S. Government Securities Business Days (or such other larger number of U.S. Government Securities Business Days as specified in the applicable Pricing Supplement);

“ni”, for any U.S. Government Securities Business Day(i), means the number of calendar days from (and including) such U.S. Government Securities Business Day(i) up to (but excluding) the following U.S. Government Securities Business Day(i); and

“SOFRi-xUSBD” for any U.S. Government Securities Business Day(i) in the relevant Interest Accrual Period, is equal to the SOFR reference rate for the U.S. Government Securities Business Day falling the number of Lookback Days prior to that U.S. Government Securities Business Day(i).

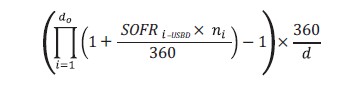

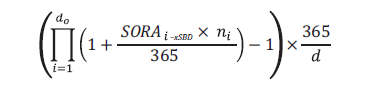

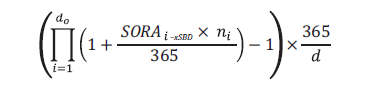

(II) SOFR Observation Shift:

with the resulting percentage being rounded, if necessary, to the nearest one hundred-thousandth of a percentage point, with 0.000005 per cent. being rounded upwards (e.g., 9.876541 per cent. (or 0.09876541) being rounded down to 9.87654 per cent. (or 0.0987654) and 9.876545 per cent. (or 0.09876545) being rounded up to 9.87655 per cent. (or 0.0987655) and where:

“d” means the number of calendar days in the relevant SOFR Observation Period;

“do” means the number of U.S. Government Securities Business Days in the relevant SOFR Observation Period;

“i” means a series of whole numbers ascending from one to do, representing each U.S. Government Securities Business Day from (and including) the first U.S. Government Securities Business Day in the relevant SOFR Observation Period (each a “U.S. Government Securities Business Day(i)”);

“ni”, for any U.S. Government Securities Business Day(i), means the number of calendar days from (and including) such U.S. Government Securities

Business Day(i) up to (but excluding) the following U.S. Government Securities Business Day(i);

“SOFRi” for any U.S. Government Securities Business Day(i) in the relevant SOFR Observation Period, is equal to the SOFR reference rate for that U.S. Government Securities Business Day(i);

“SOFR Observation Period” means, in respect of an Interest Accrual Period, the period from (and including) the date falling the number of SOFR Observation Shift Days prior to the first day of such Interest Accrual Period to (but excluding) the date falling the number of SOFR Observation Shift Days prior to the Interest Period Date for such Interest Accrual Period; and

“SOFR Observation Shift Days” means five U.S. Government Securities Business Days (or such other larger number of U.S. Government Securities Business Days as specified in the applicable Pricing Supplement).

The following defined terms shall have the meanings set out below for purpose of this Condition 5(b)(iii)(C)(x):

“Bloomberg Screen SOFRRATE Page” means the Bloomberg screen designated “SOFRRATE” or any successor page or service;

“Reuters Page USDSOFR=” means the Reuters page designated “USDSOFR=” or any successor page or service;

“SOFR” means, in respect of a U.S. Government Securities Business Day, the reference rate determined by the Calculation Agent in accordance with the following provision:

(i)the Secured Overnight Financing Rate published at the SOFR Determination Time as such reference rate is reported on the Bloomberg Screen SOFRRATE Page; the Secured Overnight Financing Rate published at the SOFR Determination Time as such reference rate is reported on the Reuters Page USDSOFR=; or the Secured Overnight Financing Rate published at the SOFR Determination Time on the SOFR Administrator’s Website;

(ii)if the reference rate specified in (i) above does not appear and a SOFR Benchmark Transition Event and its related SOFR Benchmark Replacement Date have not occurred, the SOFR reference rate shall be the reference rate published on the SOFR Administrator’s Website for the first preceding U.S. Government Securities Business Day for which SOFR was published on the SOFR Administrator’s Website; or

(iii)if the reference rate specified in (i) above does not appear and a SOFR Benchmark Transition Event and its related SOFR Benchmark Replacement Date have occurred, the provisions set forth in Condition 5(l)(ii) shall apply as specified hereon;

“SOFR Rate Cut-Off Date” means the date that is five U.S. Government Securities Business Days (or such other larger number of U.S. Government Securities Business Days as specified in the applicable Pricing Supplement) prior to the end of the relevant Interest Accrual Period, the Maturity Date or the relevant Optional Redemption Date, as applicable; and

“SOFR Determination Time” means approximately 3:00 p.m. (New York City time) on the immediately following U.S. Government Securities Business Day.

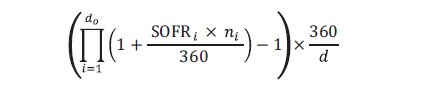

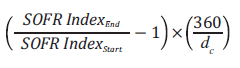

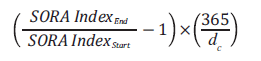

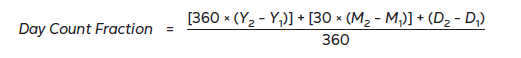

(y)If SOFR Index (“SOFR Index”) is specified as applicable hereon, the SOFR Benchmark for each Interest Accrual Period shall be equal to the compounded average of daily SOFR reference rates for each day during the relevant SOFR Observation Period as calculated by the Calculation Agent as follows:

with the resulting percentage being rounded, if necessary, to the nearest one hundred-thousandth of a percentage point, with 0.000005 per cent. being rounded upwards (e.g., 9.876541 per cent. (or 0.09876541) being rounded down to 9.87654 per cent. (or 0.0987654) and 9.876545 per cent. (or 0.09876545) being rounded up to 9.87655 per cent. (or 0.0987655) and where:

“SOFR Index” means, in respect of a U.S. Government Securities Business Day, the SOFR Index value as published on the SOFR Administrator’s Website at the SOFR Index Determination Time on such U.S. Government Securities Business Day, provided that:

(I)if the value specified above does not appear and a SOFR Benchmark Transition Event and its related SOFR Benchmark Replacement Date have not occurred, the “SOFR Index” shall be calculated on any Interest Determination Date with respect to an Interest Accrual Period, in accordance with the Compounded Daily SOFR formula described above in Condition 5(b)(iii)(C)(x)(II) “SOFR Observation Shift”, and the term “SOFR Observation Shift Days” shall mean five U.S.

Government Securities Business Days; or

(II)if the value specified above does not appear and a SOFR Benchmark Transition Event and its related SOFR Benchmark Replacement Date have occurred, the provisions set forth in Condition 5(l)(ii) shall apply;

“SOFR IndexEnd” means, in respect of an Interest Accrual Period, the SOFR Index value on the date that is five U.S. Government Securities Business Days (or such other larger number of U.S. Government Securities Business Days as specified in the applicable Pricing Supplement) prior to the Interest Period Date for such Interest Accrual Period (or in the final Interest Accrual Period, the Maturity Date);

“SOFR IndexStart” means, in respect of an Interest Accrual Period, the SOFR Index value on the date that is five U.S. Government Securities Business Days (or such other larger number of U.S. Government Securities Business Days as specified in the applicable Pricing Supplement) prior to the first day of such Interest Accrual Period;

“SOFR Index Determination Time” means, in respect of a U.S. Government Securities Business Day, approximately 3:00 p.m. (New York City time) on such U.S. Government Securities Business Day;

“SOFR Observation Period” means, in respect of an Interest Accrual Period, the period from (and including) the date falling the number of SOFR Observation Shift Days prior to the first day of such Interest Accrual Period

to (but excluding) the date falling the number of SOFR Observation Shift Days prior to the Interest Period Date for such Interest Accrual Period;

“SOFR Observation Shift Days” means five U.S. Government Securities Business Days (or such other larger number of U.S. Government Securities Business Days as specified in the applicable Pricing Supplement); and

“dc” means the number of calendar days in the applicable SOFR Observation Period.

The following defined terms shall have the meanings set out below for purpose of this Condition 5(b)(iii)(C)(y):

“Interest Determination Date” means, with respect to a Rate of Interest and Interest Accrual Period, the date specified as such hereon or, if none is so specified, where SOFR Benchmark is specified hereon as the Reference Rate and where SOFR Observation Shift is specified in the applicable Pricing Supplement to determine Compounded Daily SOFR or where SOFR Index is specified as applicable hereon, the fifth U.S. Government Securities Business Day prior to the last day of each Interest Accrual Period;

“SOFR Administrator’s Website” means the website of the Federal Reserve Bank of New York, or any successor source;

“SOFR Benchmark Replacement Date” means the date of occurrence of a Benchmark Event with respect to the then-current SOFR Benchmark;

“SOFR Benchmark Transition Event” means the occurrence of a Benchmark Event with respect to the then-current SOFR Benchmark; and

“U.S. Government Securities Business Day” means any day except for a Saturday, a Sunday or a day on which the Securities Industry and Financial Markets Association recommends that the fixed income departments of its members be closed for the entire day for purposes of trading in U.S. government securities.

(iv)Independent Adviser. For the purposes of this Condition 5(b) and Condition 5(c), “Independent Adviser” means an independent financial institution of good repute or an independent financial adviser with appropriate expertise (which shall not be the Calculation Agent) appointed by (and at the expense of) the Issuer for the purposes of this Condition 5(b) or Condition 5(c) and notified in writing by the Issuer to the Calculation Agent and the Trustee.

(c)Interest on Floating Rate Notes (for Singapore Dollar Notes only): This Condition 5(c) applies in respect of Floating Rate Notes which are Singapore Dollar Notes:

(i)Interest Payment Dates: Each Floating Rate Note which is a Singapore Dollar Note bears interest on its outstanding principal amount from the Interest Commencement Date at the rate per annum (expressed as a percentage) equal to the Rate of Interest, such interest being payable in arrear on each Interest Payment Date unless SORA Payment Delay is specified in the applicable Pricing Supplement, in which case interest will be payable in arrear on the specified business day as set out in the applicable Pricing Supplement following each Interest Payment Date. Such Interest Payment Date(s) is/are either shown hereon as Specified Interest Payment Dates or, if no Specified Interest Payment Date(s) is/are shown hereon, Interest Payment Date shall mean each date which falls the number of months or other period specified hereon as the Interest Period after the preceding Interest Payment Date or, in the case of the first Interest Payment Date, after the Interest Commencement Date.

(ii)Business Day Convention: If any date referred to in these Conditions that is specified to be subject to adjustment in accordance with a Business Day Convention would otherwise fall on a day that is not a Business Day, then if the Business Day Convention specified is:

(A)the Floating Rate Business Day Convention, such date shall be postponed to the next day which is a Business Day unless it would thereby fall into the next calendar month, in which event:

(x)such date shall be brought forward to the immediately preceding Business Day; and

(y)each subsequent such date shall be the last Business Day of the month in which such date would have fallen had it not been subject to adjustment;

(B)the Following Business Day Convention, such date shall be postponed to the next day that is a Business Day;

(C)the Modified Following Business Day Convention, such date shall be postponed to the next day that is a Business Day unless it would thereby fall into the next calendar month, in which event such date shall be brought forward to the immediately preceding Business Day; or

(D)the Preceding Business Day Convention, such date shall be brought forward to the immediately preceding Business Day.

(iii)Determination of Rate of Interest: The Rate of Interest payable from time to time in respect of each Floating Rate Note which is a Singapore Dollar Note will be determined by the Calculation Agent on the basis of the following provisions:

(A)Screen Rate Determination for Floating Rate Notes where the Reference Rate is specified as being SORA Benchmark (“SORA Notes”):

For each Floating Rate Note where the Reference Rate is specified as being SORA Benchmark, the Rate of Interest for each Interest Accrual Period will, subject as provided below, be equal to the relevant SORA Benchmark plus or minus (as indicated in the applicable Pricing Supplement) the Margin (if any) in accordance with Condition 5(g).

The “SORA Benchmark” will be determined based on Compounded Daily SORA or SORA Index Average, as follows (subject in each case to Condition 5(g)(iii):

(x)If Compounded Daily SORA is specified in the applicable Pricing Supplement as the manner in which the SORA Benchmark will be determined, the Rate of Interest for each Interest Accrual Period will, subject as provided below, be Compounded Daily SORA (as defined below) plus or minus the Margin:

(I)where “Lockout” is specified as the Observation Method in the applicable Pricing Supplement:

“Compounded Daily SORA” means, with respect to an Interest Accrual Period, the rate of return of a daily compound interest investment during such Interest Accrual Period (with the reference rate for the calculation of interest being the daily Singapore Overnight Rate Average) calculated in accordance with the formula set forth below by the Calculation Agent (or such other party responsible for the calculation of the Rate of Interest, as specified in the applicable Pricing Supplement) on the Interest Determination Date, with the resulting percentage being rounded, if necessary, to the nearest one ten-thousandth of a percentage point (0.0001 per cent.), with 0.00005 per cent. being rounded upwards.

where:

“d” is the number of calendar days in the relevant Interest Accrual Period;

“do”, for any Interest Accrual Period, is the number of Singapore Business Days in the relevant Interest Accrual Period;

“i”, for the relevant Interest Accrual Period, is a series of whole numbers from one to do, each representing the relevant Singapore Business Days in chronological order from, and including, the first Singapore Business Day in such Interest Accrual Period to the last Singapore Business Day in such Interest Accrual Period (each a “Singapore Business Day “i””);

“Interest Determination Date” means the Singapore Business Day immediately following the Rate Cut-off Date;

“ni”, for any Singapore Business Day “i”, is the number of calendar days from and including such Singapore Business Day “i” up to but excluding the following Singapore Business Day;

“p” means five Singapore Business Days (or such other number of Singapore Business Days as specified in the applicable Pricing Supplement);

“Rate Cut-Off Date” means, with respect to a Rate of Interest and Interest Accrual Period, the date falling “p” Singapore Business Days prior to the Interest Payment Date in respect of the relevant Interest Accrual Period;

“Singapore Business Day” or “SBD” means a day (other than a Saturday, Sunday or gazetted public holiday) on which commercial banks settle payments in Singapore;

“SORA” means, in respect of any Singapore Business Day “i”, a reference rate equal to the daily Singapore Overnight Rate Average published by the Monetary Authority of Singapore (or a successor administrator), as the administrator of the benchmark, on the Monetary Authority of Singapore’s website currently at http://www.mas.gov.sg, or any successor website officially designated by the Monetary Authority of Singapore (or as published by its authorised distributors) (the “Relevant Screen Page”) on the Singapore Business Day immediately following such Singapore Business Day “i”;

“SORAi” means, in respect of any Singapore Business Day “i” falling in the relevant Interest Accrual Period:

(a)if such Singapore Business Day is a SORA Reset Date, the reference rate equal to SORA in respect of that Singapore Business Day; and

(b)if such Singapore Business Day is not a SORA Reset Date (being a Singapore Business Day falling in the Suspension Period), the reference rate equal to SORA in respect of the first Singapore Business Day falling in the Suspension Period (the “Suspension Period

SORAi”) (such first day of the Suspension Period coinciding with the Rate Cut-Off Date). For the avoidance of doubt, the Suspension Period SORAi; shall apply to each day falling in the relevant Suspension Period;

“SORA Reset Date” means, in relation to any Interest Accrual Period, each Singapore Business Day during such Interest Accrual Period, other than any Singapore Business Day falling in the Suspension Period corresponding with such Interest Accrual Period; and

“Suspension Period” means, in relation to any Interest Accrual Period, the period from (and including) the date falling “p” Singapore Business Day prior to the Interest Payment Date in respect of the relevant Interest Accrual Period (such Singapore Business Day coinciding with the Rate Cut-Off Date) to (but excluding) the Interest Payment Date of such Interest Accrual Period.

(II)where “Lookback” is specified as the Observation Method in the applicable Pricing Supplement:

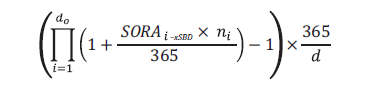

“Compounded Daily SORA” means, with respect to an Interest Accrual Period, the rate of return of a daily compound interest investment during the Observation Period corresponding to such Interest Accrual Period (with the reference rate for the calculation of interest being the daily Singapore Overnight Rate Average) calculated in accordance with the formula set forth below by the Calculation Agent (or such other party responsible for the calculation of the Rate of Interest, as specified in the applicable Pricing Supplement) on the Interest Determination Date, with the resulting percentage being rounded, if necessary, to the nearest one ten-thousandth of a percentage point (0.0001 per cent.), with 0.00005 per cent. being rounded upwards.

where:

“d” is the number of calendar days in the relevant Interest Accrual Period;

“do”, for any Interest Accrual Period, is the number of Singapore Business Days in the relevant Interest Accrual Period;

“i”, for the relevant Interest Accrual Period, is a series of whole numbers from one to do, each representing the relevant Singapore Business Days in chronological order from, and including, the first Singapore Business Day in such Interest Accrual Period to the last Singapore Business Day in such Interest Accrual Period (each a “Singapore Business Day “i””);

“Interest Determination Date” means, with respect to a Rate of Interest and Interest Accrual Period, the date falling one Singapore Business Day after the end of each Observation Period;

“ni”, for any Singapore Business Day “i”, is the number of calendar days from and including such Singapore Business Day “i” up to but excluding the following Singapore Business Day;

“Observation Period” means, for the relevant Interest Accrual Period, the period from, and including, the date falling “p” Singapore Business Days prior to the first day of such Interest Accrual Period (and the first Interest Accrual Period shall begin on and include the Interest Commencement Date) and to, but excluding, the date falling “p” Singapore Business Days prior to the Interest Payment Date at the end of such Interest Accrual Period (or the date falling “p” Singapore Business Days prior to such earlier date, if any, on which the SORA Notes become due and payable);

“p” means five Singapore Business Days (or such other number of Singapore Business Days as specified in the applicable Pricing Supplement);

“Singapore Business Day” or “SBD” means a day (other than a Saturday, Sunday or gazetted public holiday) on which commercial banks settle payments in Singapore;

“SORA” means, in respect of any Singapore Business Day “i”, a reference rate equal to the daily Singapore Overnight Rate Average published by the Monetary Authority of Singapore (or a successor administrator), as the administrator of the benchmark, on the Monetary Authority of Singapore’s website currently at http://www.mas.gov.sg, or any successor website officially designated by the Monetary Authority of Singapore (or as published by its authorised distributors) (the “Relevant Screen Page”) on the Singapore Business Day immediately following such Singapore Business Day “i”; and

“SORAi– p SBD” means, in respect of any Singapore Business Day “i” falling in the relevant Interest Accrual Period, the reference rate equal to SORA in respect of the Singapore Business Day falling “p” Singapore Business Days prior to the relevant Singapore Business Day “i”.

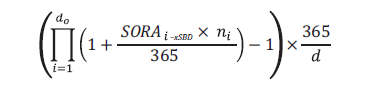

(III)where “Backward Shifted Observation Period” is specified as the Observation Method in the applicable Pricing Supplement:

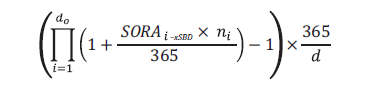

“Compounded Daily SORA” means, with respect to an Interest Accrual Period, the rate of return of a daily compound interest investment during the Observation Period corresponding to such Interest Accrual Period (with the reference rate for the calculation of interest being the daily Singapore Overnight Rate Average) calculated in accordance with the formula set forth below by the Calculation Agent (or such other party responsible for the calculation of the Rate of Interest, as specified in the applicable Pricing Supplement) on the Interest Determination Date, with the resulting percentage being rounded, if necessary, to the nearest one ten-thousandth of a percentage point (0.0001 per cent.), with 0.00005 per cent. being rounded upwards.

where:

“d” is the number of calendar days in the relevant Observation Period;

“do”, for any Interest Accrual Period, is the number of Singapore Business Days in the relevant Observation Period;

“i”, for the relevant Interest Accrual Period, is a series of whole numbers from one to do, each representing the relevant Singapore Business Days in chronological order from, and including, the first Singapore Business Day in such Observation Period to the last Singapore Business Day in such Observation Period (each a “Singapore Business Day “i””);

“Interest Determination Date” means, with respect to a Rate of Interest and Interest Accrual Period, the date falling one Singapore Business Day after the end of each Observation Period;

“ni”, for any Singapore Business Day “i”, is the number of calendar days from and including such Singapore Business Day “i” up to but excluding the following Singapore Business Day;

“Observation Period” means, for the relevant Interest Accrual Period, the period from, and including, the date falling “p” Singapore Business Days prior to the first day of such Interest Accrual Period (and the first Interest Accrual Period shall begin on and include the Interest Commencement Date) and to, but excluding, the date falling “p” Singapore Business Days prior to the Interest Payment Date at the end of such Interest Accrual Period (or the date falling “p” Singapore Business Days prior to such earlier date, if any, on which the SORA Notes become due and payable);

“p” means five Singapore Business Days (or such other number of Singapore Business Days as specified in the applicable Pricing Supplement);

“Singapore Business Day” or “SBD” means a day (other than a Saturday, Sunday or gazetted public holiday) on which commercial banks settle payments in Singapore;

“SORA” means, in respect of any Singapore Business Day “i”, a reference rate equal to the daily Singapore Overnight Rate Average published by the Monetary Authority of Singapore (or a successor administrator), as the administrator of the benchmark, on the Monetary Authority of Singapore’s website currently at http://www.mas.gov.sg, or any successor website officially designated by the Monetary Authority of Singapore (or as published by its authorised distributors) (the “Relevant Screen Page”) on the Singapore Business Day immediately following such Singapore Business Day “i”; and